The By Now Approximately Seventy Seals Of The Cryptocalypse, Part III: The Return of the Chain

Really at this point we're just hoping the signs will stay countably infinite.

“The man who runs from disaster fares better than he who is engulfed by it.“

-Homer, The Odyssey

The Oracle of Tulips has once again advised me that the signs and portents I’m about to inscribe are the By Now Approximately Seventy Seals Of The Cryptocalypse, sent to the world that they might be opened one by one until The Whore of Economic Mania has been crushed by the Sword of Market Discipline.

If you need to do some catching up you can find the last iteration of The Seals Of The Cryptocalypse here and the first one here. We will note that once again this is a purely agglomerative exercise in tulipocal mysticism as only one of the considerably more than seven ominous portents we previously revealed has stopped ominously portending.

♦️ 1/Ω. The contents of The Book of Fraudits were revealed by the prophet Mazars LLP.

In the interest of keeping it real The Oracle Of Tulips would like everyone to know that even she was totally not prepared for the levels of chicanery and pure chutzpah contained in the pages of The Book of Fraudits. Quis audit auditores indeed1.

📜 The Book of Fraudits Ch. 1 📜

Crypto.com, they of the eponymous stadium in Los Angeles, showed the world three nearly blank pages published by an accounting firm called Mazars LLP and tried to convince the world that these pages constituted a complete and transparent view of Crypto.com’s finances even though Crypto.com had seen fit to redact all the actual dollar amounts for “confidentiality reasons”.

Apparently no one explained to Kris Marszalek and the rest of Crypto.com’s executive team that confidentiality isn’t part of the audit process. In fact the word audit comes from the the Latin auditus which means "a hearing” or “a listening". We use this word because undergoing an audit back in “the day” involved standing up in front of a crowd of old men with really severe eyebrows and the power to order your execution and explaining yourself which is literally the opposite of confidentiality.

In the end it wasn’t an issue. The world only had a few days to wonder about whether or not the accountants at Mazars LLP were actually geniuses who had invented a groundbreaking new approach to the audit process before the firm suddenly made it known that actually this was totally not an audit and they had been kidding the whole time lol.

The whole spectacle was kind of amazing… but not as amazing as the fact that many of Crypto.com’s users were completely convinced by an “audited financial statement” without a single dollar sign on it.

📜 The Book of Fraudits Ch. 2 📜

Binance, the world’s largest cryptocurrency exchange, showed the world some pieces of paper containing exactly three carefully chosen numbers whose charitable interpretation would be that Binance might have most of its customers Bitcoins but seems to have at least temporarily lost track of a bunch its customers’ other cryptocurrencies. Binance then tried to convince the world that these three numbers constituted a complete and transparent view of Binance’s finances.

That, at least, is the charitable interpretation. A less charitable interpretation would be that Bitcoin is the only cryptocurrency for which Binance comes anywhere close to holding 100% of its users’ cryptocurrency deposits and the company is almost certainly bankrupt.

My original arithmetical claim that the fraudit of Binance’s finances Mazars had produced proved Binance to be insolvent was technically incorrect but thankfully it was corrected by several people more knowledgeable about accounting than I am who also noticed things about it that I had missed. Things like “WTFFFFFFFF this shit is a fucking scam!”

📜 The Book of Fraudits Ch. 3 📜

Mazars LLP, one of the two quasi-legitimate accounting firms still auditing cryptocurrency exchanges not named Coinbase or Kraken, announced they would no longer audit crypto firms not named Coinbase or Kraken.

Mazars made its name in the accounting world as the firm that was willing to pretend to audit The Trump Organization’s finances. They pretended to do these audits right up until the moment felony charges were filed at which point Mazars revealed to the world that they were totally kidding about basically every single number on Donald Trump’s tax returns lol. Totally confidence inspiring move.

Mazars made its about-face concerning cryptocurrency exchange audits known to the world more than six whole days after Binance and Crypto.com attempted to convince the world that the nearly blank pieces of paper Mazars had given them were totally legitimate audits but less than an hour after deleting the entire cryptocurrency auditing section of both its website and its workforce. Given the long time lag it seems unlikely these events were related but maybe, just maybe, they were2.

