How To Insider Trade And Influence People (With Tariffs)

Days where the stock market gains 10% on the proclamations of a mad orange king are far more correlated with impending disaster than with strength.

“I have never cheated any honest men.” - The Yellow KidEver since last week’s big reveal of the nonsensical Trump Tariff Equation Americans have been trying to come to grips with the fact that their nation’s future prosperity (or lack thereof) seems to be wholly dependent on a series of increasingly unhinged proclamations emanating from the phone of an economically illiterate and extremely orange madman. It’s a decidedly less than ideal political reality that stands in stark contrast to the utopia of rational citizens making cool-headed and well informed decisions that populates economists’ erotic fantasies about how the country’s economic affairs should be conducted.

Not since FDR has an American president attempted to effect anything even in the ballpark of the kind of direct intervention in the nation’s economy that Trump has been bungling his way through over the last few weeks. One gets the sense Americans don’t even know what to make of what is happening to them because there’s nothing in their history to compare it to. Even FDR makes for an extremely poor comparison - sure, he did a lot of interventionist and vaguely central planny stuff. But he did those things after convincing Congress to pass laws that gave him the power to do them. Which is, you know, how the American constitution says the president is supposed to do that kind of thing.

Donald Trump, on the other hand, showed up to the free market drunk, punched congress’s girlfriend in the tits, and proceeded to throw a series of J6 gang signs before grabbing the steering wheel of the steamroller of American free enterprise and using it to execute a series of highly performative donuts directly on top of your stepmom’s flowerbeds. Steamroller donuts, each one cheered on more enthusiastically than the last by a cavalcade of botoxed ghouls from Fox News, OANN, Newsmax, and the entire consortium of Tenet Media connected podcasts caught red handed taking millions of dollars from Russian intelligence less than a year ago. It’s a trajectory of government takeover that is unrecognizable to the American electorate, though I have a bad feeling that anyone who lived through the attempt of a populist strongman like Robert Mugabe, Victor Orban, or (especially) Hugo Chavez to place themselves at the center of a new and “improved” centrally planned economy would feel the shock of recognition.

American economic catastrophes are not rare. A big one usually rears its monstrous head at least every decade or two. What’s different this time is that in The Beforetimes America’s catastrophes were all bottoms up, grassroots affairs (albeit ones often shaped by bad incentives dispensed from above). They emerged from herd behavior - the “madness of crowds”, if you will - whereas if and when this catastrophe hits it will be an entirely top down affair that floweth from a single orange mind.

Which is not to say that catastrophes brought on by the madness of crowds are in some way less serious. America, being a capitalist society built around a population whose gene pool is overflowing with the DNA of ancestors who fell for a dubious 18th century get rich quick scheme called “Subsistence Farming In The New World”, is in a lot ways singularly susceptible to them. What usually happen is that an (often quite large) subset of the population manages to hypnotize itself with whatever the latest and greatest model of get rich quick scheme happens to be at the time (Dotcoms! McMansions! Tesla! Crypto! AI!). But whether those catastrophes were worse or not is besides the point. Being driven into the jaws of economic catastrophe by a single deeply flawed and orange mind is new to the American experience.

There’s never been an American equivalent of Mad King George or Caligula because America, somewhat famously, doesn’t have kings or emperors. You might say it’s kind of the country’s whole deal, especially as far as the nation’s world famous economy. One would be hard pressed to name any point on the timeline of American history where a single orange faced jackass with a combover could burn down all of the world’s major financial markets simultaneously.

No longer. Every time Donald calls Printer Girl into his office to take some rage tweet dictation the DOW, Nasdaq, NYSE, FTSE, Nikkei, Hang Seng, DAX, and more cower with fear.

