Of Tech Bros And Trumpers

A case study of how North Korea may have played a supporting role in convincing Silicon Valley billionaires to back Donald Trump. Also starring Uniswap.

This is part one in a series about the broligarchy. Part two, “Trump's Transition Team Is Tethered To Thievery (And Worse)” covers the ways in which international money laundering benefits the chairman of the Trump transition team.

Over the past few months there has been a lot of gnashing of media teeth over the fact that a group of billionaires from the usually-assumed-to-be-far-left San Francisco area suddenly decided to go all in for Trump. “Oh billionaires, oh billionaires, why hast thou forsaken us?” was the refrain across all manner of podcasts, think pieces, and posts on The Privatized Public Square1. What seemed to go unmentioned, however, was the fact that these were not just regular tech bro billionaires. These were crypto bro billionaires. And not only were they publicly endorsing Trump, they had assembled what is currently the single largest2 pool of money being deployed to influence the upcoming American election3.

Frustratingly (at least for me) no one outside a small group of sceptics and a handful of journalists seemed to have noticed either the important tech bro/crypto bro distinction4 or the enormous pile of money these bros had assembled in order to attempt to influence the elections5.

Or rather no one besides a small group of sceptics and Mark Cuban:

The reason these guys are spraying a reality distortion field hundreds of millions of dollars wide into the election across the pond is really quite easy to understand:

Most of the obscenely wealthy and obnoxiously loud tech bros you see turning up to Trump’s beat have enormous financial stakes in companies whose business activities include either participating in or indirectly enabling things that the laws of the United States currently forbid6. Things like laundering money for fentanyl dealers, helping Vladimir Putin evade sanctions, running telehealth pill mills for controlled substances, and ensuring North Korea has continual access to sufficient capital for its nuclear weapons programme, all set against a backdrop of alleged securities fraud and good old fashioned embezzlement on a scale the world hasn’t seen since 1928.

What is motivating all the sudden Bro On The Road To Mar-A-Lago conversions to Trumpism is simple: the Biden administration7 has, through its various enforcement arms, recently been on an absolute tear of charging most if not all of these companies with various forms of fraud8. In the minds of the bros this has amounted to a level of unjust persecution not seen since the Romans fed Christians to lions just for the entertainment value. The bros even have a sinister name for the conspiracy they see at work: Operation Chokepoint 2.0.

The responses of the executives to the charges filed against these recently indicted crypto companies has almost uniformly been to give the government the middle finger while doubling down on profiting off of idiots trading dog and frog themed memecoins910. Their behaviour has on the whole been so far outside of the bounds of what used to be allowed in polite recently indicted society11 that a Trump shaped Hail Mary pass is pretty much all these guys have left. Because Trump has explicitly promised these guys that if he is elected he will immediately fire the government servants responsible for these obstreperous attempts to enforce the laws of the United States against such financially innovative bros.

Trump’s announcement of this plan at this year’s bitcoin conference received the kind of thunderous applause usually reserved for Taylor Swift encores. A plank to that effect can now be found in the “innovation”12 section of the official Republican party platform for 2024. Trump has even promised to stop “Operation Chokepoint 2.0” by name13 (even though it doesn’t actually exist).

This is why these bros are backing Trump’s bid for the presidency. You can safely ignore most of the other reasons they give publicly14.

The Curious Case of Uniswap

There are a cornucopia of examples to choose from that are illustrative of the ways in which the laws of the international rules based order threaten the business models of the bro-ocracy15. This post will focus on just one that is extremely topical right now, having occurred just a few weeks ago in July of 2024. Here’s the sequence of events:

On or around July 18th $230 million16 “worth” of cryptocurrency was stolen from a cryptocurrency exchange in India named WazirX (announcement, archive).

The theft was linked to North Korea17 by reputable blockchain analysts (Elliptic, ZachXBT, The Register).