📜 The Book of Fraudits Appendix A: Et tu, Armanino? 📜

Later on the same day Armanino, the other quasi-legitimate accounting firm still auditing cryptocurrency exchanges not named Coinbase or Kraken, also announced it would no longer audit crypto firms not named Coinbase or Kraken. A rumor went around that a group of wizards known as the SEC had made a call over to Armanino headquarters and threatened to kick Armanino’s accountants repeatedly in the nuts before imprisoning a few of them and driving the rest into personal bankruptcy if Armanino in any way vouched for a single number that later turned out later to be incorrect but no one knows for sure whether or not that phone call actually happened.

♦️ 2/Ω. Crypto bros are rising from the dead.

The Oracle of Tulips has long foretold an event known as The Harrowing of the Bros. While a number of crypto bros have recently undertaken the journey to the spirit world some had foolishly begun to doubt whether the prophesied transmigration in the other direction would ever occur. At last, it seems The Almighty Blockchain has given us a sign: Bitcoin wallets connected to Gerald Cotten, the long “dead” CEO of QuadrigaCX who stole everyone’s money before “dying” unexpectedly, came back to chain-life after years of inactivity.

If you’re new here it may add colour to understand that the question of whether Gerald Cotten is dead or just pretending to be dead is crypto's version of "Who really killed JFK?" except with a less sympathetic3 leading man who stole everyone's money.

And Gerald Cotten is not even the only bro we saw harrowed! Cryptographic keys originally held by one of the only realistic candidates for the identity of Satoshi Nakamoto were used to send the world a message from beyond the grave through an earthly prophet known only as "Pharma Bro".

Hal Finney, who has been dead for ten years, apparently wanted the world to know that Paul LeRoux is Satoshi Nakamoto, which is a subject The Cryptocalypse Chronicles has some opinions about. Scientists are still working on the question of whether that makes Hal Finney more or less likely to be the real Satoshi.

🐳 THE WAR OF THE WHALES 🐳

In the original revelations handed down by The Oracle Of Tulips it was foretold that a conflict that shall be known to future generations as The War Of The Whales would erupt as crypto bros turned on their brothren4. This conflict, The Oracle prophesied, would herald the beginning of the transition out of the phase of The Cryptocalypse that shall become known to future generations as “The Fear” and into the phase that shall be known simply as “The Panic.”

Brothers and sisters, the time of war is upon us.

