Trump's Transition Team Is Tethered To Thievery (And Worse)

Howard Lutnick manages a huge pile of money for Tether, a sketchy offshore company whose name appears frequently in criminal indictments. He also just became co-chair of the Trump transition team.

This is part two in a series about the broligarchy. Part one, “Of Tech Bros And Trumpers” covered the ways in which international money laundering and decentralized finance enrich the crypto venture capitalist firms who’ve chosen to back Trump.

“Opportunity makes a thief.”

- Francis BaconHoward Lutnick is perhaps best known as the CEO of Cantor Fitzgerald, a financial services company that up until the morning of September 11th, 2001 occupied the particularly inauspicious real estate at the tippy-top of 1 World Trade Center. Up until that morning Lutnick’s name was not well known outside of Wall Street circles but in the weeks that followed the public got to know him as the guy who stopped the paychecks of all his recently vaporized employees before the dust had even settled around the smoking crater that used to be two of the world’s tallest buildings1. That decision left the families of his employees without their expected incomes just as they were grappling with the horror of having lost a loved one in a terrorist attack.

I share that anecdote not because it’s particularly germane to the topic we’ll be covering here but because it effectively sets the stage as far as what kind of person we’re talking about when we talk about Howard Lutnick.

These days Lutnick should be well known2 for managing “many” of the $118 billion3 dollars theoretically belonging to a company whose name appears in criminal indictments the world over. Pig butchering fraudsters, fentanyl traffickers, slave traders, Russian oligarchs, North Korean hackers, Hamas, and Hezbollah have all relied on the full faith and credit of this pile of money to ply their trade while skirting the laws created to prevent them from opening the kind of plain vanilla checking accounts the rest of us non-terrorists take for granted4.

The company whose money Lutnick is holding5 is named Tether. No one knows who actually owns Tether or what its finances look like because Tether is the largest financial services company in history to have never undergone a basic financial audit6. Bloomberg has described the company, which has been caught red-handed lying to both its customers as well as various governments about everything from how much money it really has to who its partners are, as “practically quilted out of red flags”. It’s also far and away the single most important company7 in the rolling tsunami of fraud and cringe sometimes called “the cryptocurrency market”.

BANKING THE UNBANKABLE

What kind of company is Tether? Here’s a good mental model that will get you most of the way to understanding their business plan. Envision an enormous bank account that is simultaneously shared by every kind of criminal the world over. Think organized crime groups of many and varied ethnicities, drug cartels, terrorists, rogue nuclear states, money launderers, offshore casino operators, and so on8. Then:

Tether is the accounting system9 that enables this cast of supervillains10 to share the bank account, keeping track of who owns how much of the money in the account at any given time.

Howard Lutnick’s company Cantor Fitzgerald is the bank.

Tether makes money because this bank account earns interest. A whole lot of interest, paid directly by the United States Treasury into Tether’s pocket11, none of which is ever passed on to Tether’s customers (the people sharing the bank account) as would be expected in any normal financial operation that involved taking custody of customer money. By many metrics Tether is one of the most profitable companies in human history, often reporting more quarterly income than Goldman Sachs. On a per employee basis it’s not even close:

Anyways while that’s not exactly how the Cantor/Tether setup works - for instance Cantor is not technically a bank and what’s in the shared account isn’t cash but instead “cash equivalents” as well as gold, bitcoins, and worse - that’s a pretty reasonable way to think about it. In fact that’s the way Tether wants you to think about it. The slogan “banking the unbanked” is endlessly repeated both by their executive team as well as the crypto industry writ large.

It would be reasonable to wonder whether these impressive profit margins are related to the fact that Tether’s name keeps showing up in criminal indictments all over the world, perhaps most noticeably in the American and Chinese court systems.

Back to Howard Lutnick. In addition to his work as CEO of Cantor Fitzerald Lutnick has recently taken a keen interest in politics, holding at least one star-studded fundraiser for Donald Trump at his home in the Hamptons. This fundraising activity appears to have paid off handsomely seeing as how Lutnick was just appointed to be co-chair of the Trump transition team12, a title he shares with Linda McMahon from World Wrestling Entertainment (WWE13).

