"Now I am become death, the destroyer of worlds." - The Bhagavad Gita

The Oracle of Tulips has advised me that the signs and portents I’m about to inscribe are The Seven1 Seals of the Cryptocalypse, sent to the world that they might be opened one by one until The Whore of Economic Mania has been crushed by the Sword of Market Discipline.

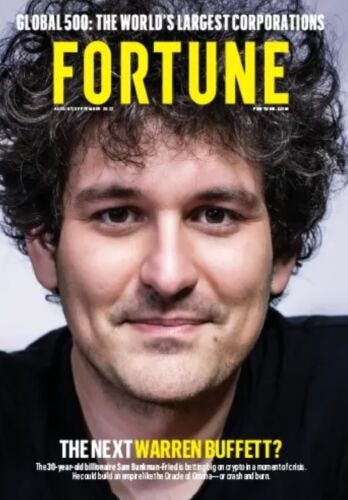

The facade is crumbling. Cracks in the house of crypto are appearing so rapidly at this point that it’s hard to even keep up let alone write a witty long form analysis without forgetting some of the many Really Ominous Events going on right now. These cracks are far more serious than even the deepest fissures we saw open in June/July. That era was nightmarish - the world watched many of the largest cryptocurrency companies - those “worth” or “managing” an amount of assets in the $2-20 billion range (20,000 - 200,000 houses2) - tip over into bankruptcy destroying hundreds of thousands of financial futures in the process3. But back then there was hope. Sam Bankman-Fried of FTX (henceforth known as “SBF”) along with Barry Silbert of DCG/Digital Currency Group (basically the Emperor Palpatine to SBF’s Darth Vader) strode confidently into the chaos pretending they had a wall of money 10 miles high that could stop the market panic in its tracks.

For a minute it even kind of worked. While Barry Silbert was content to remain a vaguely menacing shadowy apparition, SBF was elevated into the limelight as a hero. Serious People referred to him as a macher, a savior, even “The Next Warren Buffet.”

SBF and DCG bought up and bailed out basically every crypto company touching the American market except Celsius, which, I mean let’s face it, it’s in New Jersey. No one wants to go there. Also it was apparently a total dumpster fire of a company that had lost multiple billions of dollars worth (tens of thousands of houses) of its customers money. But mostly it was because it was in New Jersey.

Well that was then and this is now. SBF, originally cast as the hero of this drama, dropped the mask and revealed himself to be a complete fraud (and probably a psychopath) who stole everyone’s money. All of their money. African children’s money. Retired teachers’ money4. And when that happened - when the value of SBF and his company was reduced from $32 billion (320,000 houses, several small towns, 9 Nimitz class nuclear powered aircraft carriers) to $0 literally overnight in what Bloomberg described as the fastest dissipation of wealth in history - all those participating in or even just watching the drama were instantly transported to another world if not an entirely different dimensional plane.

Truly we are entering the end of days. Just look at all the signs: Ω

(Please forgive - or even better, leave a comment correcting - typos/grammar mistakes. Given the time sensitive nature of this information I decided it was more important to get it out now than to get it out perfect.)

1/Ω. Genesis Trading, by far the biggest portal between Wall St. money and a giant money laundering machine known as “the cryptocurrency markets”, is going to declare bankruptcy as soon as Monday at 10 A.M.

2/Ω. DCG might go down with it.

It’s been quite a few weeks of headlines from Genesis Trading and related lending institution Genesis Capital.

That is at least if it doesn’t get a $1.2 billion bailout before then.

Here’s the problems though:

Genesis already went bankrupt and got bailed out. Its parent company DCG bailed It out to the tune of hundreds of millions of dollars earlier this summer5. Or at least that's what they told us.

Back in

the prehistoric eraJune the leadership of Genesis had spread rumours that they had lost an amount of money with only 9 digits6 in it. This was, shall we say, not entirely accurate. Turns out it was 10 digits7. Whoops!DCG isn’t going to bail them out this time. If they were going to do another bailout they would have already done it and not let news this bad freak out the cryptocurrency markets.

