Crypto.com or Crypto Dot Con?

And a song of a gate made of silver.

Before we get into the weeds on Crypto.com here’s an unexpectedly popular thread I ended up writing on The Privatized Public Square1 about something a little more temporally relevant: the apparent implosion of Silvergate Bank.

If you choose to read the thread just keep in mind:

I used wrong-ish nomenclature sometimes: Treasury Bills are (vaguely) different from Treasury Notes which are (not really) different from Treasury Bonds. My bad. Here’s the gory details if you’re curious about those kinds of weeds but the point of the thread was specifically to avoid getting into the weeds and help illuminate the situation for those who have no understanding of fixed income markets (that’s why it’s labelled “ELI5” A.K.A. “explain it to me like I’m 5 years old”).

$100 of treasuries are just an easy example of the kind of debt instrument that blew up Silvergate. They actually held a bunch of different kinds of debt, but the $100 in treasuries is illustrative of what went wrong.

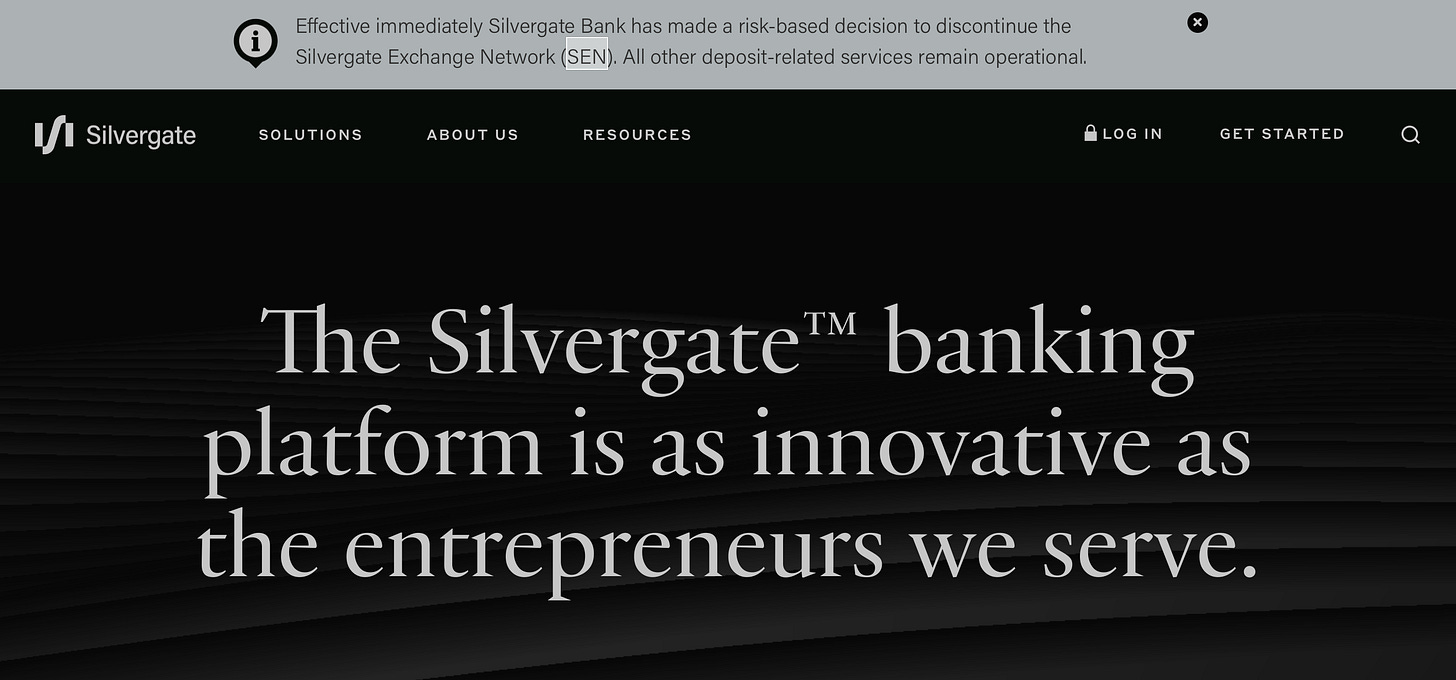

So what is Silvergate? Silvergate is2 one of the two “TradFi”3 banks that really matter in the US dollar denominated cryptocurrency economy, which is most of the cryptocurrency economy. The important development is that on Friday, March 2nd 2022 the bank sent out a notice that the Silvergate Exchange Network (“SEN”), a custom payment network that had for years been the backbone of much of the cryptoverse, was suddenly and without warning shutting down because of a “risk-based decision”.

This news came a day after the bank had revealed that it had lost a lot more than just the billion dollars it had told everyone about and was “evaluating its ability to continue as a going concern” in a notice it filed with the SEC.

I know - you came hear to read about Crypto dot con not some weird bank in a town famous for its deep ties to Mexican drug cartels. Bear with me; this will all become relevant a bit further down the page.

CRYPTO CROESUS IS UNCROWNED

A little over a month ago I published a piece about the plight of a particularly sketchy cryptocurrency exchange called Crypto.com. You may have heard of it because a major sports arena in one of America’s two biggest cities is called The Crypto.com Arena4. In that piece I explained that The Bank of Lithuania had announced that it had seized all the cryptocurrency related accounts at an “electronic money institution” called Transactive Systems UAB that, as fate would have it, Crypto.com just so happened to use for its Euro denominated deposits and withdrawals. Well a few weeks after my post Bloomberg did a deep dive on what, exactly, was going on at Transactive Systems UAB. What they found was not encouraging, at least if you are a person who has ever sent any of your hard earned euros to Crypto.com.