This article proposes that it would be reasonable for an American citizen to be Somewhat Concerned about the fact that a man who manages money for an offshore company which by all appearances seems designed more to avoid criminal prosecution than to serve its customers could well end up choosing who will be in charge of things like the Department of Justice and the armed forces if Donald Trump is reëlected14. And if you think this is just a partisan perspective I will note that even in our polarized times a large and diverse group of people from both sides of the political aisle15 agree that Tether’s role in international criminal finance is Very Concerning16. In fact scepticism about Tether has done wonders to bring people from all sides of the political divide together.

POKER FACED

So if Tether is an accounting system then how does it actually manage the accounts? A good mental model is that of a poker chip. Poker chips are, in their own way, an accounting system. When you enter a casino you give your money to the cashier in the cage. In exchange you are given poker chips along with the promise that you can bring those chips back to the cage and cash them in for real money at some time in the future. Your account balance in this system is the number of chips in your pocket. When you acquire more chips your balance increases, when you (inevitably) lose chips gambling your balance decreases, and if someone hits you in the face with a metal pipe and steals all your chips then your balance falls to zero.

This is a pretty good way to understand Tether’s token, usually referred to by the four letter symbol USDT17. In our simplified scenario USDT is the poker chips, Tether is the cashier where you buy those poker chips, the swarm of rigged gambling parlours that make up the cryptocurrency market is the casino18, and North Korea’s Lazarus Group is the metal pipe.

What specifically happens when you give Tether your U.S. dollars is that Tether takes those dollars and puts them in an account at Cantor Fitzgerald19. They then give you an equal amount of USDT “tokens” on a blockchain20 along with not-quite-a-promise21 that they will give you $1 for every USDT token you bring back to them in the future22.

[EXAMPLE]

If you give Tether $100,000 you will receive 100,000

USDTtokens.If you give Tether 100,000

USDTtokens they (almost) promise to give you $100,00023.

Once you have exchanged your real money into cryptocurrency you and your newly purchased USDT tokens are loosed into the Hobbesian jungle of international criminal finance. It’s a place where the life of your capital is likely to be nasty, brutish, and short, but if you can come up with a good enough scam or rob enough people you can get incredibly rich.

MULLAH MULLAH

It is worth noting that Tether is not the only poker chip vendor in the cryptoverse. It is, however, by far the biggest one, claiming to manage more than three times as many dollars24 as its only competitor of any size25: a company called Circle. This size disparity may or may not be related to the fact that Circle is an American company that at least tries to create the illusion that it complies with existing financial regulations26. If you are the kind of cryptocurrency user who might be negatively impacted by that compliance - if, let’s say, you were an Iranian money launderer who was well known for violating the current sanctions regime imposed by the United States government, a sin which would get normal banks a corporate death sentence and the executives of those banks a trip to prison27 - you might prefer to just not go near anything that has even a whiff of legal compliance. Therefore you might always choose Tether when presented with a choice of poker chip vendors.

At least, if there theoretically was such a person.

Or if you were, say, an Iranian cryptocurrency exchange allowing Iranians of all stripes to access dollar backed tokens you might also prefer some poker chip vendors over others. If such a company theoretically existed, at least.

If such a company existed it might even publish instructions on how to avoid getting caught by the money laundering authorities on its public FAQ page.

It might also publicly advertise the fact that Tether’s USDT token is one of its most actively traded tokens.

It would not be unreasonable to conclude from the above evidence that no one in either political party in America cares about sanctioning the Iranian regime despite a lot of sturm und drang from both sides. Trump in particular made a lot of noise the Iran nuclear deal not being tough enough on the mullahs. Now the head of his transition team is holding American assets that back tokens with which Iranians transact freely using what are functionally U.S. dollars. And while I was unable to confirm it I will mention that I have heard rumours from very good sources that the Iranian Revolutionary Guard, one of the most aggressively sanctioned entities on the planet, uses Iranian crypto exchanges (like Nobitex) to distribute funds to its proxies in the region (like Hezbollah), much to the chagrin of Iranian crypto bros28 who both do not like the theocratic government and also know this could put their business in a dangerous place.