The way in which North Korean money launderers turn hundreds of millions of dollars “worth” of stolen dog coins18 into the kind of IRL money Kim Jong Un can use to acquire the various ingredients in the nearly century old recipe for atomic bombs is (extremely) complicated19 but it mostly involves swapping the stolen dog tokens into other tokens20 many times over, eventually either cashing out to hard currency through an over the counter sale in China or Southeast Asia or converting the ill-gotten dog coins into a pile of “major” tokens21 like bitcoin and ethereum and then parking those tokens somewhere “on chain” for future use22.

A substantial portion of that money laundering activity happens in crypto markets called “decentralized exchanges23”.

The most popular decentralized exchange by an overwhelming margin24 is the work product of a New York City company called Uniswap. North Korean money launderers in particular love Uniswap25 and made heavy use of its code to launder the dog coins they stole from WazirX.

An “on chain” window into the mind of a North Korean youngster who displayed extremely high mathematical aptitude as an infant.

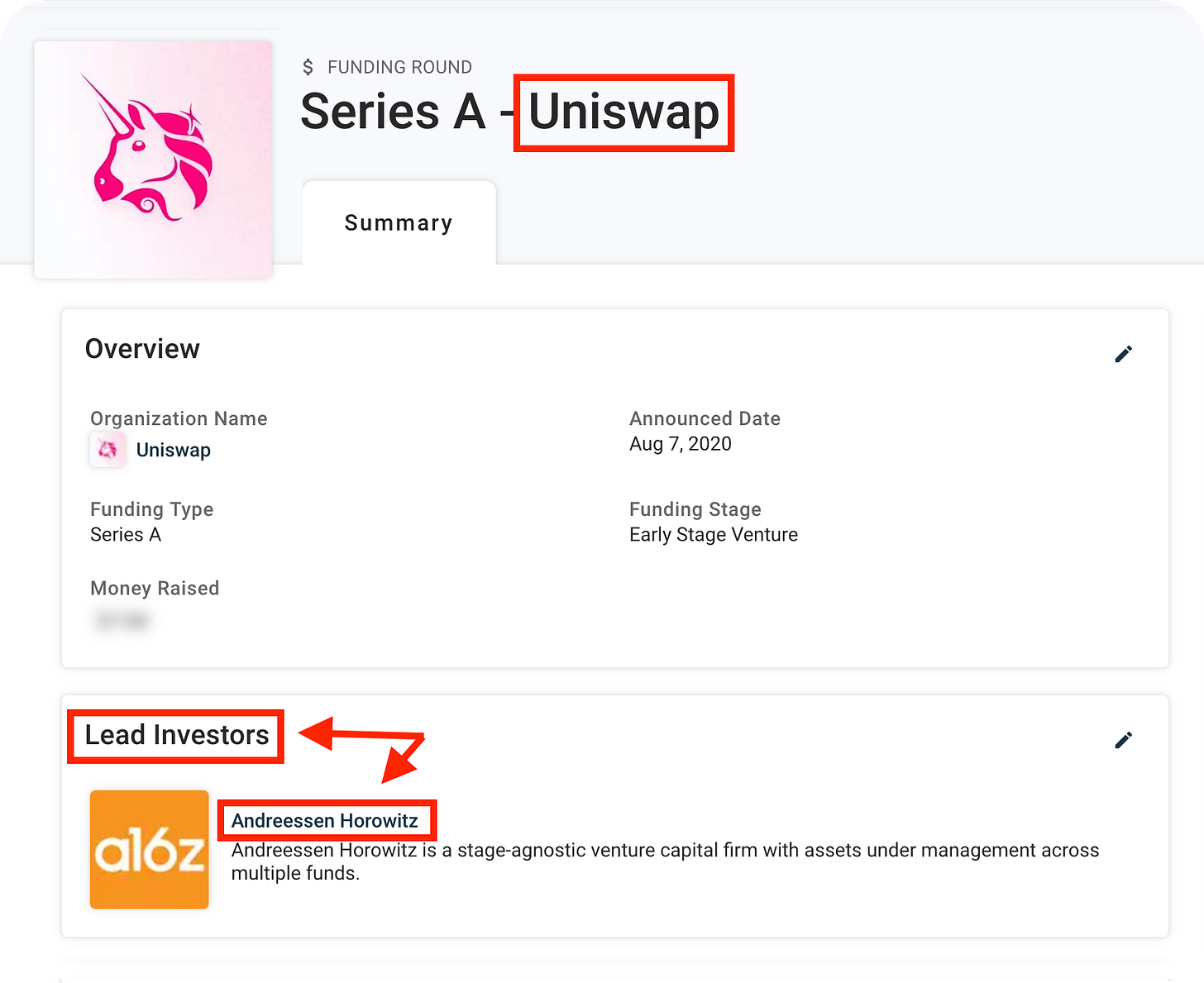

It would thus perhaps not surprise you to learn that the American government has taken a dim view of Uniswap’s corporate activities. In point of fact the Securities and Exchange Commission (AKA “the SEC”, the government agency in charge of regulating most of the American financial markets), charged Uniswap with financial crimes in early 202426. As part of that investigation the SEC reportedly served subpoenas directly to Uniswap’s financial backers just a few days ago. And who are Uniswap’s biggest financial backers? They just so happen to be recent Trump converts Marc Andreessen and Ben Horowitz.

Now you might be wondering what enabling North Korean cybercrime has to do with thinking putting a man like Donald Trump in charge of the nuclear codes is a good idea. Answering that question involves digging into a labyrinth of byzantine legal fictions concocted by the crypto bros’ obscenely well paid lawyers.

Buckle up.

WARNING: This section contains a detailed explanation of the legal shadow boxing that enables money laundering activity by North Korea to indirectly financially benefit crypto bros in the bay area. If that sounds like tough sledding you may want to just read Liz Lopatto’s excellent recent piece in The Verge: “The Moral Bankruptcy of Marc Andreessen and Ben Horowitz”. Ms. Lopatto sees the situation clearly even if she doesn’t discuss all the underlying mechanisms we’re about to dig into.