DIARY OF AN ORANGE MAN

“Tariffs” is, as the man often reminds us, Donald Trump’s favourite word in the English language. He has publicly called it “the most beautiful word” too many times to count. Beauty is in the eye of the beholder I guess. I, for one, can think of an incredible number of words more beautiful that “tariffs”. But “tariffs” is not a word without its merits! As far as magic words go “tariffs” is actually quite malleable; its awesome market moving power can be tempered and/or redirected just by changing up the words placed around it. For instance if Donald Trump tweets something like this:

chairman xi can SUK MY DIK!!!

bc America is gonna make the BIGLIEST TARIFFS EVER!!!!! #MAGA Then investors around the world will (quite reasonably) start worrying that an orange madman is about to hurl the world’s second largest economy into a trade war against the world’s largest economy and global markets will crash. If, on the other hand, he rage tweets some weak sauce excuse for canceling temporarily postponing those same BIGLIEST TARIFFS EVER, investors will assume that the trade war has been called off and prices will (hopefully) go back up to roughly where they were before the now canceled postponed BIGLIEST TARIFFS EVER were announced.

Obviously if you know with certainty that the price of a thing is about to go up (or down1) you can make money by buying that thing, waiting a bit, and then selling it to someone at the new and higher price. How much money you can make depends (mostly) on the size of the market: bigger markets with more participants present more opportunities to make trades happen. And what is the biggest, most liquid market in the world?

America’s financial markets are so massive and so liquid that you can make millions of dollars just by knowing that the price of a single company’s stock is going to go up by 5% in the next 30 minutes. Now imagine how much money you could make if you knew that the share price of every single publicly traded American corporation was about to go up by 5% in the next 30 minutes.

Put all that stuff together and this is the picture that emerges as of April 2025:

Anyone who knows that the stock price of a company is about to go up (or down) can make a lot of money.

Anyone who knows that the stock price of every company in the United States is about to go up (or down) can make an almost unlimited amount of money.

Donald Trump’s mean tweets have the power to make the stock price of every company in America go up (or down) any time he wants to.

Anyone who knows what Donald Trump’s next mean tweet will say about tariffs knows when the stock prices of every company in America will go up (or down).

It’s a picture of a world where a single man who happens to be the President of the United States can move the world’s financial markets in whatever direction he so chooses without even leaving the comfort of his golden toilet. Which means it’s also a world where that man can shower almost unlimited riches on himself and/or his cronies at any time just by telling them in advance what it is he plans to say in his next mean tweet about tariffs.

And just for good measure the same guy also has near absolute authority over the largest, most expensive, and most destructive military ever to exist, augmented by thousands of hydrogen bombs that are each 1,000 times more powerful than the bomb America dropped on Hiroshima.

ONE SMALL HITCH

If you are trading stonks2 based on information you have that the people on the other side of your trades don’t have and can’t get - for instance if you are selling shares of a company called BobCorp that you happen to know is going to declare bankruptcy tomorrow morning because you also just so happen to be BobCorp’s accountant - it’s pretty easy to earn money on the trade, though “earn” is probably the wrong word to describe what is going on with the money you receive in such a transaction.

Trading shares of stock is, on a short enough time frame3, a zero sum game, so any money you “earned” is money someone else “lost”. One doesn’t have to squint all that hard to think that a trade that involves you “earning” money from the sale of shares in company that won’t exist tomorrow bears a pretty strong resemblance to what might reasonably be described as “fraud”.

As it so happens that’s exactly how America’s criminal justice system has viewed such a transaction for most of the last century, ever since the stock market crash of 1929 had awakened an enormous number of Americans to the fact that their net worth consisted mostly of (now worthless) shares in companies like BobCorp that they had purchased from people like BobCorp’s (now wealthy) accounting team. During the Great Depression there were in fact so many of these bankrupt and furious BobCorp investors among the American electorate that they were able to convince the U.S. Congress to pass the securities acts of 1933 and 1934. Among other things those laws criminalized what is now called insider trading - buying or selling a company’s stock based on stuff you know about that company because you are an insider. The technical term for such forbidden knowledge is “material non-public information”.

Now there are quite a few ways to get your hands on information that might give you an advantage when trading a given company’s stock even if you aren’t technically an “insider” of that company, none of which legislators contemplated when drafting the original securities laws. As it turns out one of the best ways to get access to valuable information is to work for the government. All manner of government officials have access to information that could easily be described as “material and non-public”. For instance a senator might know which rifle manufacturer is about to get a lucrative 10 year ammunition contract. Food inspectors might know which companies are passing (or not passing) their health inspections. Medical clinicians might know which drugs are about to be approved to treat a particular illness. But the 1930s securities acts said nothing about these kinds of situations.