First of all there was the fact that a company called Nexo also used Transactive Systems’s financial services. This article isn’t about Nexo but here’s one that is. Long story short Nexo is a Bulgarian neobank involved in laundering money (probably for Putin, Inc.) that was recently targeted by a massive 300+ person police enforcement action. So there’s that. And then there’s the stuff about Transactive Systems itself. There are many fun details in the Bloomberg investigation so we pulled out a few quotes for you; as you read them consider how you would feel if any of these things was reported about the bank you keep your savings in.

TRANSACTIVE WAS PRETTY ACTIVE

Transactive Systems was founded by refugees from the wreckage of "the payment processor of choice for scam artists”:

Multiple high-level employees who helped set up and run Transactive came from PacNet Services Ltd., a company that had to close down after being sanctioned by the United States for being the “payment processor of choice” for scam artists. Several are being targeted by authorities, including one facing federal fraud charges who remained a senior Transactive employee until just weeks ago.

The person with the largest ownership stake plead guilty to being part of a $1 billion healthcare fraud in the USA:

A few months after Transactive received its licenses, prosecutors announced that early investor Scott Roix – who owned half of the company – had pled guilty to participating in a $1 billion healthcare fraud.

Transactive Systems’ compliance officers were charged with fraud in the USA:

Among the PacNet employees who had taken a job at Transactive were Miles Kelly, a senior anti-money laundering specialist, and Renee Frappier, who worked in marketing and communications. In 2019, US prosecutors in Nevada charged them with fraud and money laundering in relation their work at PacNet.

...and in Canada:

Kelly and Frappier face more trouble in Vancouver, where the Office of Civil Forfeiture for British Columbia is trying to seize properties they own because they were allegedly bought with the proceeds of PacNet's "unlawful activity," according to legal filings.

There were other convicted Russian money launderers on staff:

The firm has been represented in meetings by businessman Mikhail Syroejine. Originally from Russia but based in the US since the 1990s, Syroejine pleaded guilty to money laundering charges in 1996, according to regulatory filings.

At a certain point you start to wonder if any of their customers are not fronts for money laundering.

