Signature Bank, FTX, Binance, and TrueUSD: A Tale of Questionable Judgement

If something is not "not illegal" then what is it?

"From the gods alone come all their miseries they say, but they themselves, with their own reckless ways, compound their pains beyond measure."

― HomerWhat follows is a timeline of events concerning the actions of Signature Bank, Sam Bankman-Fried, FTX, Binance, Bittrex, Silvergate Bank, and a handful of other cryptocurrency players. It was collected by Michel de Cryptadamus and CryptoInferno who are very thankful to DataFinnovation for some of the more revealing calculations. Note that any inferences as far as relationships between these facts or possible implications of this fact pattern are the reader’s own1.

Here’s a glossary of players and terms you may find helpful if you’re new to the exciting and depraved world of cryptocurrencies:

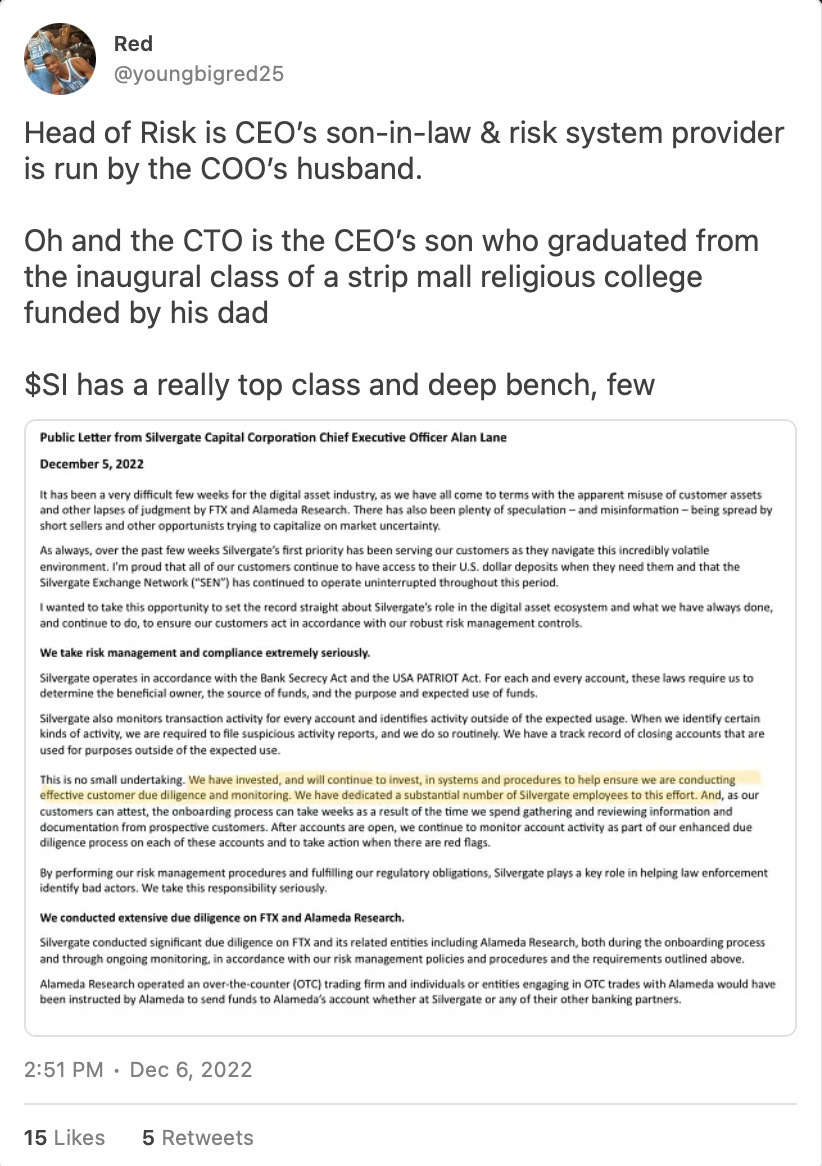

Signature Bank (stock ticker: SBNY) and Silvergate Bank (stock ticker: SI) are America’s leading “cryptocurrency friendly” banks which means they are willing to offer banking services to people and companies all the other banks in the United States regard with suspicion2. This article is mostly about Signature Bank; for colour on Silvergate just look at the news.

SigNET (or just “Signet”) is Signature Bank’s not illegal (❖) blockchain based alternative to the bank transfer systems 99.999% of people3 and companies in the world use to send money to other people and companies.

SEN is Silvergate Bank’s incredibly similar technology. It is worth noting that SEN and SigNET are so similar because they both seem to have been based on Facebook’s defunct4 Diem (FKA “Libra”) code base.

FTX was a cryptocurrency exchange that turned out to be a scam5.

Alameda Research was a cryptocurrency hedge fund that turned out to be a scam6.

Sam Bankman-Fried A.K.A SBF was the creator / owner of both the FTX scam and the Alameda Research scam.