LOGOMACHY

You may be wondering how this is all legal. The short answer is that for now Tether and Cantor Fitzgerald can afford enough lawyers with Ivy League educations and black holes where a conscience should be to let them pretend that cryptocurrency is so newfangled and “innovative” that the myriad laws preventing other financial institutions from doing business with criminals, terrorists, and rogue nuclear states do not apply to them. The legal argument29 goes something like this:

“We, Tether, really only have around 300-400 customers who give us money and to whom we have given poker chips. Once our poker chips are out in the world we pay no attention to who might be holding them and what those people might be doing with them30. In addition should any of our 300-400 customers repeatedly keep arriving with billions of dollars in cash we will never ask any questions about where that cash came from. All of this is fine because we are but a lowly poker chip vendor and definitely not a bank, money transmitter, currency exchange, or any other kind of financial business currently regulated by the government of any country larger than a small Caribbean island.”

Thus it may not surprise you to learn that enormous quantities of Tether’s USDT tokens keep showing up in the hands of fraudsters, drug dealers, Russian oligarchs, terrorists, Chinese kleptocrats, and so on. To individuals in this vaunted cast of characters USDT on a public blockchain is pretty much as good as a checking account.

As an example consider a situation where I, a Cambodian slave trader, would like to buy a slave from you, the owner/operator of a scam factory where this slave currently plies her trade. All I have to do is transfer the appropriate number of USDT tokens from my blockchain address to yours. The uncensorable31 and peer to peer nature of blockchains ensures that no government can stop our transaction. And if you don’t have a blockchain address32 yet you can set one up right there on the spot in minutes. It’s more or less like opening a U.S. dollar bank account except without all the pesky paperwork and background checks. This is why “banking the unbanked” has become a rallying cry of both the crypto industry at large and Tether in particular33.

Because in a very real sense the actual bank account - the one that has to do the paperwork - is already open. The dollars that back the USDT tokens I exchanged for your slave are sitting in an American financial institution called Cantor Fitzgerald.