Several other Transactive customers have run into legal trouble. One is Viola Money, a UK payments company that the FCA forced into bankruptcy last December after one of its banks closed its accounts due to alleged “financial crime typologies,” according to public filings. Another is Blue Diamond Sports, which operates a foreign-exchange business on the southern side of the Irish border and had its accounts shuttered by Bank of Ireland in 2018 on suspicion of money laundering. The company denied any wrongdoing and sought an injunction in the Irish High Court but the action failed, filings show..

A GATE MADE OF SILVER

The fate of Silvergate is actually quite relevant to Crypto.com’s future. This should hardly be surprising given that at the end of the day we will probably discover that the entire cryptocurrency industry is 5,000 shell companies run by 20 dudes in a foul smelling room in some non-extradition country, but in case you’re interested in the specifics it turns out that in order to make dollar denominated deposits to Crypto.com you could actually send money to the Silvergate bank account of a totally different company called Circle Internet Financial.

Circle, as it is known, is in the stablecoin5 business. When you sent $100 to Circle’s bank account at Silvergate, Circle would create (“mint”, in the language of the crypto bros) 100 stablecoins called “USDC” for you on a blockchain somewhere6. Let’s leave aside for a moment both the fact that everything about that arrangement was almost certainly highly illegal7 as well as the fact that Circle has deep ties to Coinbase, whose CEO likes to LARP around as if Coinbase were some kind of legitimate technology company that is definitely not profiting from Ponzi schemes on its platform and is also not bleeding out under the weight of staggering financial losses. We can instead focus on the fact that in order to accept USD deposits Crypto.com has to lean on their other longstanding American banking relationship with a bank called Metropolitan Commercial Bank (stock ticker: MCB).

Metropolitan Commercial Bank is perhaps not coincidentally a bank that already got burned when another cryptocurrency company called Voyager Digital blew up and took both its customers’ money and the bank’s reputation down with it. It’s also a bank that two months ago claimed it was really, truly putting down the financial crack pipe known as cryptocurrency.

Metropolitan said that this putting down of the pipe would be gradual over the course of 2023 so perhaps it would be forgivable if they were still banking some quasi-legitimate enterprise like Paxos or Coinbase. But they’re not banking Paxos or Coinbase. They are banking a company that lost its European bank accounts due to accusations of money laundering activity. For bonus points that activity probably involved Russian money and for the jackpot bonus it looks like that money is probably tied to Putin and the oligarchs. Given the immense risk to Metropolitan’s executives’ continuing ability to walk the earth as free men it would seem safe to conclude that either Metropolitan Commercial Bank can't survive without taking deposits from money launderers or financial crack is like, really really fun. Because Metropolitan don’t seem to be able to stop smoking that shit despite the fact that if you get caught laundering money for Russian oligarchs in this day and age you will go to prison. Because believe it or not the old adage “when in crypto, do as crypto bros do” is not considered a valid defence in a court of law.

THE BOOK OF FRAUDITS

I’m not going to spend too much time on this because we’ve already covered the revelations in The Book Of Fraudits extensively in the past but before we dig in I would just like to remind you that several months ago Crypto.com released an “audit” with many interesting and unique8 properties:

It wasn’t an audit, as the auditor Mazars LLP made very clear. It was an “attestation”.

It consisted of three nearly blank pages.

Those pages contained no USD or crypto amounts. All the numbers were redacted for “confidentiality reasons” except for some very vague percentages9.

It was immediately retracted by Mazars so violently that they deleted that part of their website and dissolved that entire part of their business.

And yet despite all that if you go to r/Crypto_com on Reddit right now, on March 5th 2023, many weeks after Mazars clearly stated that the document in question definitely was not an audit and then retracted it, you will still find the pinned post to be the one claiming that Crypto.com’s user accounts have been fully audited.