The legal and moral fictions offered by the bros in equal parts to the government and their own souls are myriad but they tend to revolve around the word “decentralization” with a frisson of disingenuous appeals to “free speech”. “No one owns the Uniswap code” they argue. “It’s open source, anyone can use it! More importantly Uniswap doesn’t directly profit from the money laundering trading activity that code facilitates”. This is, in point of fact, more or less true.

There are, however, some important caveats.

For one thing we really need to insert a “yet” in there, making the full sentence more akin to “Uniswap doesn’t directly profit (yet) from the money laundering trading activity its code facilitates”. Because while for the most part Uniswap’s market making code matches buyers and sellers completely free of human intervention once deployed “on chain”27 there are a still a few powers Uniswap’s developers have reserved for members of homo sapiens. The most important of these reserved powers is the ability to flip a switch that will instantly redirect a portion of the millions in dollars in fees generated by all the money laundering trading activity directly into that homo sapiens’ bank account.

The other caveat is that the word “directly” is doing an absolutely heroic job of holding up a legal fiction heavier than 10,000 suns. Consider that Uniswap (the company) currently makes money in two ways:

Fees it charges people to trade on uniswap.org, a website it runs that hosts what most people think is the Uniswap app but which is actually just a web interface to the real Uniswap app. The real Uniswap app - the one that actually moves money around - runs “on the blockchain” (meaning “on someone else’s computer”)28 is owned by no one29.

Selling its own “governance token” called

UNIto the general public.

A “governance token” entitles its holder to a vote on the future direction of Uniswap. Technically it is holders of UNI tokens and not a company named “Uniswap” that holds the voting power to flip the aforementioned money switch that would redirect a share of the fees generated by all the money laundering trading activity into that voter’s bank account. You would be forgiven for thinking that sounds an awful lot like a share of stock in a company that pays dividends30.