In order to try to remedy this 2012 Congress revisited the issue and passed the STOCK Act which theoretically was supposed to rein in government officials (especially members of congress) who want to cash in on the government secrets they’ve learned. Results have been… mixed. For one thing the STOCK Act didn’t seem to prevent several members of congress from making a lot of money trading on the information they were receiving in secret briefings about the oncoming covid pandemic. For another it certainly does seem suspicious that almost everyone in Congress, from highly educated legislators with family connections to finance like Nancy Pelosi and Mitch McConnell all the way down down the Marjorie Taylor Greene yahoo caucus, seems to be shockingly good at playing the market.

If you know anything about the details of what is and isn’t considered legally “insider trading” by government officials feel free to leave a comment. I don’t know much about the issue but from where I’m sitting there seem be at a minimum some pretty big loopholes in the STOCK Act’s approach to government accountability. [EDIT: left an interesting comment on this topic]

So yeah, “insider trading” is a crime. A serious crime, even. There’s even an entire agency (the S.E.C.) in large part devoted to finding and prosecuting the people who do it. But… what if there were away to turn “insider trading” into just plain old “trading” at the stroke of a “truth”?

A CONFEDERACY OF INSIDER DUNCES

Consider a possible timeline for an insider trading scheme based on knowing that Trump was about to deploy a killer magic word + mean tweet combo that’s guaranteed to move the market. You are Donald Trump in this scenario (I’m sorry).

[9:00 AM] You quietly inform your donors, cronies, and family members that you will be announcing the partial suspension of your disastrous tariff policy4 at 12:15 PM.

[9:01 AM] Give your donors, cronies, and family members time to buy lots and lots of stonks. (Maybe they actually buy call options on stonks because call options provide more bang for the buck when the stock market makes a big move5 but if you don’t know what a call option is don’t sweat it.)

[9:30 AM] Post "GREAT TIME TO BUY!" on the failing social media platform you created so you could name an app after Pravda6. In so doing you have plausibly transformed the legal status of your cronies’ recent stonk purchases from "insider trading felonies" to “beautiful trades based on publicly available information and raw genius"7.

[9:31 AM] Watch the MAGA faithful, from retail plebs in red hats on up through the right wing mouthbreathers that stalk the halls of Congress, begin to "buy the dip" based on the fact that their idol just “truthed” that now is a GREAT TIME TO BUY.

[12:15 PM] Publicly announce the partial suspension of your disastrous tariff policy.

[12:16 PM] Watch stonk prices skyrocket as the whole world apes in to “buy the dip” on the news that there has been an

end of hostilitiesvery temporary partial ceasefire in America’s 21st century trade wars. You and your cronies make tonnes of money selling the stonks and options you bought earlier to the suckers FOMOing back into the market now that the trade war has beencanceledpartially temporarily suspended.

Perhaps it’s not a coincidence that the steps of the scheme I just described which would be publicly visible were it ever attempted just so happen to look exactly like the things Donald Trump did on April 9th, 2025.

We can also ask ourselves “what other evidence would we expect to see if such a scheme were attempted?” to which you might say “I would expect to see a whole lot of people buying stonks and (especially) call options in size in the run up to Trump’s utterance of the magic word.”

Thankfully it just so happens that data about the trading of stonks and call options is publicly available. The story that it tells is that someone (or maybe a lot of someones) was buying a metric fuckton of call options in the minutes before Trump deployed the less mean tweet with the magic word that made the markets surge 10%. More specifically there was a 1,000% increase in the volume of call options being traded at exactly that moment.

You don’t have to be a rocket scientist to notice that data strongly suggests that someone (probably a lot of someones, given the 1,000% surge) was trading call options based on their insider information about Trump’s upcoming mean tweet.

I’ve heard people hypothesize that perhaps smart traders saw a news item about Treasury Secretary Scott Bessent getting called in to an emergency meeting with Trump immediately before the less mean tweet hit the wires. Based on this data point plus the knowledge that Bessent has been urging Trump to take a more moderate approach w/r/t the trade wars these smart traders were able to guess that tariffs were about to be cancelled partially postponed… or at least that’s how the theory goes.