ALUMNI GIVING

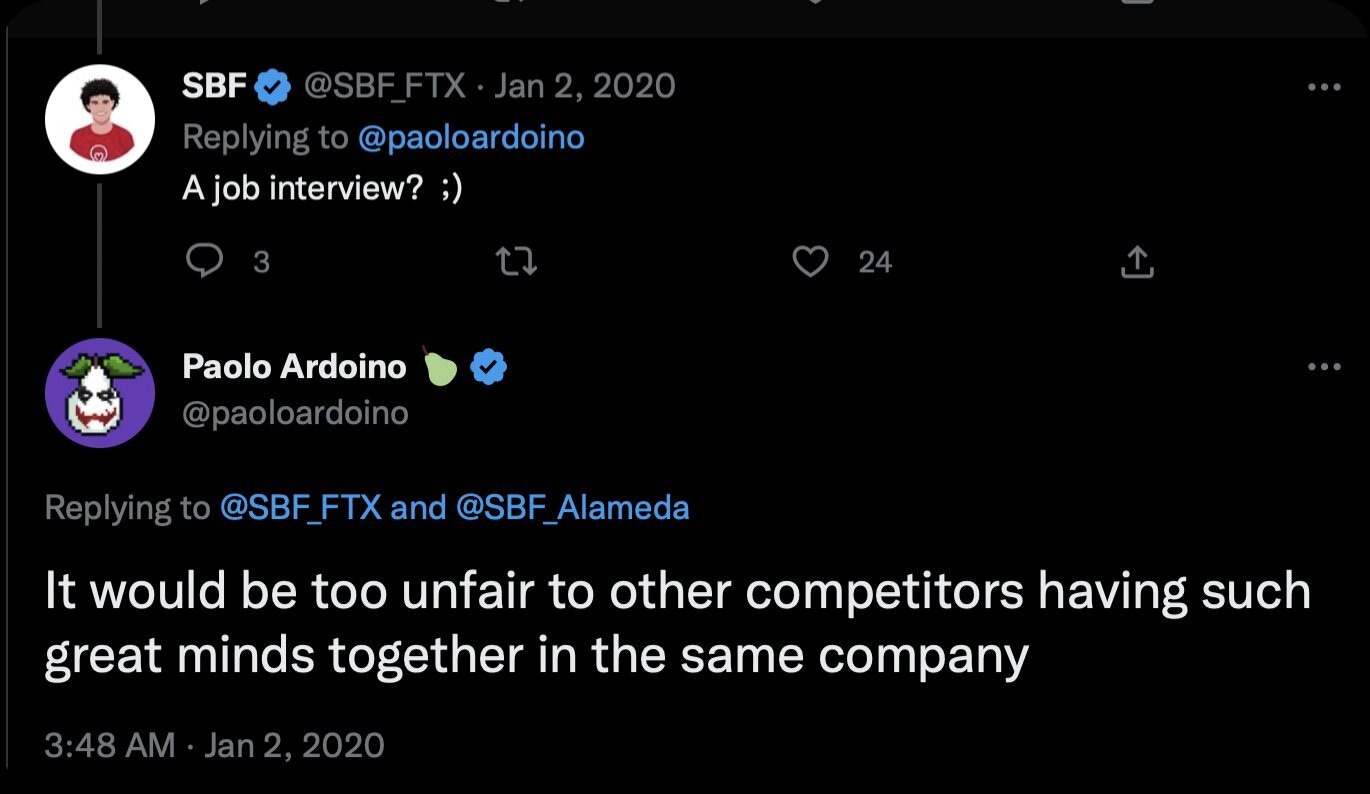

It is perhaps worth pausing for a moment to note that several of Tether’s customers have become quite famous in the last few years.

Tether’s biggest customer, a young man by the name of Sam Bankman-Fried, appears to have bought $40 billion worth of

USDTfrom Tether prior to becoming quite famous in 2022 when his company FTX turned out to be one of the largest frauds in human history. Bankman-Fried is currently serving a 25 year sentence in a federal penitentiary while theoretically most or all of the $40 billion is still in Howard Lutnick’s possession, earning interest for Howard Lutnick and his crew of merry pranksters. According to The Financial Times a lot of that $40 billion came from guys with bags full of cash lining up outside a sketchy office in Hong Kong every day for blocks over the course of several years.Alex Mashinsky, a customer to whom Tether “loaned” $1 billion USDT tokens in exchange for bitcoins (which very importantly is not how this is supposed to work - new

USDTis supposed to only be issued in exchange for actual U.S. dollars), became famous around the same time as Bankman-Fried when his company Celsius Network turned out to one of the larger frauds in corporate history even if it didn’t put up FTX numbers34. Mashinsky’s criminal trial starts in a few weeks. If convicted35 he could end up spending 25 years in a federal penitentiary.Kanav Kariya, the head of Jump Crypto and one of Tether’s bigger customers, recently stepped down amid rumours of investigations by the CFTC and FBI. While he has not been indicted yet I suspect he will eventually be sent to a federal penitentiary.

Zhao Dong, both a Tether customer as well as a shareholder, was arrested and sent to the equivalent of a federal penitentiary in China in 2021 for running an organized money laundering ring.

Pavel Durov, the CEO of popular social media app Telegram36, was recently arrested as he stepped off his private jet onto French soil. Details are still coming out but as of time of writing it appears he will be charged with a host of crimes related to the fact that Telegram refused to police its users even when those users turned out to be organized crime figures, fraudsters, and child abusers.

Any patterns you are noticing about Tether’s customers are probably just a coincidence. Additionally I will point out that while not as famous as the men just listed one of Tether’s other shareholders, a man named Christopher Harborne, managed to make the news as the single largest donor to the Brexit campaign.