Binance is the world’s largest cryptocurrency exchange by a staggering margin. So far it only has the appearance of being a scam.

Bittrex is a medium sized cryptocurrency exchange that recently decided it would be easier to just withdraw from the Canadian market altogether rather than waste time trying to prove to Canadian regulators that it is not a scam.

TrueUSD A.K.A TUSD is a very small “stablecoin” whose value is supposed to be tied to the U.S. dollar. 1 TUSD 🟰 $1. The supply of TUSD is managed by a company once called “TrustToken” but recently rebranded as ArchBlock.

❖ You may be wondering what I mean when I say that SigNET is “not illegal”. For answers I would point you to the paragraph above that was filed with the Securities and Exchange Commission (A.K.A “the SEC7”) by Signature Bank at the end of 2021 wherein Signature’s executives cheerfully explain that:

Digital asset payment and transaction networks may be vulnerable to all kinds of fraud and money laundering abuses.

Such networks are, at present, totally unregulated because they are a new thing Signature Bank8 just invented.

Signature never checked with banking regulators about whether such a payment network is actually “bank-permissible”.

Invoking a historically important set of banking regulations called “Ask For Forgiveness Not Permission” Signature just went ahead and built just such a high speed digital payments network9.

Signature Bank’s customers then proceeded to use that high speed network to transfer trillions of dollars all over the world.

Of course an alternate explanation for that paragraph’s appearance in the end of year SEC filing might just be because Signature Bank wants you to believe that 24/7 intrabank transfers are like a new and important thing10 just because they put those transfers “on the blockchain.” In other words this might just be marketing copy. Which I hope it is because the other interpretation sounds a little bit like language an insane person might use in a vain attempt to convince banking regulators that something obviously illegal is actually “not illegal.”

[2014-2017]

2014-2017 // Money laundered and Iranian sanctions violated by Bittrex at least 116,421 times.

Bad Bittrex, bad11.

[2018]