If, the legal theory goes, UNI tokens are controlled by a collection of international individuals that is “sufficiently decentralized” then no harm, no foul, and definitely no triggering of American laws against securities fraud. There are two issues with this argument. For one thing it’s obviously bullshit. For the other it doesn’t appear that the ownership of UNI tokens is all that decentralized. One party in particular seems to control an awful lot of the voting shares UNI tokens:

Details, Details, Details…

The legal fictions get more concrete (and sadly probably more correct in a court of law) when you consider that it is Uniswap not a16z who is creating the voting shares UNI tokens. Thus, the argument goes, if anyone is committing securities fraud here it is Uniswap and not Uniswap’s financial backers. Investors like a16z can’t issue new voting shares UNI tokens; they can only sell the voting shares UNI tokens given to them by Uniswap to an unsuspecting public. Which, legally speaking, might mean that a16z’s hands are clean even if they are absolutely morally bankrupt because historically it has been the creation and not the selling of unregistered securities to the public that has attracted lengthy sentences in correctional facilities.

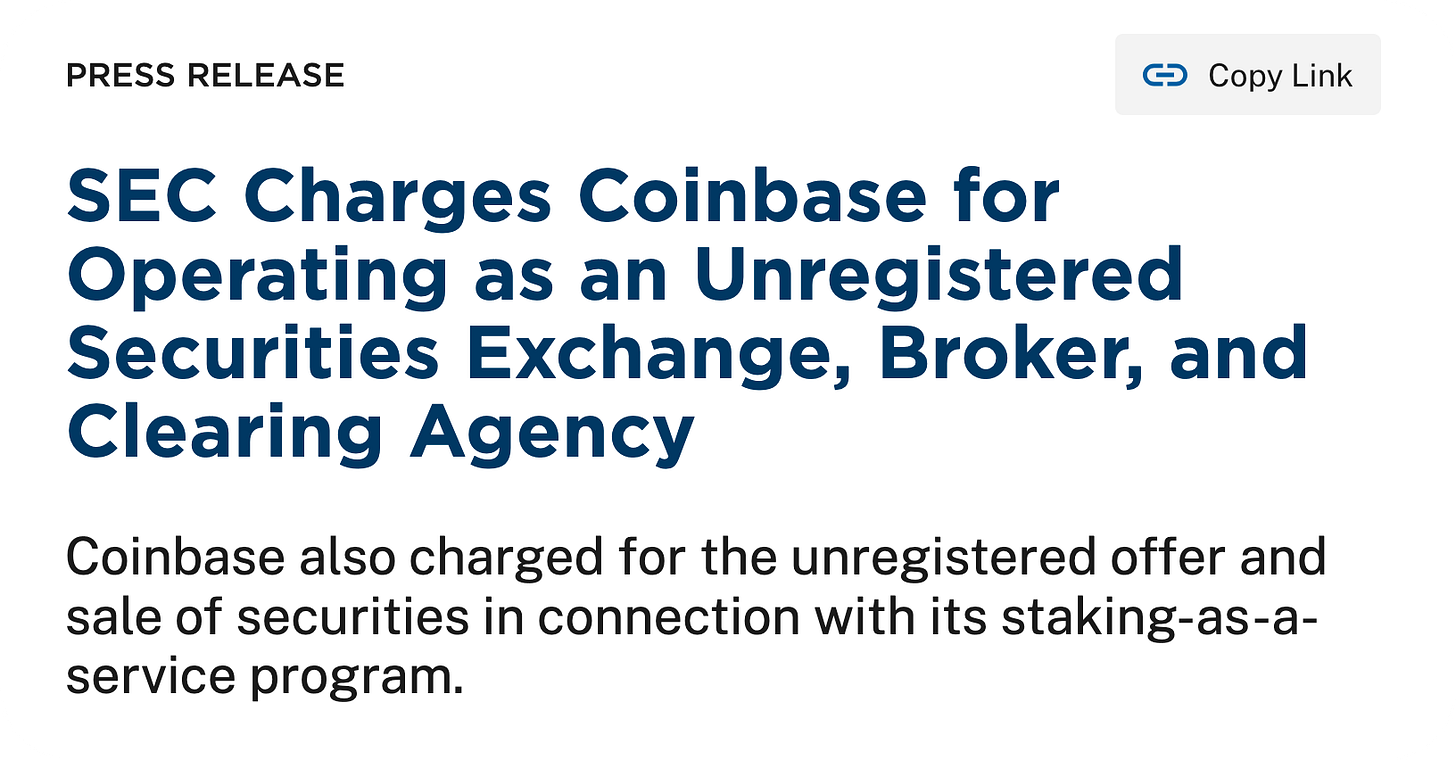

Of course if you, an investor in the extremely profitable international money laundering industry crypto startups, want to actually sell your voting shares tokens to an unsuspecting public you need a marketplace to do so. And not a decentralized marketplace like Uniswap - realistically only money launderers, blockchain developers, and market manipulators know how to use those things. You need an easy to use marketplace where retail consumers with dollars in their fists and greed-glazed expressions in their eyes will look favorably on your magic beans voting shares tokens. Preferably a marketplace whose banking partners are routinely sanctioned for facilitating fraud on a massive scale and thus can be counted on to look the other way about any suspiciously large transactions. Maybe a marketplace with an internal venture capital fund31. One whose CEO has some, shall we say, “questionable” ideas about profiting from pump and dump schemes and dog/frog coins32.

In other words, you need Coinbase:

But then what if the government tried to take away the money bowl by shutting down your favorite source of retail fools to dump tokens on? Well then you’d probably be hopping mad. Maybe even mad enough to donate hundreds of millions of dollars to Trump while claiming you’re really concerned about Ukrainian sovereignty, free speech, and Hunter Biden’s laptop.