🐋 3/Ω. The War of the Whales: The Parting Of The Stablecoin Waters

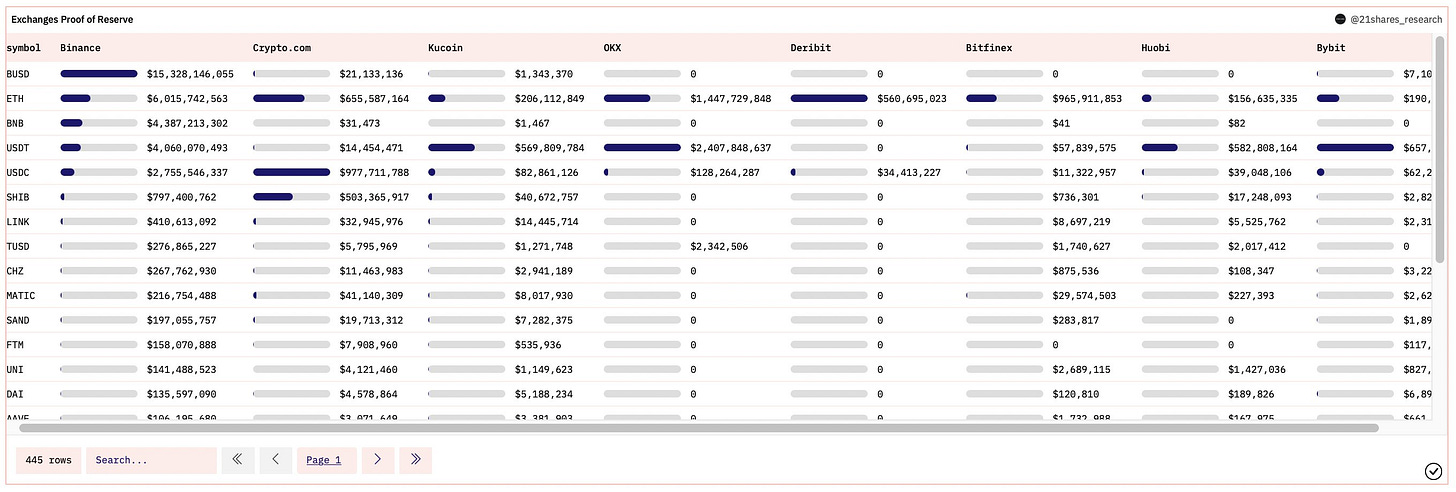

On December 14th it was noted by keen astrologers that 99% of Crypto.com’s claimed $1 billion (22 F-15 fighter jets) of on-chain stablecoin reserves consisted of a Coinbase-backed stablecoin called USDC. On the flip side it was noted that the originally Chinese language exchanges - the ones most closely tied to Binance (and therefore to Tether) - went in the other direction. Huobi, KuCoin, OKX, ByBit, and other exchanges primarily serving the Asian and Shady continents became 99% USDT and only 1% USDC. Only Binance was able to bridge the East/West divide, possibly because of Changpeng Zhao’s generational family roots in a land called Canadia.

🐋 4/Ω. The War of the Whales: Sir Paolo of the Tether Table publicly attacked the CEO of Crypto.com.

The accusation was the most serious charge one bro can level at another: poverty.

Paolo Ardoino is perhaps best known as the sweaty, shifty-eyed star of the CNBC drama “How To Look Incredibly Shady On TV When Explaining How You Manage $80 Billion”. He and the totally not-shady Crypto.com CEO Kris Marszalek used to be business partners. Friends. BFFs even. But not any more.

Oh, and then Tether’s official press releases also threw the Tethers that theoretically exist on the OKX exchange’s private “blockchain" (hint: it’s not a blockchain) under the bus.

Spicy.

🐋 5/Ω. The War of the Whales: Bro Will Set Upon Bro

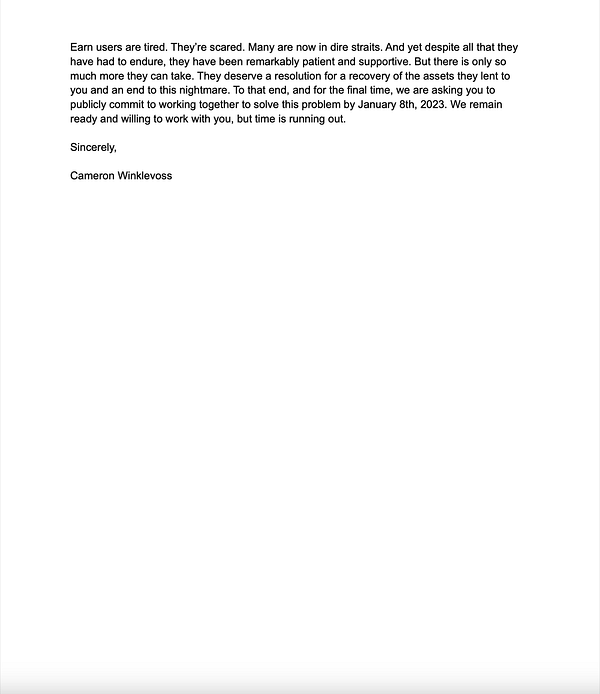

Recently the singer of a world-famous cover band named Cameron Winklevoss publicly accused Emperor Palpatine Barry Silbert, the CEO of Digital Currency Group5 (A.K.A “DCG”), one of the largest cryptocurrency companies in the world with part ownership of basically every single American cryptocurrency venture of any kind, of being if not a scam artist then definitely a poor person. The jewels of the DCG empire, Winklevoss sang, were totally bankrupt. He knew this, he said, because some of DCG’s companies with the word “Genesis” in their names owed his company’s customers $900 million which they had been refusing to pay for several months.