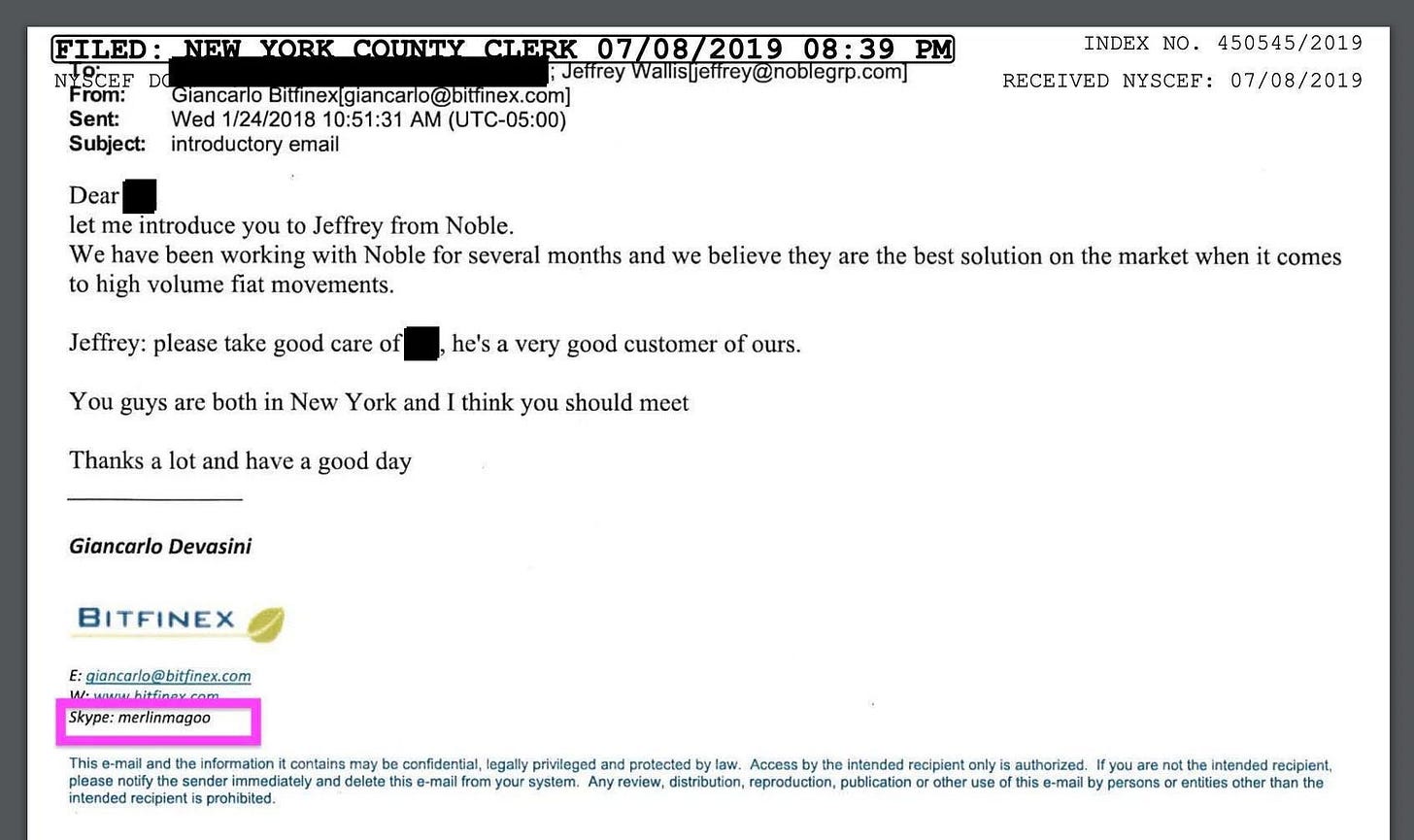

JANUARY 24th, 2018 // Jeffrey Wallis begins his journey as Tether’s banking contact at Noble Bank before going on to work on SigNET at Signature Bank.

This Bitfinex internal email was acquired by the New York Attorney General when they were in the middle of busting Bitfinex and Tether for fraudulently moving their money around between different banks to make it look like they had more than they did. Jeffrey Wallis was apparently Bitfinex’s or Tether’s banker at a Puerto Rican lending institution called Noble Bank at the time this activity was going on though the email above was sent after Bitfinex and Tether are rumored to have found other banking solutions.

“But who is Jefferey Wallis now?” you may be asking. After all people change a lot in 5 years. In fact studies show that a very high percentage of possibly shady bankers opening possibly shady bank accounts for possibly shady customers like Tether make a complete recovery. So there’s hope for Jeffrey. “Does Jeffrey Wallis have a Twitter account?” might be your next question, to which the answer is ”yes.” And if you’re wondering whether Jeffrey Wallis likes to Tweet about where he has been working and what he has been working on since his glory days at Noble Bank, the answer is also a definitive “yes”.

Jeffrey also did plenty of tweeting when he was actually living in those glory days of Noble Bank getting subpoenaed by the New York Attorney General, just in case you had any doubts.

MAY 31st, 2018 // Signature Bank agrees to be Bittrex’s banking partner.

In 2018 it was really hard for cryptocurrency firms to get bank accounts mostly because a lot of people with banking licenses suspected that cryptocurrency companies might be doing things like laundering money for the Russian mafia or violating Iranian trade sanctions. Thank god Signature was there to help out. (Bloomberg)

[2019]

MAY 30th, 2019 // TrueUSD “whitepaper” is published.

Ryan Rodenbaugh, an aspiring crypto bro still in the larval phase of the opisthopora order’s standard life cycle, publishes a short whitepaper12 describing his dream of a stablecoin13 named TrueUSD (“TUSD”). It is even dumber and more pointless than most cryptocurrency white papers but also mercifully short, impressively offering not a single detail about important things like which blockchain TUSD would exist on, how the token contract would operate, or anything else that might tell you how TUSD would actually work.

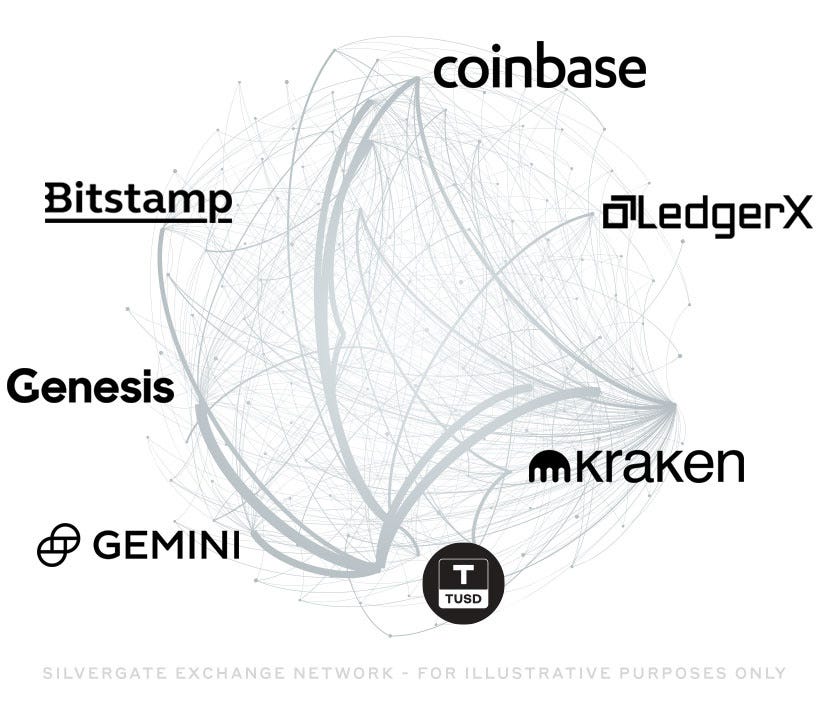

Given all that you may be asking yourself “who would use TrueUSD and what would they use it for?” Silvergate Bank’s now deleted diagram of their competing SEN network gives some clues.