But enough about legal fictions and marketplaces. The more important question is the issue of why anyone would want to own $3.5 billion worth of UNI tokens in the first place, thus creating the demand that allows the Uniswaps of the world to sell those voting shares tokens to the public. Perhaps it might have something to do with the dollar value of the fees generated by Uniswap’s code. You might plausibly tell yourself something like: “The Uniswap team is smart. They control the ‘official’ Uniswap codebase. Surely some day they will find a legal way to redirect those fees to UNI holders - after all they already put a switch in the code to do just that! Maybe if I buy their token now I will make a lot of money down the road,”33. If enough people follow that line of thinking it could drive the price of Uniswap’s voting shares UNI tokens “to the moon” in the parlance of the bros.

And what do you think could reinforce that line of thinking more than a demonstrably enormous number of “on-chain” transactions generating a proportionally enormous amount of transaction fees? Fees that that some day UNI token holders could vote to claim as their own? You know what generates a lot of transactions, usually in an attempt to obscure the true source of the funds used in those transactions?

North Korean money laundering.

Postum Scriptum

A few final thoughts:

Nothing in this blog post should be taken to mean that either Uniswap or a16z is directly involved in international money laundering for drug cartels, North Korea, and Vladimir Putin. I am merely pointing out that the incentive structures created by crypto in general and decentralized finance in particular have created a situation where we now have a class of billionaires with an indirect but very real financial stake in looking the other way when drug cartels, North Korea, and Vladimir Putin want to launder hundreds of millions of dollars. Obviously these incentives exist in regular finance too - after all how do you think the world ended up with a creepy gold vault run by Nazis34 in the middle of Europe called Switzerland? The difference is that in regular finance there is a powerful countervailing incentive of wanting to stay out of prison while in decentralized finance there are no countervailing incentives or rules of any kind.

Truth be told I actually think Uniswap is kind of “cool” in a research project/proof of concept kind of way. As someone who has spent a lot of time looking at blockchain code I can say pretty conclusively that Uniswap is one of the cooler things crypto has created35. In a world where retail customers are routinely fleeced by market makers like Citadel automated market makers even seem like kind of a good idea.

The problem is that we don’t live in a libertarian utopia. If you build tools that are good at laundering money and make them publicly available and unstoppable by law enforcement then guess what: a bunch of extremely evil people with world-destabilzing amounts of money earned from selling fentanyl, trafficking human beings, or outright theft are going to be your biggest customers. Seeking to profit on that sort of thing is grotesquely immoral so if you work at Uniswap or “invest” inUNItokens then maybe go read a book about “good Germans” in the 1930s, because you are one.If you enjoyed reading this and know other people who would benefit from reading it do this publication a favor and send them a link.