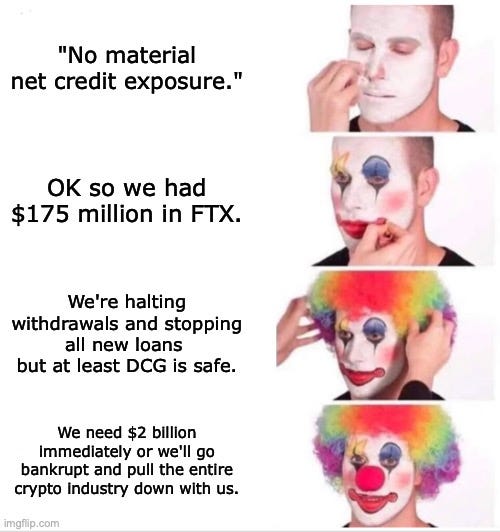

It turned out that when Genesis and DCG had radioed out to the world that they had “no material net credit exposure” from the smoking crater left by the FTXplosion what they actually meant was “we’re bankrupt.”

Emperor Palpatine Barry Silbert responded by making some shit up.

Things escalated from there.

🐋 6/Ω. The War of the Whales: Revenge of the Chain

Binance threw Crypto.com off of its one of its private “blockchain”, the BNB Smart Chain. (If you are asking yourself “Wait, aren’t blockchains supposed to be this public and decentralized thing?” count yourself among those who understand the scare quotes.) As a result Crypto.com users who hold what they thought was Binance’s dollar-backed stablecoin called BUSD are actually holding some random numbers made by graphics cards.

In other news OKX, a “separate” cryptocurrency exchange6, admitted it was no longer going to be sending or receiving transactions on the Solana blockchain. Maybe it’s just a coincidence that Solana is basically FTX’s blockchain and BNB Smart Chain is Binance’s “blockchain”?