This is a diagram of either Silvergate’s SEN payments network or Signature’s SigNET payments network.

[2020]

JULY 23rd, 2020 // Cryptocurrency custodian Copper integrates with SigNET, offers “not illegal” approach to tax accounting.

Note that last sentence:

Copper offers multi-signature custody and prime brokerage to its clients. This is provided by Copper’s Walled Garden infrastructure, giving clients access to trading facilities without taking digital assets out of custody.

Which kind of sounds like letting people trade crypto without actually executing the trades, which in turn sounds kind of like a "not illegal" approach to tax code compliance14. The text of the Coindesk article quoted above would also seem to imply that Signet can move currencies other than USD. Maybe even currencies like Bitcoin or Ethereum. If only there were some other way to send Bitcoins and Ethereum from one wallet to another. Some way that was trustless, anonymous, involved none of the hated bankers, and triggered all of the appropriate tax laws… Maybe using some kind of chain… possibly involving blocks…

AUGUST 20th, 2020 // Signature Bank reveals that a number of its customers are “foreign [currency] exchange liquidity providers” and that most of these customers are also involved in cryptocurrency.

That’s interesting because I have to assume that being a “foreign exchange liquidity provider” is kind of a niche line of business. For one bank to have a number of customers in this line of work sounds impressive.

Here’s the exact quote (source):

The bank is now looking to expand its Signet offering beyond U.S. dollars with the launch of a foreign currency exchange wallet sometime in the near future. A number of the bank’s clients are FX liquidity providers and Seibert believes foreign exchange is a large component of the crypto space, with some FX trades still taking weeks to settle if a bank is not crypto-friendly.

“Ideally we would like to launch that sooner rather than later, hopefully next year,” Seibert said of the new forex service.

Someone explain to me what being “crypto-friendly” or not does to the speed at which a bank can turn dollars into euros because I’m at a loss. Unless, of course, we’re talking about other, less “western” currencies.

SEPTEMBER 12th, 2020 // This tweet is tweeted in the context of a longer thread about TrueUSD and a company called PrimeTrust.

Presented without comment.

NOVEMBER 25th, 2020 // SBF tweets about SigNET being a way to move money into and out of FTX.

Curiously this is quite a bit before the official FTX account tweets about SigNET being a way to move money into and out of FTX (read on for details). Note also the fact that Silvergate Bank’s similar 24/7 payment network SEN is listed.

DECEMBER 2020 // TrueUSD undergoes a “material change to its ownership structure” when it is purchased by an “Asian conglomerate” named Techteryx that may or may not actually exist.

Here’s some great reporting by Cas Piancey on TrueUSD’s current owners.

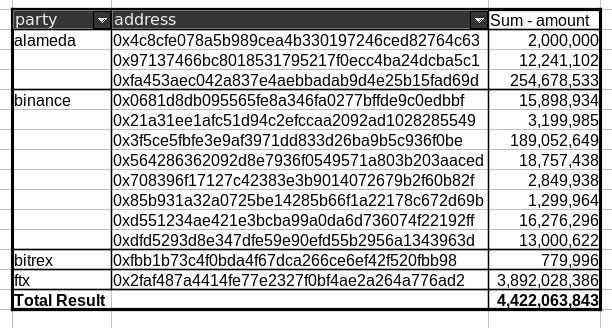

You may again be asking yourself “who would use TrueUSD and what would they use it for?” Some possible answers are suggested in DataFinnovation’s great thread on TUSD. This table of total TUSD redemptions by wallet address should also give you some idea.

Here’s the same data over time:

For anyone new here let me break it down for you:

Alameda Research is the “hedge fund” run by Sam Bankman-Fried that was set up to basically steal the money of FTX’s retail customers and yet somehow despite this enormous trading edge managed to “lose track” of something like $8 billion (two Nimitz class aircraft carriers, school buildings for 89,000 students15).

QuadrigaCX was a giant Canadian crypto scam of yesteryear.

Sifu was the co-founder of QuadrigaCX, the giant Canadian crypto scam of yesteryear. (According to DataFinnovation there is less certainty about this wallet belonging to Sifu than the other attributions.)

His Excellency Justin Sun is a guy who has alternately been pursued by the law enforcement authorities of many large countries. Mr. Sun decided in December 2021 that the best business move he could make was to move to Grenada and purchase diplomatic immunity (hence the “His Excellency”) which is of course what every honest entrepreneur does once they reach a certain net worth. Oh and he also seems to be one of the owners of Techteryx.

The Nomad Bridge Hacker is, well, a hacker who stole a ton of money.

Worth noting that up until July 21st another big customer of TrueUSD was Binance. Also worth noting that DataFinnovation also said this in a research paper on small stablecoins:

TUSD could not look more like it was trying to hide something.