A SUNNY PLACE FOR SHADY PEOPLE

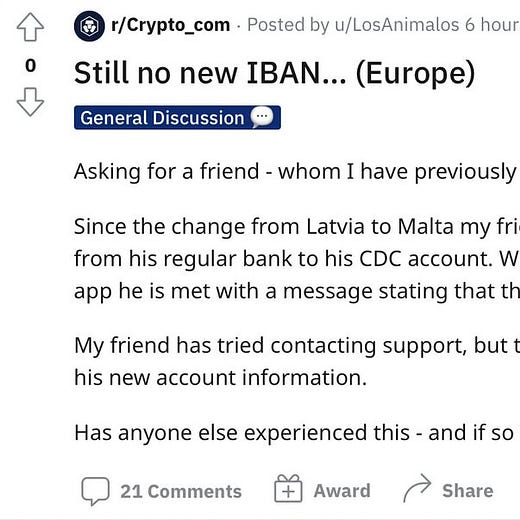

Well at least things are better now. Crypto.com’s customers don’t have to worry about guilt by association with that shady Russian organized crime bank Transactive Systems UAB any more. After all it seems like the migration to a bank in Malta called OpenPayd went swimmingly.

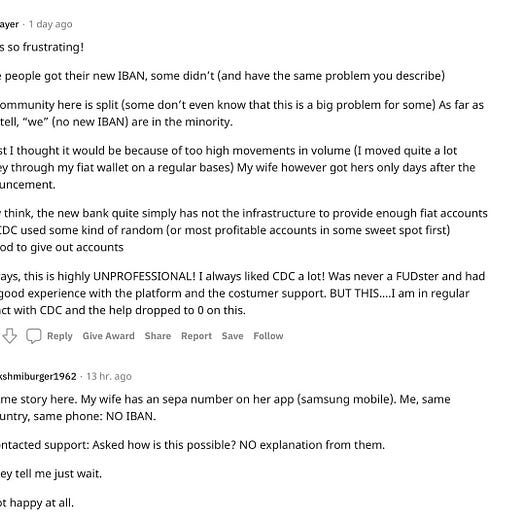

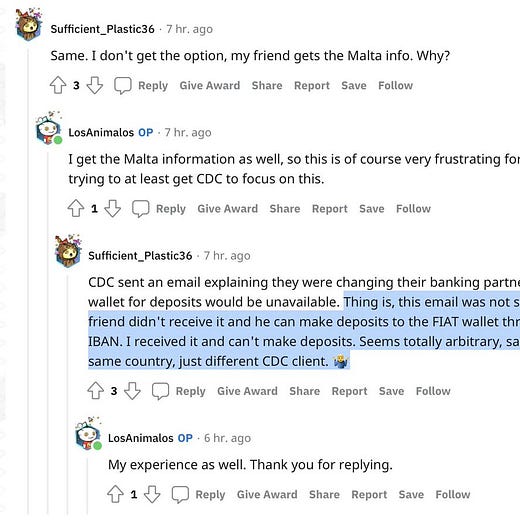

Hmm… seems that not all customers were told about the new bank. Well, at least it’s all back to normal for most customers who can now easily deposit and (more importantly) withdraw their money, right? Because it seemed kind of touch and go there for a minute, especially if Crypto.com had had a fuck ton of its customers’ euros frozen in its Lithuanian bank account. I was worried people might not be able to withdraw funds if the new Crypto.com account at the Maltese bank was starting its Euro balance from €0.

Well that’s probably just one dude’s problem, right? And probably he’s having a tough time because he’s trying to get kind of a lot of money out - €100,000 is a big number! They probably have to do some extra vetting for that kind of funds. Surely regular customers are not having any issues, right?

Maybe that’s just a one off?

Maybe in Turkey it’s better?

What about getting funds onto the platform? Surely everyone’s bank is totally cool with letting their customers wire money to this totally legitimate Maltese bank that definitely is not run by anyone associated with organized crime?

Well, St. George is just one bank. I bet every other bank works great.

Hmm, “EUR is banned” doesn’t sound great. Neither does “USD to USDC is banned”.