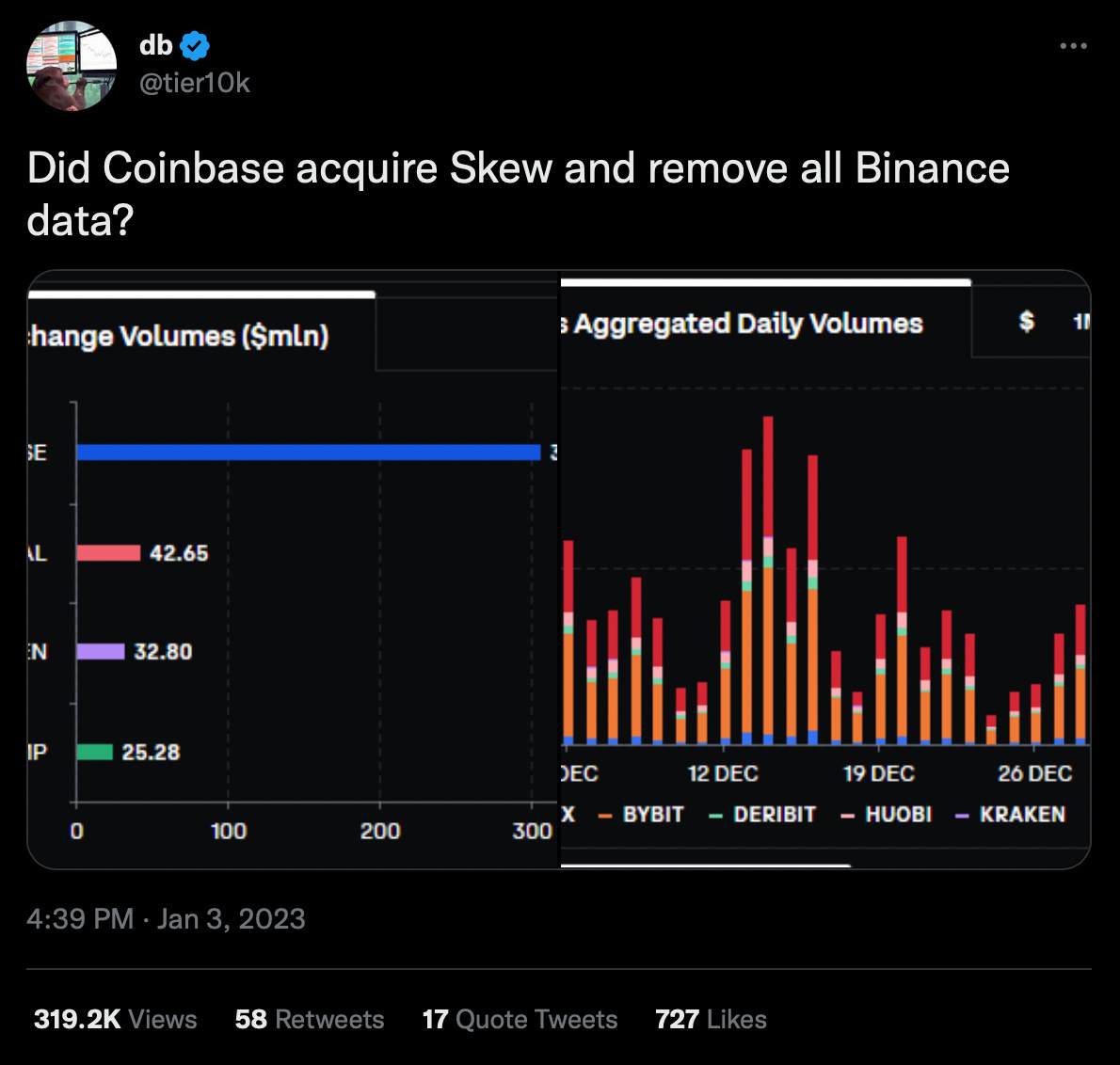

Oh, and then Coinbase removed data provided by Binance and a couple of the other Chinese-language exchanges from the analytics platform it recently acquired.

Because that’s what you do with fake data - you remove it.

♦️ 7/Ω. Eva Kaili, the only left-wing rapper7 in the European Parliament Greekadelic supergroup who routinely felt moved to regale her brethren with rhymes about the nobility of both the Qatari government and crypto bros, was arrested with suitcases full of cash.

It might have been Ms. Kaili’s father who was actually found with the €500,000 (one nice-ish middle-class home) in €500 bills stuffed into suitcases found in his hotel room but either way both the seed and the sower were frogmarched out in handcuffs when the suitcases in question were found. The headlines say she allegedly accepted bribes from the Qataris in exchange for telling all the European Parliamentarians that the Qataris were the nicest slave drivers she’d ever met.

Presumably it’s just a coincidence that she was also the European Parliament’s most notable cryptocurrency supporter on the more progressive side of the aisle.