This video of storied fund manager Hugh Hendry discussing Tether at a bitcoin event is a good approximation of how most competent financial professionals view Tether. The frightened “Is it OK to let him say this publicly?” look on the face of the interviewer pretty much sums up how everyone in the crypto industry views anyone publicly questioning Tether’s legitimacy.

WHAT THE TETHER

There is very little left to say about how obviously sketchy Tether is that has not been said over the course of the past 7 years by an army of financial journalists, attorneys general, regulators, United States senators (even the most militantly pro-crypto senators), offices of the United Nations, American treasury secretaries, and on and on and on. To date the best characterization of Tether is Zeke Faux’s description from a 2021 Bloomberg article titled “Anyone Seen Tether’s Billions?”

“It was hard to believe that people had sent $69 billion in real U.S. dollars to a company that seemed to be practically quilted out of red flags.”

It was hard to believe then. Today, as the number approaches $120 billion and Tether becomes at least theoretically one of the largest pools of capital in the entire world outside of things like the sovereign wealth fund of Saudi Arabia, it has become harder and harder to believe.

The incredible nature of Tether’s claims to solvency has given rise to a spectrum of opinions ranging from “Tether Truthers” who think that there’s just no real money there (and thus Tether is the largest fraud in history) to those who believe that it doesn’t matter if the money is there or not as long as people keep believing it’s there (a commonly held opinion among crypto bros). Of course many crypto bros, along with an army of Filipino “PR people” in Tether’s employ, wax philosophical on social media about Tether’s trustworthiness even though technically the record shows very plainly that Tether has repeatedly lied about its assets in the past.

I’m not here to re-litigate the issue of Tether’s solvency but if you want my opinion anyways I tend to think that at a minimum most of the money backing Tether at least exists. There are, however, still some questions I consider to be “extremely open”. Questions like:

Does all of the money exist or just most of it?

Has Tether loaned out or otherwise encumbered whatever money they do have?

Where did all that money come from?

Does Tether actually have control of the money?

Has the U.S. government or E.U. already frozen any of Tether’s accounts?

Some day the world will get answers to those questions. If they are the wrong answers it will be an extinction level event for crypto, thousands of times more destructive than the collapse of FTX. The fact that the probability seems quite high that at least some of the answers will be the wrong ones is why most people in the cryptocurrency industry do not ask questions about Howard Lutnick or Tether… and they would rather you didn’t ask any either.

FURTHER ELUCIDATIONS

If you’re the kind of sicko who really wants to read more about the mechanics of how a dubious shadow banking systems for criminals the world over actually works here’s some links:

[UPDATE] Wall Street Journal’s long form reporting on Tether which they called “The Shadow Dollar That’s Fueling the Financial Underworld” came out a week or two after the article you just read was published.

“Charting the Shadow USD Network In Asia: Part 1” (also Part 2) is an excellent article by Jan Santiago that gets into the nitty gritty and links to many detailed sources. “$75 Billion In Pig Butchering Is Not ‘F*cking Absurd’, Actually” is another good post by the same author.

Bloomberg’s excellent Odd Lots podcast did a “What We Know About Tether” episode with Bennett Tomlin, a journalist at Protos and possibly the world’s greatest Tether expert who has been following the company for more than 5 years.

“Huione Guarantee: The multi-billion dollar marketplace used by online scammers” is recent research showing that $49 billion worth of

USDTtokens - roughly the value of the U.S. Air Force’s entire fleet of F-16 fighter jets - has passed through a drugs/weapons/slaves/etc. marketplace in Southeast Asia.“Tether and Northern Data Part I” (Part II, Part III) is a series about Tether’s more than half a billion dollar investment in a German bitcoin mining company Northern Data that was recently formally accused of committing fraud by the CEO and CFO of its American subsidiary.

“The Many Escapes Of Justin Sun” is an article published in The Verge about the antics of one of Tether’s most colorful business partners, a man who hails from the People’s Republic of China and is so incredibly shady that even the rest of the crypto bros are like “yeah that guy’s obviously a crook”. [UPDATE: As of late December 2024 Justin Sun became the largest “investor” in Donald Trump’s crypto scam World Liberty Financial.]