One can thus infer that DCG, the Empire to Genesis’s death star, does not have excess capital to deploy. 6 months ago DCG was sitting on something like tens of billions of dollars (tens of thousands of houses) worth of liquid capital and owned a piece of hundreds of crypto companies. Basically all of the crypto companies. They were masters of the cryptoverse and none dared oppose them. DCG running out of capital is… not good for crypto8. And if DCG goes bankrupt? That would be cataclysmic for the crypto economy. Maybe even worse than cataclysmic.

The only thing that could be any worse for crypto than a major bank failing would be a major bank failing at the same time as a major cryptocurrency exchange.

Wait, what’s that you say? Genesis Trading is actually also a trading desk? Come to think of it that kinda makes sense… But did you just say it’s the trading desk handling the exchange of the biggest amounts of “fiat” for the biggest amounts of cryptocurrency? Like in the world?

Oh dear.

3/Ω. Prosecutors at the Southern District of New York Will Indict Sam Bankman-Fried Very Soon

They filed the paperwork to get involved in the court proceeding in the Bahamas, where SBF is currently being prevented from boarding an aeroplane.

There’s a very good reason you are not allowed to sign up for most cryptocurrency services if you live in New York. That reason is that the federal prosecutors of New York’s Southern District (AKA “SDNY”) are possibly the gnarliest regulators on the planet. Texas and Illinois regulators deal with like, farmers trying to cheat a few cents of ethanol subsidies or the price of some corn futures. SDNY regulates Wall St. “Masters of the Universe”. Schlubby insider traders, greasy junk bond mafiosi, and straight up psychopaths with billions of dollars. And SDNY fucks people up. It’s an office that has worked the miracle of putting a billionaire into a prison cell. Like, multiple times.

The outcome of the arrest of SBF, who is now no longer a billionaire and thus will require no miracles be worked to end up in prison for the rest of his life, is not in doubt: SDNY will threaten him with multiple life sentences for setting everyone’s money on fire and then giving an interview to Vox admitting to being both guilty and a psychopath. SBF will then turn state’s evidence and tell SDNY everything and anything they ever wanted to know. I say this not because SBF is a soft boy with man tits but because they all turn state’s evidence. Especially the psychopaths. Psychopaths don’t give any more fucks about their co-conspirators than they do about the rest of the human race. Self preservation, self-gratification, and self aggrandizement are the only metrics they can even see let alone act upon.

Who will SBF rat on? How about Binance and it’s CEO Changpeng Zhao, who publicly humiliated and then bankrupted him just last week? How about Emperor Palpatine himself, Barry Silbert? How about the company he gave $40 billion (400,000 houses) to in cash that is now missing? The one, the only, Tether, sometimes called “The Final Boss”.

4/Ω. Gemini, a regulated on-shore American crypto exchange considered “safe”, froze some of its users’ assets.

Meaning it won’t give some of its customers back any of their money. Granted this only applied to customers in a program called “Earn”, which was a program you put money in to, you know, earn. Interest. Unfortunately to earn the interest you had to put the money in an account at Genesis Trading (see #1), who then loaned it out to people like SBF. Whoops!

So that was one issue. The other problem was that customers of a company that throws the life’s savings of even a handful of its customers into a volcano suddenly has an extreme credibility problem. That problem is magnified a thousand fold for companies whose business model basically amounts to “trust me bro your money is safe here.” Thus it was hardly surprising that Gemini’s users started pulling enormous amounts of cash and cryptocurrency out of Gemini.

Oh, and then Gemini’s site crashed. Whoops!

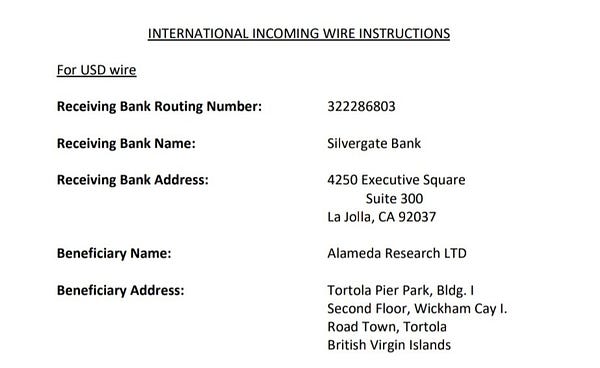

5/Ω. Silvergate Bank, the biggest crypto friendly bank by assets under management, is about to implode

FalconX, a cryptocurrency trading desk for Serious Cryptocurrency Scammers Investors and institutions (AKA “those with fat stacks”) announced to its customers that it would not send or receive a single dollar to or from Silvergate Bank.