I don’t buy it. While I’m sure there are traders out there who are smart enough to make a bet based on a small data point about Scott Bessent’s schedule on a day when everyone suspected Trump was going to make some kind of announcement about tariff policy I’m extremely doubtful that the entire 1,000% increase in options volume that only got going in the final few minutes before Trump waved the white flag of surrender can be attributed solely to smart traders making inferences about the movements of Scott Bessent.

PARDON ME, SIR

If there’s anyone out there who doubts that Donald Trump is crass enough to crash the global economy just so he and his friends can make a few bucks trading call options I would ask them to consider Donald Trump’s recent string of pardons exonerating some of America’s more infamous white collar criminals of recent vintage. I would argue that the way these pardons have been doled out provides ample evidence that the man is more than willing to abuse his presidential powers in exchange for 30 or more pieces of silver.

Trump pardoned Nikola Motors fraudster Trevor Milton, a man who defrauded everyone who invested in the fake electric vehicle company he founded for hundreds of millions of dollars and then thoughtfully donated a few of those millions to Trump’s presidential campaign before those millions could be seized by the court and handed over to his victims as part of his court ordered restitution (conveniently the pardon absolves Mr. Milton of ever having to pay any restitution at all so he will presumably get to keep the rest of the money he stole). The fact that Trevor Milton’s lawyer also just so happens to be the brother of Pam Bondi, AKA “America’s top law enforcement officer”, is probably not relevant to why Milton received a full pardon.

Fraud charges that had been filed in 2023 against a Chinese crypto tycoon named Justin Sun - a man widely considered to be the most depraved and amoral bro in the sea of amoral bros that makes up the crypto industry - were dropped shortly after His Excellency8 Mr. Sun made a $75 million “investment” in Trump’s second crypto venture World Liberty Financial (WLFI)9. Justin Sun is also involved in Tether, a stablecoin10 whose enormous pile of assets were (are?) managed by Trump’s Secretary of Commerce Howard “Nutlick” Lutnick.

Arthur Hayes, a convicted money launderer who founded a crypto exchange called BitMEX back in “the day”, received a full pardon despite having served out his sentence and reintegrated into the crypto markets years ago. Perhaps coincidentally Hayes recently founded a new stablecoin company called Ethena. For reasons that probably have absolutely nothing to do with why Hayes received a presidential pardon years after the fact, it just so happens that Trump’s company World Liberty Financial is one of Ethena’ financial backers. And in what appears to be a first of its kind situation, Trump has issued a pardon not only to Arthur Hayes (the person) but also to BitMEX (the corporation that Arthur Hayes created to do the money laundering crimes he was later convicted of) the day before BitMEX was due to pay a $100 million fine for (you guessed it) money laundering crimes. Give Trump credit for innovation I guess? I doubt any of America’s other presidents have ever even considered pardoning a corporation, let alone a sketchy Asian crypto corporation widely used by international money launderers.

Carlos Watson, the man who defrauded Ozy Media’s investors out of tens of millions of dollars by doing things like impersonating executives at companies like YouTube, had his sentence commuted days before he was set to report for a long prison sentence.

And of course one cannot forget the fact that immediately after his inauguration Trump pardoned almost every single January 6th rioter who had tried to help him steal the 2020 election, including all of the rioters who were caught on video beating the shit out of police officers11 with weapons.

Of course other than Justin Sun most of the people who Trump just pardoned were financially pretty small potatoes (at least that we know about). Trevor Milton only donated $1.8 million to Trump. World Liberty Financial invested a mere $4.7 million in Ethena. What, then, to give the megadonors who collectively poured billions into Trump’s reelection effort?

By mafia logic those who pay more tribute to the boss deserve more blessings from the boss. Recently, however, Trump’s donors have not been feeling very blessed. The Trump Tariff Equation, along with the level of incompetence it revealed, has been rampaging through the stock market and causing wealthy people to lose incredible sums of money on their investments. Things had even gotten to the point where these wealthy people were starting to say kind of ugly things in public. For instance billionaire MAGA bro cum dude who LARPs as an intellectual on Twitter Bill Ackman called out Commerce Secretary Howard Lutnick for being financially incentivized to root for the collapse of America. Elon Musk started calling Trump’s favorite tariff adviser Peter Navarro “Peter Retarrdo” on The Privatized Public Square.