I’m going to break the 4th wall here for a minute and remind everyone that to do the USD to USDC deposit method you would send US dollars to Circle’s bank account at Silvergate, who would then send USDC coins “on chain” to your Crypto.com account (somehow). I will also point out that this post was made to Reddit 10 days ago, well before Circle announced to the world that it was leaving Silvergate bank 3 days ago. Almost makes you wonder if someone knew something bad was coming, doesn’t it?

I will also point out that the Redditor above uses a “neobank” called Revolut that is quite popular in Europe, is run by the son of a Russian oligarch (Gazprom), and whose auditor just announced it cannot account for almost half a billion British Pounds (GBP) of Revolut’s income.

What about trading crypto? Doesn’t Crypto.com offer a great marketplace?

How about Crypto.com’s “DeFi” trading?

How about those Crypto.com credit cards?

Well at least they work at Costco, right? Oh.

Well at least there’s CRO, Crypto.com’s exchange token. Thank god I invested in such a widely traded and reliably appreciating risk free asset.

Whoops. Well at least my crypto is insured on Crypto.com, right?

Phew. Thank god Crypto.com’s policy is so short and easy to understand, unlike literally every other insurance policy I’ve ever seen in my life that consists of pages and pages of conditions and terms like “if the theft under $50,000, then ____ but if theft was over $50,000, then ____” or “if water damage but not act of god then ____ but if act of god and not water damage then _____”. It seems Crypto.com has been working extra hard on this because the insurance policy is now even shorter than it was back in October 2021 when it actually explained that my bitcoins were insured against both 3rd party theft and physical damage.

Because it would be a shame if all my bitcoins got dropped on the floor or burnt in a fire. And it’s totally no problem at all that these terms pretty clearly say that I have no insurance whatsoever against a failure of the Crypto.com exchange or theft by someone who who works at Crypto.com. Why would I need that? The CEO Kris Marszalek is totally trustworthy.

Well, at least I can see on the app just how much money I’ve made or lost trading crypto on Crypto.com’s platform, right?

What about that psychedelic mushroom themed NFT project Crypto.com had been hyping? That looked really awesome. NFT bros were stoked about having a chance to buy tacky links to ugly cartoon characters made of psychedelic mushrooms.

Oh. Well at least I can earn interest on my crypto through Crypto.com’s amazing staking program, right?

For the blissfully crypto-ignorant members of my readership it’s worth mentioning that the five tokens above are on the more “legitimate” end of the spectrum. One of them, TUSD, was even the subject of one of our past issues.)

Oh. Hmm… Well I guess I better unstake my crypto then.

Hmm, starting to wonder if the Crypto.com team might need to do a little more work to get their house in order!

EIN KLEINE GELD MUSIK

Obviously most of the above are anecdotes that prove nothing in and of themselves. But there do seem to be kind of a lot of them. What I’ve shown you, dear reader, is really just the tip of the iceberg. I encourage you to peruse r/Crypto_com for yourself and see what’s going on. Because it’s not a pretty picture. But what might be a slightly more alarming picture is the one that emerges when you start going through European corporate filings trying to prove the long postulated “5,000 shell companies run by 20 dudes in a room” hypothesis. Thankfully you can skip the research part because anonymous OSINT sleuth annihil4tiongod has already done this over on his Substack. Spoiler alert: Binance and Crypto.com are part of the Tether cartel, along with ByBit, Huobi, KuCoin, Mexc, Poloniex, and Bitfinex10.

Of course that is kind of interesting. You may recall that Crypto.com was booted off of Binance’s private blockchain. Or at least one of Binance's private blockchains: the BNB Smart Chain F.K.A. “Binance Smart Chain”. Companies like Binance and Crypto.com breed new blockchains like rabbits - Binance just announced a 3rd private blockchain (“BNB Greenfield”) and I’m pretty sure I saw Crypto.com also announce their 3rd private blockchain but I’m too lazy to confirm given that one private blockchain is already one more than any legitimate financial services company would offer11.