What a strange thing to do! Until you consider that Silvergate was SBF and FTX’s bank, meaning they were involved in facilitating the greatest theft in human history.

Psychopaths stealing tens of billions of dollars from working class people is one of those things that actually gets the regulators to pay attention. In fact they are probably doing a lot more than just paying attention - banking regulators are almost certainly already in the Silvergate building… and not just the Silvergate building. Regulators are probably also in the building of every single bank that ever did a transaction with Silvergate.

The penalty for financial companies that send money to and from a bank engaged in any kind of fraud is straightforward: they get the death penalty. Or at least their banking licence does. And it’s kind of hard to run a financial business without a bank account.

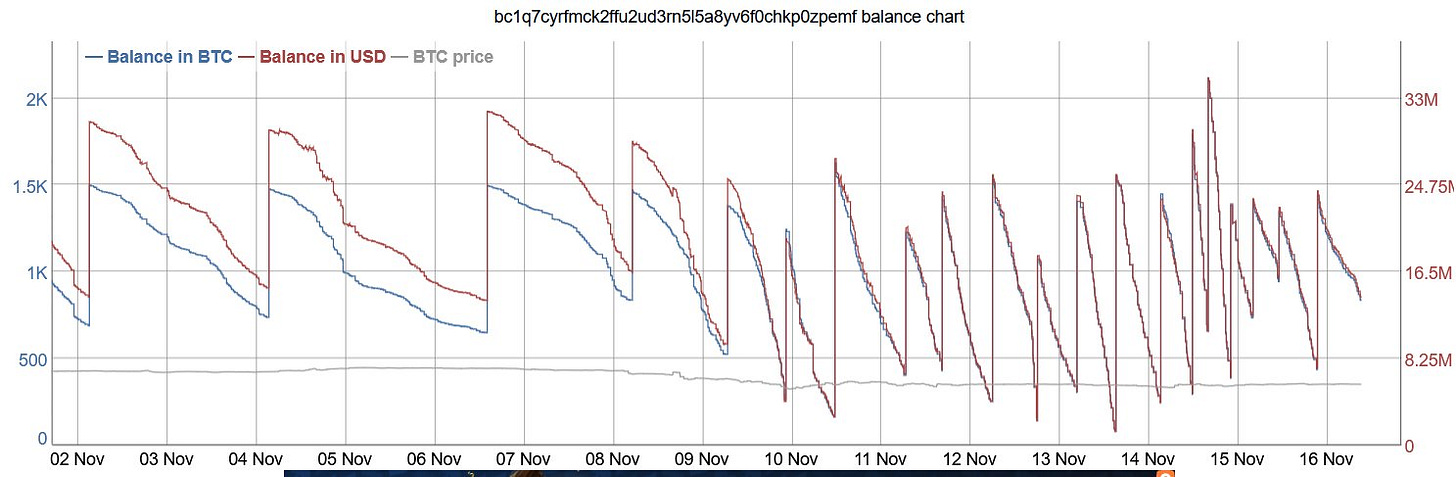

6/Ω. Crypto.com, AKA “The Other Cryptocurrency Company Besides FTX With An Eponymous Football Stadium In A Major American City”, is experiencing a run on the bank that it will probably not survive

This bank run was triggered when Crypto.com customers actually did their own blockchain research and discovered that the company had sent something like $400 million of their money to a sketchy crypto exchange in China called Gate.io right around that magical time that comes around once only every 3 months called “The 30 Seconds Per Quarter Something Sort of in the Shape of An Accountant9 Gets to Look at the Books”.

The CEO of Crypto.com had an explanation: it was just an innocent mistake. A fat finger, even. Like a fender bender but with all of your money getting sent to criminals in China. No biggie.