“Signature Bank, FTX, Binance, and TrueUSD: A Tale of Questionable Judgement” is an article I published on this blog about one of the Trump and Kushner family’s favorite banks37 a few months before that bank collapsed in one of the biggest bank failures in American history. I was interested in Signature Bank primarily because I suspected Tether banked there (some of Tether’s shareholders reportedly attempted to bank there at some point).

While all those links provide important info about Tether the best way to understand the vibe of Tether is to watch Tether’s now CEO (then CTO) sweating his way through a CNBC interview while attempting to explain why Tether “can’t disclose” any information about where all the money is.

When you finish watching consider the fact that this guy is nominally running one of the biggest investment funds in the entire world. More than the GDP of some countries.

Lutnick turned off the paycheck well before the smoke stopped billowing (which took quite a while - most of a month).

But sadly isn’t, which is why I had to write this.

Roughly the cost of 1,815 F-16 fighter jets which is more than two times as many F-16 fighter jets as the United States Air Force feels necessary to own.

The Bank Secrecy Act and other anti-money laundering and “know your customer” (KYC) laws, many of which were put into place after Howard Lutnicks office was vaporized on September 11th. Time is a flat circle.

Not exactly bank accounts but it’s reasonably safe to think of it like a bank account if you’re not the kind of person who understands the treasury market. More specifically it’s a collection of assets most of which are U.S. treasuries AKA “pieces of America’s national debt”. Almost uniquely among world assets U.S. treasuries can be sold for cash pretty much instantly and in massive amounts so people in finance tend to view treasuries as more or less the same as cash that pays its owner interest.

It is almost certainly the largest financial firm in history to have never been audited. At some point way back in 2018 when Tether was a tiny fraction of the size it is now the company hired the auditor Friedman LLP to finally do their books and then almost immediately fired that auditor for asking too many questions.

It would not an understatement to say that as Tether goes so goes the entire crypto market.

And some, I assume, who are good people.

This accounting system exists on various blockchains but I’m only putting that in this footnote because I think it unnecessarily confuses things. The only way it matters at all is that blockchains allow people who don’t trust each other to transact with each other. Needless to say criminals do not trust each other very much.

And some, I assume, who are good people.

Because it’s not exactly a bank account. It’s actually a pile of bonds issued by the U.S. government which are referred to as “treasuries” in the financial industry. Said another way: the money in the bank account is currently on loan to the government.

A presidential transition team is theoretically a group of people who help a new president smoothly assume the reins of power. Practically speaking they help the president choose candidates for the hundreds or thousands of political appointments he or she will make to the top of every kind of government agency from the Department of Defense on down to whatever agency researches whether chemicals in the water might be turning the frogs gay.

Formlery known as the World Wrestling Federation or “WWF” for those who experienced the pre-millenial era as children.

There has recently been a big public relations push coming from the right about Tether’s use in illicit finance that I tend to assume was paid for by Tether’s American competitors, Circle and Coinbase.

Right of center publications like The Daily Mail have even called Tether “the next FTX”.

These “tokens” exist as numbers in spreadsheets called “blockchains” but we don’t need to get into that here. Also it’s “USDT” because it’s USD… tethered (to $1). Get it?

While the vast majority of crypto casinos accept USDT it is worth noting that not all of them do, at least not any more. Canada banned USDT last year. Tether will be forced out of the E.U. by new regulations that became law in 2022 but don’t come into effect until later this year.

Or at least they used to put it into Cantor Fitzgerald. While it is widely assumed this is how the setup still works it’s worth noting that no one knows for sure. We just know tens of billions of dollars of money that people gave Tether in the past ended up in Cantor Fitzgerald.

Which blockchain and why are beyond the scope of this article but don’t be bamboozled by the fact that Tether exists “on chain”.