Tokens are minted to Binance and redeemed via FTX. And the other way around. Tokens are also minted to Justin Sun and then knock around a closed system for a bit before being redeemed.

And, perhaps most interestingly, FTX and Binance share a redemption address.

Any patterns you may be seeing here among the clients of TrueUSD are purely your own conjecture.

[2021]

JANUARY 21st, 2021 // Signature passes $10 billion in cryptocurrency deposits and $100 billion in overall deposits.

SEC filings reveal that Signature’s deposit base has grown by an impressive 68% in a single year. They also reveal that 92% of the $106 billion (30 Nimitz class nuclear powered aircraft carriers) in customer money is not FDIC insured, meaning 92% of the bank’s assets16 are not your grandmother’s bank accounts. DataFinnovation's post on Medium shows how closely the quarterly growth in certain types of deposits tracks the growth of a stablecoin called Tether17.

On January 21st Signature Bank announces they have passed the $10 billion mark in crypto deposits and have pulled way out in front of their competitor Silvergate Bank. That of course makes perfect sense because a bank like Signature which is run by Responsible People who implement strict Know Your Customer / Anti-Money Laundering (A.K.A “KYC / AML”) controls should naturally have a smaller crypto18 deposit base than a bank like Silvergate, which is becoming increasingly well known for having a sort of… "relaxed" attitude about KYC / AML and risk management.

I mean, wait19…

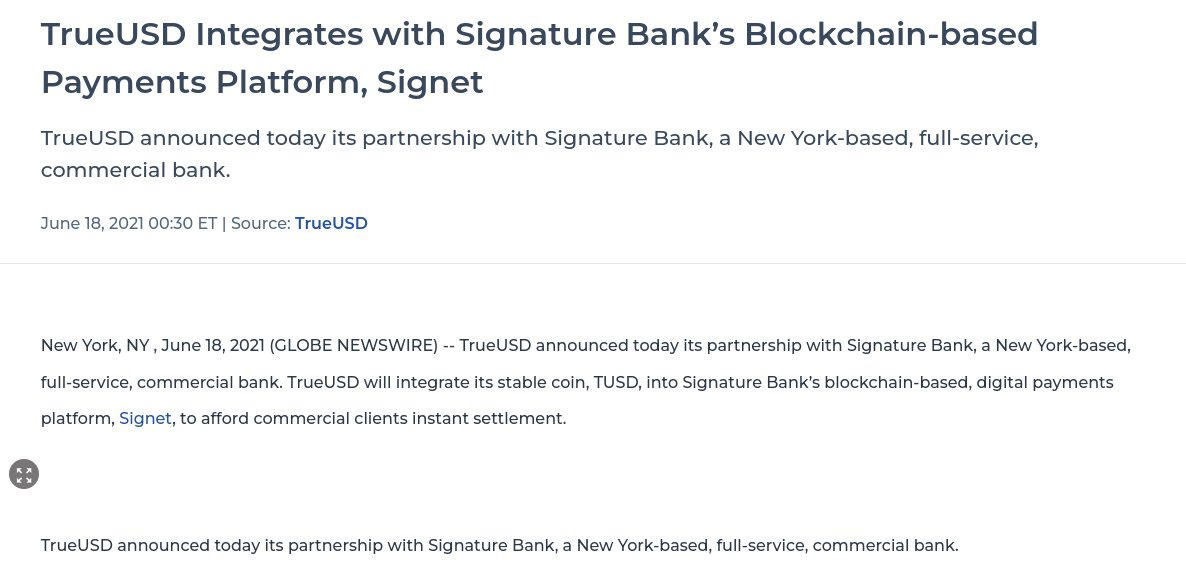

JUNE 18th, 2021 // TrueUSD integrates with SigNET, Signature Bank’s custom payment network.

Either TrueUSD’s new Asian owners were super on the ball and got this done in a single month or it was already underway when they made the acquisition.

JUNE 21st, 2021 // Silvergate Bank cuts Binance out of their SEN payment network.

Silvergate, Signature’s biggest competition in the “crypto friendly American bank” space, announces they are discontinuing Binance’s ability to process U.S. dollar deposits and withdrawals. Of no particular interest to anyone is who Silvergate did not discontinue:

At least only a quarter of the companies on the competing SEN network's diagram have lost billions of dollars worth of customer funds20.

JULY 21st-ish, 2021 // FTX and Binance part ways.

Binance was FTX’s first investor. Many people have suggested that Binance, FTX, Tether, and others have long been working together in some kind of Satanic crypto cartel. But in mid July, 2021 that all changed. SBF, citing “irreconcilable differences”, filed for corporate divorce, buying out Binance’s ownership stake in FTX in a part cash, part FTT deal that was eventually to prove to be FTX’s death warrant.