Perhaps Trump thought that he could placate his wealthy donors by giving them an opportunity to make back some or all of the money they had recently lost by handing them history’s most incredible insider trading opportunity (and promising to pardon them or have their charges dropped if they get caught). Or maybe consider a scenario where the “Tesla Takedown” protests have driven Tesla’s stock price down to a level that puts Elon Musk financially on the ropes and badly in need of cash12. With just one hot tip and a few tweets Trump could provide Elon an instant and massive cash windfall, most of it from retail apes catching falling knives. Does anyone think Trump wouldn’t do that kind of favour for a man who donated a quarter billion dollars to get him reëlected?

CRYPTO SUB ROSA

It’s worth pointing out that while America’s government officials are (usually) required by law to disclose their stock trades to the public, America’s laws do not yet require those same officials to disclose their crypto trades because cryptocurrencies are still masquerading as something other than an “investment” (even though all the marketing around why you should buy crypto is very obviously pitching it as a great investment).

Consider that bitcoin, ethereum, and pretty much every other cryptocurrency behaved pretty much exactly the same as shares of American companies and also immediately popped 10%-20% on the news that the dumbest trade war in American history had ended experienced an extremely temporary partial stay based on the whims of one man who still doesn’t understand that “trade deficits” are not the same as “fiscal deficits”.

That means people trading on their advance notice of Trump’s upcoming mean tweet could make the same kind of money trading bitcoin (which they wouldn’t have to disclose to anyone) as they could make trading stonks (which they would have to disclose). This begs the question, why would a corrupt official looking to cash in on insider information ever trade stocks when they could trade bitcoin?

To perhaps make this issue feel more salient I will point out that at least one crypto trader managed to go 50x levered13 long right before trump’s early incantations of the magic word made global markets boom the first time. The same trader also managed to go 50x levered short a few days later immediately before another one of Trump’s mean tweets crashed the markets.

He made a small fortune in the process.

This particular trader is a bit of an anomaly. For one thing he14 was trading on an anonymous “decentralized exchange” called Hyperliquid where everyone can see everyone else’s (anonymous) trades “on the blockchain”. This is not what your average crypto bro would do in this situation, nor is it what members of the criminal cartel that controls most of the global crypto markets (a criminal cartel that includes a Chinese national and recent presidential pardon recipient named Justin Sun who became Donald Trump’s business partner a few weeks ago after placing around $50 million in cash directly into Donald Trump’s pocket) would ever do if they were looking to cash in on a hot tip.

Bros of all shapes and sized would instead just do their insider trading on the crypto exchanges with major sporting arenas named after them: companies like Binance, Crypto.com, Coinbase, KuCoin, etc. Trades that happen on these “centralized exchanges” happen entirely within those companies’ private databases and are never written “on the blockchain”15, which means the only way the public will ever find out them is if that crypto exchange decides to make their data public, which they never do. And while theoretically law enforcement could roll up on these exchanges with a subpoena for information about a particular user’s trading activity, that only really works when the company is located in the same country as the judge that issued the subpoena. Most offshore16 exchanges are located in small tropical islands with a, shall we say, laissez faire attitude about things like subpoenas.

The harsh reality is that while insider trading on the Nasdaq or New York Stock Exchange is actually quite hard to hide from prying eyes, crypto trades are more or less invisible by default. Thus if Trump’s cronies were to make a fortune going 50x leveraged short bitcoin ten minutes before the Trump Tariff Equation’s big reveal the public will probably never find out about it. This would be the case whether said cronies did their trading on an offshore exchange (because the trades are not public) or on a decentralized exchange (because the trades are pseudonymous if not functionally completely anonymous17).

Oh, and it just so happens to be the case that Trump Media & Technology Group (stock ticker: DJT, also known as Truth Social) announced it was pivoting to crypto in an SEC filing it made a few days after the inauguration.

Realistically the only ways the voting public is ever going to learn anything about the activities of any government officials who might be trading crypto (other than voluntary disclosure, which seems unlikely for people who are committing felonies) is if those platforms decide to weaponize their user’s private data against (which, I should note, is something that has actually happened18). And that’s just “regulatable” crypto like bitcoin and ethereum. When it comes to bribery tools memecoins like TRUMP law enforcement’s gloves have been taken all the way off. America’s financial regulators declared memecoins to be essentially unregulatable a few weeks ago, meaning no matter how shady the memecoin grift there’s nothing illegal about running it on American citizens.