The fact that Tether does not provide such a promise is an extremely important distinction when compared to a real casino but we will gloss over it for now. Just know that deep in Tether’s terms of service they make it extremely clear that they don’t really ever have to give you anything if they don’t feel like it. If you are a bit shocked that people have handed $115 billion to a company that won’t even promise to give it back instead of giving it to one of Tether’s competitors who absolutely do promise to give it back - in a contract governed by the laws of the United States, no less! - then congratulations: you are well on your way to understanding the paradox of Tether.

Because USDT tokens are always worth $1 they (along with other tokens that purport to always be worth $1) are referred to as “stablecoins”.

Actually they’ll give you $99,900 because they charge a 0.1% fee on all redemptions. The minimum redemption amount is $100,000 so they can avoid dealing with all the poors in their quest to provide banking services to the world’s underserved populations.

Or cash equivalents. Theoretically, at least.

Tether’s largest competitor is a company named Circle that is a close partner of the better known American crypto company Coinbase. Tether is roughly three times as big as Circle and between 15 and 40 times as much as the next biggest company, depending on the day. While they are not the subject of this article it would be remiss to not at least mention that those 3rd and 4th place stablecoin companies (TrueUSD and First Digital USD) are probably even more shady that Tether. Which is pretty impressive, in a way. [UPDATE: As of late December 2024 Justin Sun, the Chinese national responsible for one of those even shadier companies (TrueUSD) and for bonus points was part of Tether during their period of fastest growth, became the largest “investor” in Donald Trump’s crypto scam World Liberty Financial.]

It doesn’t. In fact Circle’s executives trot out the exact same legal fairy tale Tether claims allows it to skirt regulations. However in observed practice Circle’s fairy tale of compliance is more than enough to convince bad guys to use Tether. As an example some of the Iranian exchanges that move billions of Tether will automatically bounce back any of Circle’s tokens accidentally sent by users attempting to make a deposit.

The U.S. government takes sanctions violations Very Seriously. You can launder all the drug cartel money you want and you’ll probably get away with a fine… but if a wire from the bank you run even accidentally sends money to Iran, North Korea, or (now) Russia and the U.S. government finds out about it you are going to have Problems.

I actually have no real issue with Iranian crypto bros. They are one of the few groups of people for whom crypto might be a beneficial thing seeing as how it lets them exfiltrate capital and maybe one day make a run for it.

Some refer to it as a legal “fiction” and not a legal “argument”.

Even if those people happen to be terrorists or rogue nuclear states.

Tether transactions are actually entirely censorable but a) most crypto bros don’t know that and b) Tether almost never bothered to censor unsavory transactions up until Iran and Israel got into a war. I wrote a whole piece a year after this one was published about this kind of thing.

Often called a “wallet”.

Perhaps more realistically described as “banking the unbankable”.

At least, allegedly.

He will probably be convicted. The Celsius Network corporate chat logs released by the Department of Justice leave very little to the imagination.

In addition to the Telegram application Durov had also created his own blockchain (called “Ton Network”) on which Tether had just recently launched $600 million worth of USDT tokens in April 2024.

Ivanka Trump was even on the board of directors for a while, albeit not when the bank collapsed.

I think that the exposure to the reality of the global criminocracy has started to totally warp my sense of humour, because mid-way through your BRILLIANT article exposing how Tether has literally replaced the tax havens of the world and empowers the global criminal classes, and sanctioned nations (in fact sanctions force money into Tether), and bearing in mind that this is the Trump's transition team leader, I just started LAUGHING out aloud. The criminals are all in charge, they criminally print the money from thin air, wage economic warfare on all of mankind, blow up nations left right and center, and run the transnational criminal spaces with impunity.

Now we see the true purpose of allowing the private sector to develop the crypto-currency market because it gives the global criminocracy a brilliant new platform to steal the wealth from everyone, and for the greatest criminals to steal it from all the smaller criminals, which is exactly what they do. I am still laughing.

You are the best writer on the crypto universe, by far! The spergs who object to you poking fun at libertarians should just get over it and learn from the master