Next Time On “The Cryptocalypse Chronicles”

We’ll be discussing the case of Ivy Leaguer and up and coming member of The Forbes 30 Under 30 To Prison Pipeline Nader Al-Naji whose financial backers just so happen to include the same pro-Trump venture capitalists who brought you revolutions in finance like Uniswap, FTX, and BlockFi.

The app formerly known as “Twitter”.

According to Molly White because of the way some PAC money can be doublecounted it might be technically the second biggest piles of money but I’m sticking with the official government numbers for dramatic effect.

For more of the specifics on what the crypto industry is doing to the election with all this money it has extracted from the global population Molly White has an incredible blog. She has also assembled an amazing resource to track crypto money in the election over at followthecrypto.org. While at the top of the ticket the bros have chosen their candidate it should be noted that when it comes to other elections the bros will back whichever candidate promises more fealty to their cause.

It’s admittedly hard to tell at first sight given that the two breeds of bro have very similar taste in outerwear and share many mating rituals.

The not noticing the money part was kind of surprising. I mean we are talking about Americans here.

Often referred to as “crimes”.

It would be unfair to not point out that at least some of these persecutions began under the Trump administration’s SEC chairperson - Donald Trump actually used to be extremely clear eyed about crypto - though in the post-FTXposion era their urgency and their breadth has dramatically increased.

The U.S. Securities and Exchange Commission has as of late filed lawsuits against pretty much every major player still standing in the cryptocurrency space over which it has jurisdiction including many (most?) of the crypto companies backed by these same tech bros (including the so-called “reputable” companies). The Department of Energy is attempting to understand why the United States is wasting 2% of its total energy production processing bitcoin transactions. The Federal Reserve keeps sanctioning the crypto friendly banks. CEOs of crypto companies keep getting suddenly and dramatically arrested.

The market cap of PEPE, the most popular frog themed coin, is currently $3.5 billion, roughly the value of a Nimitz class nuclear powered aircraft carrier or two. The market cap of the original Dogecoin is almost an order of magnitude larger than that, so roughly 10 Nimitz class aircraft carriers which is about the size of the carrier fleet fielded by the United States Navy, though some of its audience has bled off into the $2 billion DOGWIFHAT market where people trade a picture of a dog wearing a hat.

Those that are executives of publicly traded companies have also been furiously selling off their stock in those companies for hundreds of millions of dollars while they still can [rats_from_a_sinking_ship.gif]

Recall that we allow Citadel, Goldman Sachs, and HSBC to continue to masquerade as “respectable” businesses.

It’s not completeley untrue. Crypto has absolutely revolutionized the fraud industry.

This shouldn’t actually be that difficult seeing as how Operation Chokepoint 2.0 is more the fever dream of conspiratorially minded crypto bros (AKA “all crypto bros”) than an actual coordinated government policy.

Except maybe some of the more racist reasons. Those seem to be sincerely held beliefs.

Please stop calling them oligarchs. An oligarchy is when a cabal of insiders derive their wealth from their proximity to the leader. A plutocracy is government by the wealthy, for the wealthy (“one dollar one vote”). A bro-ocracy is what you call a plutocracy when the plutocrats all call each other “bro”.

This should not be surprising. Historically when amounts of cryptocurrency in the $40 million to $650 million range get stolen it’s pretty much always North Korea. “By the claw, the lion is revealed” applies here.

Most of what was stolen from WazirX was a Dogecoin knockoff brand token called SHIB because the original doge was a shiba inu. It was most likely spun up by the extremely sus crew behind Crypto.com (or at that is where the overwhelming majority of SHIB started out and where it has remained which is generally how crypto bros do things). SHIB’s developers only give interviews while wearing masks because they are definitely not committing securities fraud. And yes, to answer your question, this is all actually as stupid as it looks. Actually much stupider.

Speaking as someone who’s investigated many kinds of crypto laundering “on chain” let me just say that the North Koreans have no serious competition in the Crypto Launderer Olympics. Their on chain theatrics make the Iranian Revolutionary Guard and the Russian and Chinese mafias look like rank amateurs.