GREEN DAY

The fact that stonk prices did, in fact, go massively up when Trump announced the cancellation temporary partial suspension of the Trump Tariff Equation - more up, in fact, than Nasdaq stonks have ever gone up before other than one day in 2001 - had many MAGA bros engaging in a lot of victorious crowing about the ineffable financial genius of one Donald J. Trump. I’d like to suggest a different interpretation.

Consider this chart of the top ten most up days in the history of the Nasdaq. Every single one of these days was a rebound days that occurred in the midst of a major market meltdown. Only two of those days - the ones that happened during the covid panic - turned out to be good opportunities to BTFD19. Other than yesterday, whose long term portents are still TBD, 100% of the other days were short lived bursts of enthusiasm that occurred in the early or middle phases of brutal and protracted market crashes.

In other words if you “bought the dip” on any of those days you got rekt af20.

I suspect this happens because as a bubble is popping traders who desperately want to believe that the bubble has not yet popped latch on to any and all good news and convince themselves en masse that “the bottom is in” and they need to “buy the dip”. Unfortunately a more sober assessment of the history of massively up market days would conclude that such days are far more likely to be a harbinger of impending doom than a sign of returning strength.

History is known to repeat itself first as tragedy, then as farce, and finally as Pee Wee German houting stuff about the economic genius of the Dear Leader on Fox News so it was unsurprising that today, one day after the 2nd biggest up day in Nasdaq history, the market’s animal spirits delivered a massive 5% sell off that left the Nasdaq down 15% since Trump’s inauguration.

With the caveat that as of the time of writing there’s only one new day of market data to look at it happens to be the case that that data point strongly supports the “harbinger of doom” interpretation of Wednesday’s massive gains. And as long as I’m going to be manifesting negativity about the state of the world I’d also like to throw out the fact that just a few days ago an incorrect internet rumour posted by some random guy on Twitter managed to move $4 trillion in asset prices within minute.

A market where that can even happen, let alone a market such a move can be triggered by Twitter randos, is deeply broken in ways it will take economists decades to fully understand.

Good luck America.

Restacks, likes, and (free) subscriptions are very much appreciated by the staff of The Cryptocalypse Chronicles. Privately sharing this post with a friend, family member, or feline familiar that you think will enjoy reading it is even better.

POSTUM SCRIPTUM

While the news has been pretty bleak lately there are at least a few points of light on the horizon: the penguins of the Heard and McDonald Islands have won their trade war against the United States and been freed of the tariffs that the evil empire had levied against them.

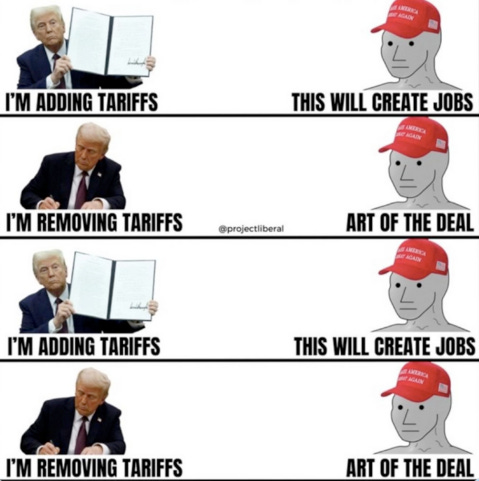

In other news the justification industrial complex that comprises so much of American political discourse on the right in 2025 has proven itself up to even the most difficult challenges of the moment.

I’m not going to over complicate things by explaining how to make money when prices go down but if you’re not aware traders can make money when the market moves in either direction just file that information away.

“Stocks” in the Wall Street Bets Bro dialect.

Over the medium and long term this is not true at all, mostly because a lot of companies pay out cash dividends to their shareholders a few times a year.

Suspending the tariffs will inevitably cause stock prices that have been battered by uncertainty about where Americans are going to buy all their junk from if they can no longer afford junk from China, the E.U., or that island with the penguins on it to immediately skyrocket.