The original cause appears to be a dispute over regulatory filings in Gibraltar. FTX wanted to get some license or other to operate within the European Union. Gibraltar’s regulators asked for full disclosure of all those with an ownership stake in FTX. Binance’s Changpeng Zhao refused.

But there’s probably more to it.

OCTOBER 3rd, 2021 // FTX Announces SigNET integration for “institutions”.

FTX announces full integration with Signet (and thus Signature Bank) for “institutions”. It is slightly curious that TrueUSD’s customer support site lists the commercial customer integration as having been completed 3 weeks later on October 25th, 2021.

SEPTEMBER 1st, 2021 to Present // SigNET processes a truly staggering amount of money in transactions.

After adding TrueUSD to the SigNET network already high transaction volumes almost double, to the point where Signature Bank is processing almost a trillion dollars (one hundred thousand $10 million mansions, 300 Nimitz class nuclear powered aircraft carriers, or one company named Apple or Amazon) per year in transactions on a deposit base of roughly $100 billion.

Quarterly SigNET transaction volume from Signature Bank’s annual report and recent conference call transcripts:

2021-Q1: $88.4bn[TrueUSD for “not institutions” added to SigNET payment network]

2021-Q2: $149.4bn2021-Q3: $127.9bn(TrueUSD for “institutions” added to SigNET payment network)

2021-Q4: $213.7bn2022-Q1: $209.7bn2022-Q2: $254.0bn

[2022]

APRIL 12th, 2022 // Signature Bank publishes a glowing testimonial to the usefulness and efficacy of Signet’s 24/7 money sending abilities from Sam Bankman-Fried.

Words speak for themselves. Link to source.

MAY 2022 // Bittrex leaves the Canadian market rather than comply with regulators’ demands.

Bittrex gets regulated right out of the Canadian market. C-suite decides that simply bailing on Canada altogether would be more valorous than opening their books to Ontario’s regulator.

OCTOBER 11th, 2022 // Bittrex is fined $53 million (five $10 million mansions) for violations of trade sanctions and failure to comply with Anti-Money Laundering regulations.

What exactly did Bittrex do wrong? Apparently they facilitated trades with people in Russia, Iran, and Cuba. At least, at a minimum21.

As a result of deficiencies related to Bittrex’s sanctions compliance procedures, Bittrex failed to prevent persons apparently located in the Crimea region of Ukraine22, Cuba, Iran, Sudan, and Syria from using its platform to engage in approximately $263,451,600.13 worth of virtual currency-related transactions between March 2014 and December 2017.

The penalties added up come to roughly 20% of the size of the sanctions violation. Together they are FinCEN’s largest cryptocurrency related fine to date23.

NOVEMBER 4th, 2022 // Reuters reports Binance has facilitated $8 billion of cryptocurrency transfers with Iran in violation of various trade sanctions

For those not in the world of finance let me just say that doing business with Iran is bad. Like, really, really bad. Like “the full force of the American government is now gunning for your utter ruination” kind of bad. But even if it ends up being not quite that bad a fine similar to Bittrex’s 20% would mean Binance is headed for a $1.6 billion (one hundred and sixty $10 million mansions, roughly one gated community full of wealthy people) penalty. That’s a lot of money given that no one is even totally sure that Binance can pay the debts it already has (WSJ)... and the Treasury Department doesn’t accept BNB tokens24.

NOVEMBER 8th-10th, 2022 // FTXplosion!

If you don’t know what that means, good for you; I encourage you to continue not paying attention to the train wreck of humanity that is the cryptocurrency industry. But if you want to taste the forbidden fruit of knowledge here’s The Cryptocalypse Chronicles’ blow by blow history of the event.

DECEMBER 6th, 2022 // Signature’s CEO seems to take a rather interesting tone when discussing SigNET in a presentation to bankers at Goldman Sachs.

Note that he says this:

So we're going to be involved but we're going to be involved in a much more thoughtful manner moving forward.

Which kind of maybe possibly makes it sound as though Signature’s engagement with the cryptocurrency industry has been not super “thoughtful” in the past (full transcript).

He also said this:

We're really focused on our [cryptocurrency] concentration levels in deposits. We're going to lower them to at least under 20%, most likely down to under 15% and then keep them there.

So cryptocurrency businesses are currently more than 20% of your deposits. Tell me more.

We're going to put in at least -- no one client can have more than 2% in deposits. We're going to, over time, look to lower that as well.

Almost makes you wonder what percentage of the bank’s deposit base is attributable to the depositors with more than ~$2 billion25 (one half of a Nimitz class aircraft carrier) in deposits right now?

What does that mean? That means we're going to exit about $8 billion to $10 billion worth of deposits in [the cryptocurrency] space…. So it's going to be a little bit more expensive in the short term. Remember, a lot of these deposits that we're looking to exit are backing stablecoin. And for various -- whether they're backing stablecoin or other parts of the ecosystem, we hold and maintain a lot of that in cash, right?