These tokens may or may not be named after dogs.

If you want to quibble over the fact that bitcoin and ethereum aren’t technically “tokens” please do so on another blog’s comments.

Parking the assets in bitcoin or ethereum was made significantly more useful by Putin’s decision a few weeks ago to allow cryptocurrencies like bitcoins to be used in Russia’s cross border payments (CNBC). Bitcoin and ethereum have many flaws but there is one thing they do extremely well: prevent governments from seizing them as they would a conventional bank account.

A decentralized exchange, often referred to as a “DEX” in the industry, is just a computer program that allows buyers and sellers to meet and exchange tokens “on chain” without any human oversight. Imagine if there were no human beings running the New York Stock Exchange and there was no way to ever change the rules on the trading floor and you won’t be far off the mark.

More than 99% of decentralized exchanges are either deployed by Uniswap or (more commonly) use the Uniswap source code. Those exchanges probably cover 99.999% of actual decentralized trading activity as measured in conventional currencies like USD.

I mean, so do other money launderers. But North Korea is such a heavy user of the Uniswap protocol that jokes about Uniswap’s North Korean backers are common on social media. Uniswap transactions appear in every analysis of North Korean crypto laundering that I have seen (and I have seen most of them).

Specifically running an unlicenced marketplace for financial instruments that look a lot like stocks.

Meaning “on the blockchain” if you’re new here. If you’re so new here that you don’t know what that means just envision an Excel or Google spreadsheet. Uniswap’s code would be the function you type in to do stuff like add the value in one spreadsheet cell to another. The only real difference is that you can’t delete the function once it’s in the spreadsheet.

This, according to Uniswap’s lawyers, is a Very Important Legal Distinction whose ramifications we’ll dig into in a minute. In the meantime if you want to get a sense for the fig leaf of difference upon which Uniswap’s entire legal strategy rests just imagine if the Instagram algorithm were, for the purposes of things like taxes and anti-money laundering laws, considered a totally separate app with totally different owners from the Instagram app you use on your phone… even though Instagram (the app) can’t even so much as give you pictures to look at without Instagram (the algorithm).

The bros would tell you that the real Uniswap app has been donated to humanity by beneficent blockchain devs but what’s really going here is that no one wants to claim ownership of the real app because no one wants to be held responsible for financial crimes.

Because that’s obviously what it is and that is at least in part why the SEC has charged Uniswap with unregistered securities violations.

“Coinbase Ventures” has been an investor in most of the biggest disasters to befall the crypto economy. Other than pumping and dumping tokens in startups they “invest” in (the pump comes from Coinbase agreeing to list the startup’s token and thus providing a sea of retail suckers; the dump comes from Coinbase Ventures selling all the tokens to retail suckers) obvious Ponzi schemes like the decabillion Terra / Luna disaster are their bread and butter.

Maybe more importantly in the real world of finance this arrangement of having an entity like Coinbase simultaneously be a marketplace, broker/dealer, clearing house, and venture capital fund is incredibly illegal and indeed this is what the SEC has charged Coinbase with.

Worth noting that before the SEC charged them, Coinbase specifically avoided allowing its customers to trade dog and frog coin futures in offshore tax havens but ever since the indictments came down they have completely taken the gloves off.

Channeling my best Matt Levine here. Go ahead, judge me.

Swiss people, like the citizens of Vichy France, usually prefer their grandparents be known as “Nazi sympathizers” because it sounds a little less evil but realistically I’m not sure there’s a difference.

This is an admittedly low bar given that most of the code you see on the blockchain is the computer engineering equivalent of watching a toddler enthusiastically painting a diorama by smearing its own shit on the wall.

Thank you for this. It's important to understand that JD Vance is not only the cat's paw of Thiel/Musk/Andreesen/McNeely et al, he's also deeply connected to the Christian Nationalist movement, in particular to the paleo-Catholicism of Opus Dei and related reactionary organizations. https://johnsundman.substack.com/p/i-created-peter-thiel-who-gave-us?r=38b5x

if they can do this to me, they can do this to you meant for other criminal billionaires and they listened.