Buying short dated options is by far the most efficient way of making a lot of money if you are trading on insider information. As a result buying a bunch of short dated options immediately before very good or very bad news comes out about a company is by far the best way to get busted by the SEC for insider trading. The SEC is very actively on the lookout for exactly this kind of behaviour.

Truth Social (“pravda” means “truth” in Russian).

"Insider trading” is defined as “engaging in financial transactions based on material non-public information”. Once Trump “truths” something that information is no longer “non-public” and therefore no one can be convicted of insider trading.

At some point when he was on the run from one of the many governments he’s been on the run from over the years Justin Sun bought himself a job as a diplomat from the island of Grenada. The position came with the title “His Excellency” which Justin still likes to use even though I think he’s no longer technically a Grenadian diplomat.

World Liberty Financial was founded by Trump's sons, Steve Witkoff, and Steve Witkoff's sons. Witkoff is also Trump’s “special envoy” to Russia and Israel. He was recently seen on Tucker Carlson explaining that Vladimir Putin is “not a bad guy” because Putin had commissioned “Russia’s top artist” to paint a flattering portrait of his friend Donald Trump.

Stablecoins are also known as “unregulated banks for criminals and rogue nuclear states.”

One of those pardoned J6ers ended up getting shot to death by police while violently resisting arrest within days of being pardoned and released from jail.

Musk’s recent spree of tweets and media appearances certainly gives the impression that all is not well with the man’s finances. In addition to the fact that he asked the president to let him use the White House as a car sale backdrop he also got Secretary of Commerce Howard Lutnick on TV to tell Americans to “buy shares of Tesla” because “they can never go down” and a few other stunts that reeked of desperation.

If you don’t know what “50x leveraged” means it’s just an insanely risky trade where you make or lose 50 times as much as you actually bet. So if you bet $2 and the thing you’re betting on goes from $100 to $110 you make $500 on a $2 bet. On the flipside if the thing you’re betting on goes from $100 to $98 you lose all your money as a 2% loss becomes a 100% loss..

Some folks on The Privatized Public Square claim to have identified the man behind the leverage but I haven’t been able to confirm whether they got the right guy, though if they did get the right guy it was extremely unclear how he managed to get the information about Trump’s announcements that he seemed to be trading on.

Crypto bros love to talk about the “transparency” of the blockchain but the harsh reality is that 99.9% or more of all cryptocurrency trading activity happens in these private marketplaces and is never written to any blockchains.

Pronounced “Chinese”.

The IRS was just about to force decentralized crypto trading platforms to start collecting data about their customers but a few weeks ago the U.S. Congress, 2/3rds of whom are in the pocket of the crypto lobby, voted to override the IRS and allow anonymous trading to continue. Kim Jong Un and Vladimir Putin’s cyber warfare teams, being some of the most enthusiastic users of decentralized exchanges, were probably overjoyed.

I strongly suspect this happened to Steve Bannon and his Chinese bestie Miles Guo (and resulted in the arrest of both men by American law enforcement). I have good reason to believe that the Chinese government was able to strong arm Binance into turning over all its user data. Bannon and Guo are known to have launched tokens like Bannon’s FJB (“Fuck Joe Biden”) coin on Binance’s blockchain. Incriminating details about both men’s crypto scams almost certainly ended up in the hands of Chinese intelligence which has made destroying both Bannon and Guo one of its mission.

"Buy the fucking dip.”

Crypto bro for “wrecked as fuck”, meaning you lost most of your money.

“It all makes it abundantly clear how untouched by humanity you are. It also reminds me of the greatest blessing narcissists give us. So possessed by your own hubris, you don’t know it, you can’t see it, it never occurs to you when you are showing us your ass.”

https://lokiexcelsiorsmith.substack.com/p/but-why-tho?r=fd4u4

From my time at both the police and the UK FCA I know that the SEC are...well where (come back to that) incredibly frustrated with what they felt was their inability to go after House members for insider trading, but they did feel they would need a law change to do so which obviously the house would be unlikely to pass. I may have hallucinationated it but I think AOC and of all people Gates tried to get one passes at some point.

This was all prior to Trump 2 where financial crime is now legal. Hooray!