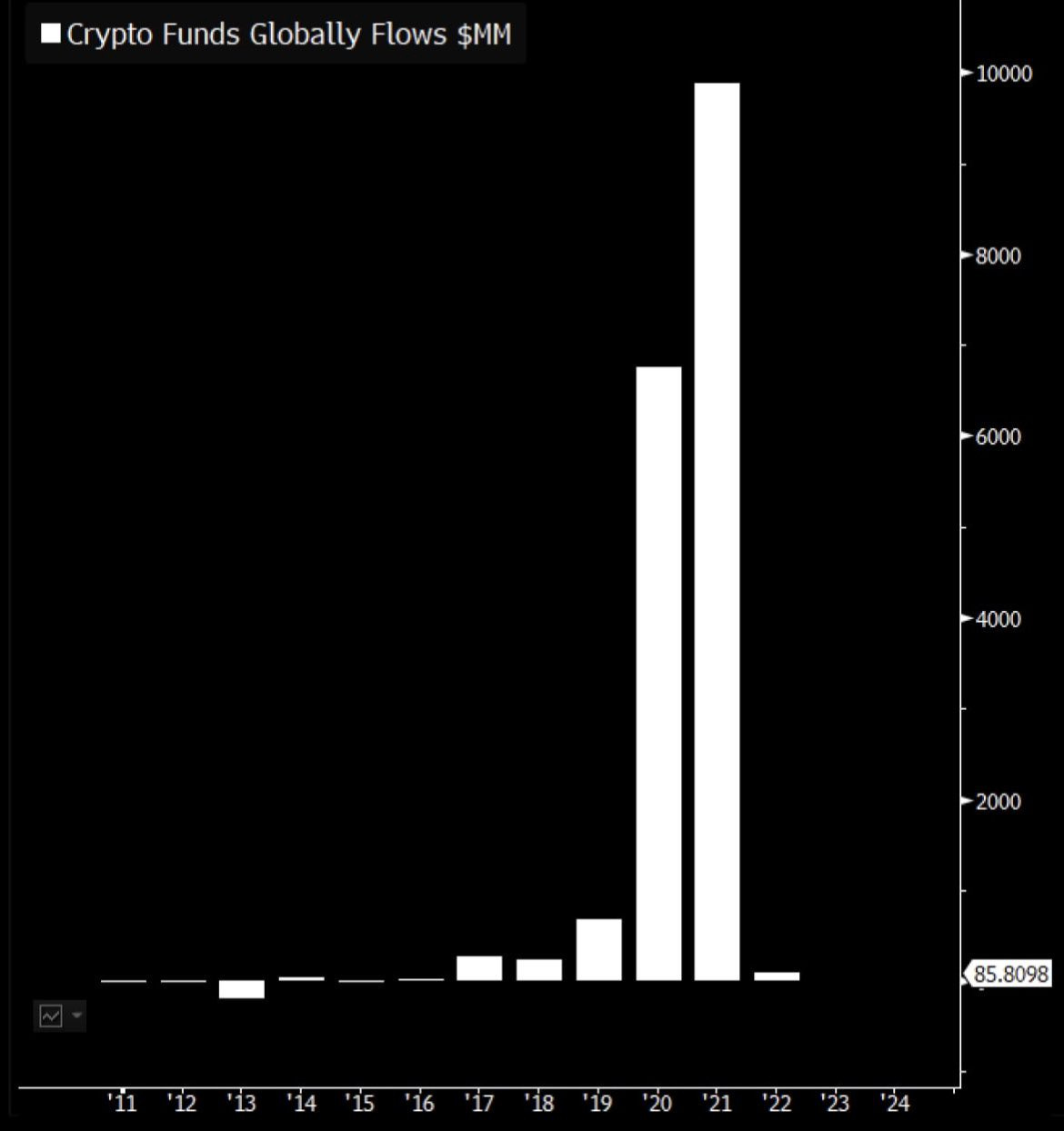

♦️ 8/Ω. Venture capital and private equity funds invested 99% less money in cryptocurrency “businesses” in 2022 than they did in 2021.

In related news A16Z, the richest and arguably most important venture capital fund that invests in cryptocurrency “businesses”, closed what some called its “Ponzi scheme marketing division”.

Maybe eventually they’ll also close what some have called A16Z’s “Ponzi schemes”.

♦️🛠♦️ 9/Ω. A READING FROM THE BOOK OF THE HAMMER OF REGULATION: The United States government seems poised to block Binance from making any more investments in American companies.

The Oracle Of The Tulips has long told us to expect a swift and brutal corporate death sentence once the American government figured out just how many billions of dollars of Iranian money Binance was willing to launder. It appears the government is starting to figure it out.

♦️🛠♦️ 10/Ω. A READING FROM THE BOOK OF THE HAMMER OF REGULATION: Avraham Eisenberg was arrested for behaviour widely understood to be nothing more than a “highly profitable trading strategy”.

You may know Avraham Eisenberg from his recent highly profitable trading on a platform called Mango Markets. The short version is that Eisenberg and his team used a bunch of borrowed money to drive up the price of Mango Markets’ token MNGO (of course). Because Mango Markets is run by morons who had been entrusted with vast sums of money by an entirely different set of morons he was able to use his vast holdings of MNGO to borrow $100 million dollars and then just… not give it back.