Almost makes you wonder which stablecoin and/or why would Signature not want to be that stablecoin’s banking partner any more? Almost worth noting that while money held in a bank without deposit insurance may technically count as “1 to 1” backing for a dollar equivalent stablecoin it’s also a kind of risky way to hold that backing. In a world where one can just buy U.S. Treasury bills that come (for free!) with both interest and the insurance of being backed by the largest military the world has ever known, holding money in an uninsured bank account seems… kind of weird. Because if Signature Bank goes down, well, so does all your stablecoin.

Oh, and there’s this, which is how this earnings call was reported by most news outlets:

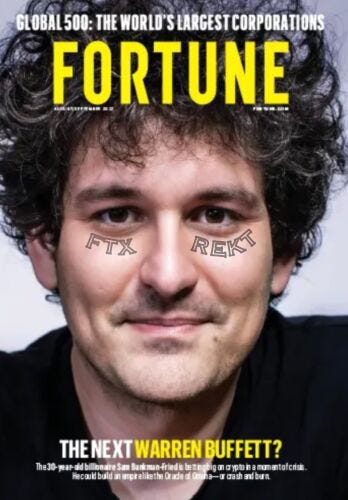

Which, yeah, that was one of the many things discussed (full audio here), though my favorite moment in the earnings call is this one:

That’s right folks, Joseph DePaolo, the President, Chief Executive Officer, and Director of Signature Bank isn’t actually sure what the name is of that company for which his bank handles large dollar amount transfers and that was just on the cover of Fortune and every other financial news publication because it is run by the most famous guy in his bank’s biggest growth sector if not the entirety of finance in 2022.

Ok then.

DECEMBER 7th, 2022 // Senator Elizabeth Warren writes a letter to Jerome Powell and banking regulators calling out Silvergate, Signature, Moonstone, and other banks.

(Full text of Sen. Warren’s letter)