Given the fact that Crypto.com and Binance were so clearly joined at the hip for so long and now seem to be at loggerheads it almost seems like the prophecies of The Oracle Of Tulips may be coming true.

You may wonder what happens when users send BUSD on BSC to their Crypto.com accounts. The answer is simple. The money disappears into a black hole. And then Crypto.com tries to extort you for $100 to make any effort to get your crypto back.

SUMMARY JUDGMENT

None of the above necessarily proves anything about Crypto.com so by way of explication as to why reading all this has been worth your time I am going to paraphrase the very famous short seller Jim Chanos. Chanos, who is most famous for uncovering what is still one of the biggest frauds in American corporate history in the form of a company called Enron, had this to say when talking about a different cryptocurrency business called Tether12 on Crypto Critics Corner a while back.

It's as though you've gone to [Crypto.com's] house. You're standing outside on their porch. There’s heat radiating from the door and it’s also quite hot to the touch. The doorknob is extremely hot - so hot that it burns your hand when you touch it. There’s wisps of smoke coming from under the door. And yet [Crypto.com] is telling you there’s nothing wrong inside the house.

That could be true! Even though normally in this situation you would assume the house is on fire you're still not totally sure it is. You've never seen any flames. There’s no fire trucks outside. Maybe [Crypto.com] just lit a fire in the fireplace and forgot to open the flue. Or maybe they’re having one hell of a cookout in the living room and, throwing caution to the wind, they leaned the grill right up against the door. All [Crypto.com] would have to do to convince you the house is not on fire is just... open the door.

And yet they don't.

In my opinion the way Crypto.com has handled the situation with the “audit”, the loss of their European banking partner Transactive Systems, and their falling out with Binance is far more incriminating than the fact that the auditor put out a bunk report, their bank had to freeze their account for money laundering, or Changpeng Zhao accused them of having small dick energy in public. Things happen. Auditors make mistakes, bankers get confused, and Changpeng Zhao is a world class piece of shit. But legitimate financial companies would never in a million years let a 5 day failure of all euro withdrawals happen without an explanation and then follow it up with lie after lie after lie to their customers.

It’s almost as if the company was run by criminals so deep in their historically massive con that they don’t even know how to pretend to be legitimate any more.

Some call it “Twitter”.

Or maybe “was”. Right now it’s kind of Schrodinger’s Bank.

“Traditional Finance”, in the language of the bros.

This, in turn, may be setting off some alarm bells for those who remember The FTX Arena in Miami, back in the mid-Jurassic part of late 2022.

This is a bit of a misnomer as stablecoins are neither stable in value nor are they coins, but theoretically a $1 stablecoin is always worth $1.

If you’re new here you may not realize that there is more than one blockchain. Most people, when they hear “blockchain” think of the Bitcoin chain or the Ethereum chain. While those are generally regarded as the “legitimate” chains they are really just the tip of the iceberg. For example Crypto.com has no less than two private blockchains that have no obvious reason for existing other than to facilitate fraud. And they have recently announced a 3rd.

You’re sending money to a bank account for a company called Circle and yet somehow the money ends up in the custody of Crypto.com, which is best described as “textbook money laundering”.

Not completely unique - Binance and KuCoin’s “audits” had similar properties. But no non-crypto company has ever offered the world an “audit” like this.

Yes, really.

Which is kind of a problem given that multiple Senators just wrote a letter accusing Binance of being a hub for money laundering by international drug dealers, North Korea, and the mob.

Niether Kraken nor Coinbase has a single private blockchain.

Bloomberg has described Tether as “practically quilted out of red flags”.

Amazing.

Thank you.

Great post, as always. Crypto bros' willful ignorance on obvious financial fraud never stops amazing me. How delusional do you have to be to keep your money or magic beans on CDC at this point? Very, very delusional.

Btw. What happened to your reddit accounts?