If code was indeed law this would have been totally legal. Unfortunately for Mr. Eisenberg code is code and law is law and when you borrow $100 million you usually sign at least something indicating that you intend to give it back. Eisenberg made a few critical mistakes:

He outed himself publicly as the highly profitable trader.

He thought that Mango Markets’ promise to not prosecute, which was given in exchange for Eisenberg returning roughly $60 million, would bind the US government. Unfortunately the attorneys of the Southern District of New York did not feel bound by promises made by people who run crypto companies with names like Mango Markets.

He set foot in the FBI’s jurisdiction (Puerto Rico, specifically) before the statute of limitations on being charged with felonious market manipulation had run out. Maybe it’s just me but spending 5 years living in luxury in Uzbekistan sounds like a small price to pay for $40 million.

The sunglasses, the scraggly beard, the constant vocal fry, the slightly sinister European/Israeli accent that every Russian soldier in an 80s action movie would have had... Eisenberg's really got the whole villain package. And to be totally honest I was kind of rooting for him. My man put himself out there as basically a caricature of a crypto villain. Where other scammers are like “we’re building the future!” and “it’s all about the community!” Eisenberg’s pitch basically amounted to "Yeah I took your money. It worked because you're a moron. I take all the other morons' money too." At no point have I heard him say a single word about how Bitcoin is going to change the world which actually made me respect him more than basically every other crypto bro.

♦️ 11/Ω. People started to take a really hard look at Binance, BinanceUS, the “blockchains” that Binance has built, Binance’s banking partners, Binance’s stablecoins, and more. It did not go well.

There used to be a cryptocurrency market made up of a bunch of different exchanges. Now there is realistically just Binance. Binance users trade more than 10 times as much cryptocurrency every day as the second biggest exchange in the world. As Binance goes, so goes the crypto verse. And Binance is not going well. Patrick Tan has written a nice summary of some of the controversies we will touch on here in a longer form piece over on Medium if you’re into that kind of thing.

📜 The Binance Saga Ch. 1 📜

Binance’s “blockchains” started to claim they held more of certain stablecoins than even exist.

The natural laws that dictate extraordinary claims require extraordinary proof are the same natural laws that gave us The Book of Fraudits.

TrueUSD isn’t even the only example. A very similar situation involves BUSD, Binance’s own stablecoin that most people assume is backed by a company called Paxos but is actually only half backed by Paxos. The other half is backed by Binance CEO Changpeng Zhao’s radiant smile.

📜 The Binance Saga Ch. 2 📜

People (I was one of them) read Binance’s code and concluded Binance’s private “blockchains” are probably not even blockchains.

First of all, yes, Binance has not one but two private “blockchains”. Second of all neither of these chains has the features that make up the definition of the word “blockchain.” For the particulars check out DataFinnovation’s Medium post on the subject or the Twitter thread above. I helped proofread the post and as a result I actually read a lot of Binance’s terrible “blockchain” code so I am biased but tl;dr the blockchain mechanism that is supposed to prove to everyone that a blockchain’s transaction history has not been tampered with seems to be very clearly proving that one of Binance’s chains has been tampered with extensively.

📜 The Binance Saga Ch. 3 📜

Binance, a company that is not allowed to do business in the United States, appears to be dodging authorities by opening American bank accounts at both Silvergate (SI) and Signature Bank (SBNY) under other names.

Given that The Cryptocalypse Chronicles recently assembled a very long and detailed timeline of the ebb and flow of the relationships between FTX, Sam Bankman-Fried, Changpeng Zhao, Binance, TrueUSD, Silvergate, and Signature we were not exactly surprised by this news. Still it was nice to see confirmation in the form of a Seychelles based company called “Key Vision Development Limited”. Europeans with Binance accounts who want to deposit USD into their trading account are instructed by Binance to send money to Key Vision Development Limited’s account.