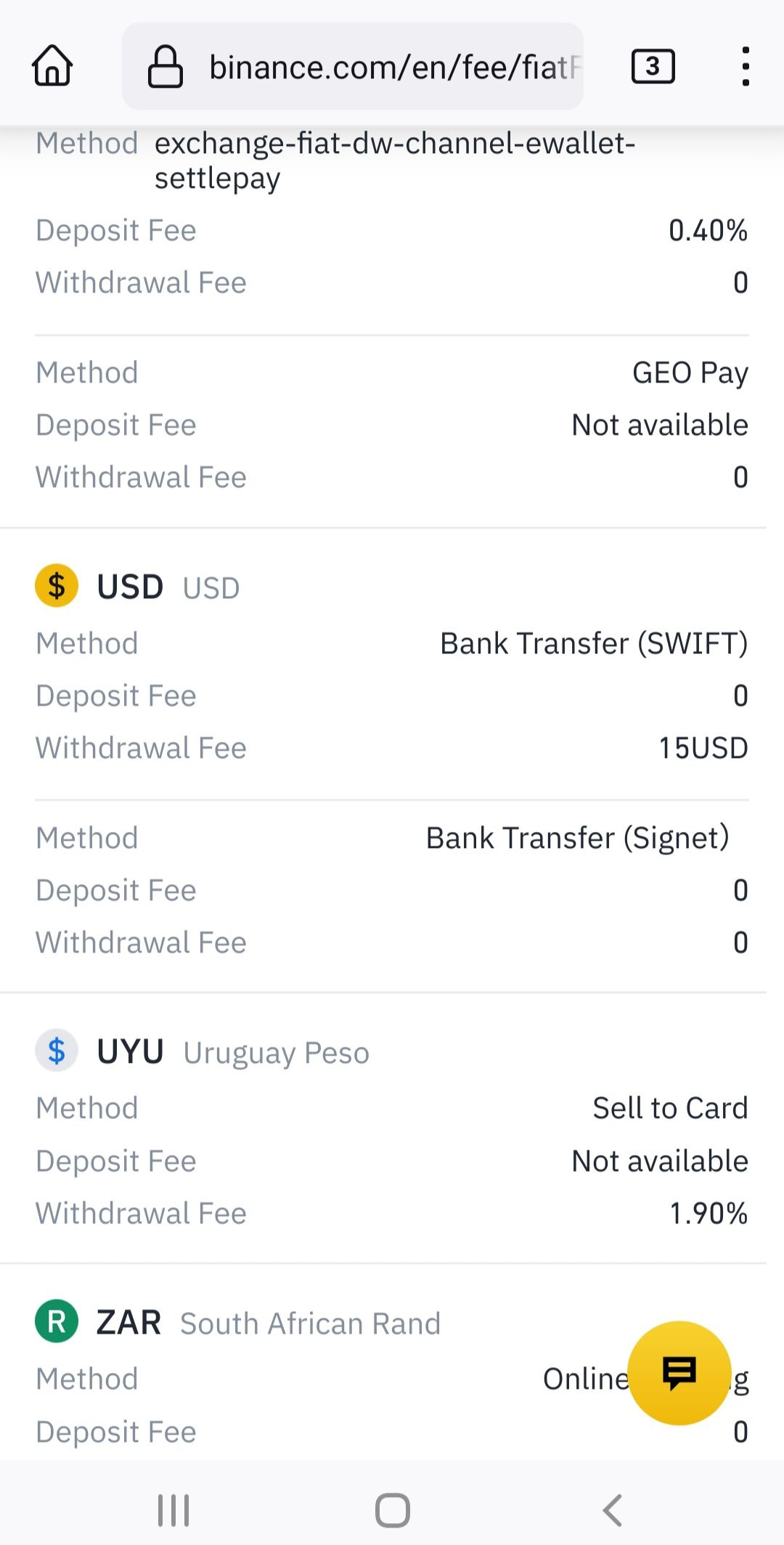

DECEMBER 10th, 2022 // Signet is still listed on the official Binance site as a payment rail for U.S. dollars.

Right here on Binance proper, not even on BinanceUS which is theoretically the part of Binance that’s actually sort of allowed to touch the American banking system. Of course BinanceUS might just be a way to fake out regulators and distract them from the real action over at “real” Binance. And that might be because “real” Binance had a habit of doing things like:

Lying to the government. Multiple governments, really.

Getting caught sending internal emails among the executive team about how lying to the government was a winning strategy.

Writing lies down on a piece of paper, signing it, and giving it to not just one but many major governments.

[UPDATE] DECEMBER 11th, 2022 - Sam Bankman-Fried arrested in the Bahamas and charged with money laundering, conspiracy to commit money laundering, and wire fraud.

At least that’s what he’s been charged with so far. Who knows what he’ll be charged with after he gets to be queen for a day.

[UPDATE] JANUARY 15th, 2022

I made a thread about Justin Sun (Tether Class of 2021 alumnus), his failing exchange Huobi, and a bank he works with with the name “Signature Bank” that went extremely viral on Twitter. Here’s one of the money shots:

And here’s another:

As an example: if you were to read all these facts and then conclude “those don’t seem like the actions of a bank run by honest people of high moral character doing their best to comply with all of the numerous and varied American banking regulations” or (more briefly) “that’s mad sus” you didn’t hear that from us.

There are good reasons why a bank would not want to provide banking services to criminals. chief among them being that providing banking services to someone later found to be a criminal can be (and usually is) a death sentence for your banking license. And unlike most crimes bankers cannot usually plead ignorance - it is required by American law that a banker understand who its customers are and where their money comes from.

The only difference between “I was El Chapo’s banker” and “I was the banker for this rather short but very nice fellow who seemed to always be depositing cash he made from what he assured me was just a very profitable farming strategy” is the amount of jail time the banker will be sentenced to. The banking license dies either way.

I made that number up but it’s important to understand that for most intents and purposes there is one global banking system that operates in one currency: United States dollars. This gives the United States Treasury, which can more or less switch off anyone’s bank accounts any time they want to, enormous amounts of power.

David Gerard’s “Libra Shrugged” is a good book about why it is defunct.

Exchanges are places to buy and sell cryptocurrencies. Theoretically some of them are not scams.

I am temporarily lumping “money laundering operation” under the “scam” rubric even though that’s not exactly accurate. Brevity is the soul of wit etc.

A.K.A “the American financial police.”

And Silvergate Bank (ticker: SI).

For the especially dense among you this is a joke. There are no such banking regulations.

24/7 transfers between accounts at the same bank are not a new thing.

Confirmed in 2022 in a U.S. Treasury Department press release on the fines they levied against Bittrex for this behaviour.

Whitepapers are (mostly) just crappy Microsoft Word documents describing the get rich schemes of morons. They are much revered by crypto bros who have invariably never actually read one of them.

Something of a misnomer given that stablecoins are not coins and historically have not proven particularly stable but the general idea is that 1 TUSD will always be equal to $1 USD.

Tax rules in America and most other countries are that as soon as you sell something at a profit you must pay taxes on that profit. What Copper proposes here seems to be a way to sell something without actually “realizing” the gain (or loss).

Using median square feet per student: 180 and median cost per square foot: $500.

Liabilities, technically, but this is for the lay reader.

If you’re new here the just know Tether is a uniquely problematic stablecoin that may or may not be the greatest financial fraud in human history.

Read “sketchy”.

The joke here is that Signature now has far more crypto deposits than the ultra-shady looking Silvergate.

…so far.

Usually people and organizations plead out to lesser charges, not greater ones.

AKA “Russia.”

Extremely fierce competition is on its may; many observers suspect Bittrex won’t be able to hold the top spot for long.

BNB is Binance’s own custom money that they print as much of as they like. They have a couple other ones as well, e.g. BUSD.

Assuming their SEC disclosures are accurate Signature Bank holds roughly $100 billion (30 Nimitz class nuclear powered aircraft carriers, 10,000 $10 million mansions, or one small city) of its customers money.