I’m not sure what would be a kind way of saying that accepting deposits for one company in another company’s bank account is close to the dictionary definition of money laundering and is strictly verboten by almost every anti-money laundering law on the books. But all is not lost - at least in Europe Binance entrusts its banking to a totally reputable company called “Skrill” which CZ is rumoured to have chosen because of his deep appreciation of the brostep genre.

📜 The Binance Saga Ch. 4 📜

If the market price of Binance’s exchange token “BNB” ever drops to a value of $203.48 Armageddon will be upon us.

The above chart comes courtesy of DeFi Llama. What it is telling us is that should the price of BNB hit $203.48 (it’s currently being manipulated to hover at around the $250 mark) there will be a “code is law8” automated liquidation where roughly $200 million worth of BNB tokens will be dumped onto the open market. This, in turn, will crash the price of BNB token to close to $0.00 because a surprisingly small number of people are actually willing to pay hundreds of millions of dollars for a sketchy crypto token whose future value is entirely dependent on how much Iranian and North Korean money Binance laundered and exactly how much money various banks allowed to flow to Binance even though it was supposed to go Key Vision Development Limited. And that, in its turn, will probably result in a Binance Supernova that will make the FTXplosion look tame by comparison.

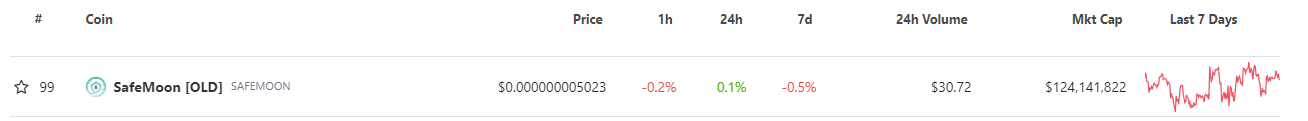

♦️ 12/Ω. Safemoon returned from its safe trip to the moon and reëntered the atmospheric top 100 on CoinMarketCap on a day it traded a total of $30.72 in volume.

If you don’t know what Safemoon is please do not invest your precious time in finding out. It’s enough to know that Safemoon is a scam roughly like FTX but without the IQ points. If you really want to scratch your head consider that Safemoon is also a scam that stole everyone’s money and blew up like, years ago at this point.

Don’t ask.

♦️ 13/Ω. Ripple settling with the SEC will be the second nail in the coffin of Ethereum and many other cryptocurrencies.

The LBRY ruling was the first nail in Ethereum’s coffin. The Ripple settlement will be the second one. If two nails doesn’t sound like enough to build a coffin just trust me when I say these are really big nails.

There is of course an alternative to the precedent such a catastrophic settlement would create. It involves Ripple’s executives being criminally indicted rather than allowed to just pay a fine.

♦️ 14/Ω. The CEO of BitFarms, one of the larger cryptocurrency mining companies, suddenly resigned.

Apparently he needed to spend more time with his family and the fact that he drove BitFarms right up to the edge of bankruptcy was just an unrelated issue.

♦️ 15/Ω. Cryptocurrency exchanges like Huobi, KuCoin, Binance, and more have become very serious about fraud detection… but only when the money is on the way out of their bank accounts.

Technically anti-money laundering laws require you do just as much if not more due diligence identifying where money that is on the way in came from as you do identifying where the money on the way out is going but I guess we can at least be happy that crypto exchanges are now doing 50% of the work required to comply with the law.

♦️ 16/Ω. SBF’s poor video game skillz may be finally catching up with him.

OK so this actually isn’t a sign of The Cryptocalypse but it is hilarious.

“Who audits the auditors?”

This is a joke. They are obviously related.

Less sympathetic because right before “dying” Gerald Cotten stole everyone’s money.

Not a misspelling.

If you want to read more about the absolute clusterfuck of pompous and demented crypto bros that have been ravaging the world under the banner of DCG I recommend reading Dirty Bubble Media’s post on the subject.

We know it’s a separate business because the cryptocurrency exchanges would never do anything so gauche as to operate as a cartel.

Pronounced “vice president”.

Pronounced “code is lol” because the ‘w’ is silent in the crypto bro language.

Pretty amazing stuff. Well done!