We still haven’t figured out whether he tweeted this during a psychotic episode or if he really thought that was going to calm his customers. Either way it didn’t calm the customers who instead started yanking all their money off of Crypto.com as fast as they possibly could.

This is what a run on the bank looks like:

Seemed clear Crypto.com was about to tip over into bankruptcy… but then all this money started to flow into Crypto.com from Binance and Circle’s wallets. The Circle transactions at least make sense as Circle is an American company that exists to convert American dollars into crypto casino chips called “stablecoins” (hint: it’s neither stable nor a coin). But Binance? One of Crypto.com’s biggest competitors already in tons of shit with American regulators for laundering money and filing declarations filled with lies with most major governments? lolwut? But the chain don’t lie:

There’s two explanations for hundreds of millions of dollars worth of USDC (a “stablecoin” worth $1) to flow from Binance to Crypto.com and both of them are Really Bad.

Binance is bailing out Crypto.com, who are accepting the cash despite the fact that Binance is a company that was just caught committing $8 billion (80,000 houses) worth of violations of economic sanctions on Iran. Crypto.com could be stripped of its access to the banking system for doing business with someone who violates those sanction so it’s safe to assume the situation of the company’s finances is dire if they thought this was the best course.

But even with the Iranian angle this is not a good scenario because telling the world you took a bailout from your competitor is the same as telling the world “we lost some of the money but we didn’t bother to tell you yet.” Whoops!Crypto.com was using its users' assets to trade or stake10 on another exchange (Binance) and now they are just repatriating all that capital. Unfortunately that’s not how exchanges are supposed to operate. Exchanges are supposed to just hang onto all the customers’ money in neat little piles and wait for the customer to come pick it back up at their leisure. They are not supposed to invest it, stake it, or lend it out because… they are not banks! You can be damn sure Crypto.com’s customers did not expect their assets to be exposed to hacks/bad decisions/dumpster fires made on an exchange they didn’t even know existed.

This explanation would mean that Crypto.com secretly was sending their customers’ capital to other exchanges in search of yield. Unfortunately if they sent capital to Binance there’s a high chance they sent it to other exchanges. Perhaps another major American exchange. Maybe one whose CEO was writing legislation that would have a massive impact on Crypto.com’s business. Maybe one whose good side they really want to be on and maybe even one also named after a football stadium.

Remind me, what’s an exchange that meets those criteria?Oh, right.

Now consider that for much of 2022 FTX was functionally bankrupt and desperately in need of capital to disguise a multi-billion dollar (tens of thousands of houses) hole created by the combination of SBF’s psychopathic personality disorder and compulsive gambling habit. Do you really think Crypto.com only did this trading of their users’ assets on Binance?

Bonus: Have I mentioned yet that Crypto.com is one of the major sponsors of the World Cup? Along with (you guessed it!) FTX. And there’s even more. Read Amy Castor & David Regard’s excellent mini-history if you want your mind shredded.

7/Ω. Now Even Binance, Theoretically Backed By Almost $70 Billion (700,000 houses) Worth of Capital, Is Headed For A Bank Run

These kind of threads do not usually get 3,500 upvotes on the parts of Reddit that are delusionally pro psychopath cryptocurrency. In fact up until just last week even posting something like this on their echo chamber would get you straight up banned. Now?

Feel free to see for yourself because by the time this is published things will probably be a lot worse. That’s just how market panics work - once they start they don’t stop until they either destroy everything in the market or someone (or some thing) steps in to destroy regulate the market itself.

8/Ω. Major Crypto Institutions Will Stop Lending To Each Other (If They Have Not Already)

Here’s the thing - with the implosion of FTX and the coming implosion of Genesis Trading and possibly Crypto.com everyone in the marketplace knows that there are some heavy bags massive losses on companies’ books. The problem, though, is that they don’t know whose books those losses are on. In such an environment everything changes. Whereas before you might be willing to sell me $1 million (10 houses) worth of Bitcoin even if I could only deliver the cash tomorrow, now you will demand payment on a different schedule and of a different sort. Interest rates on margin loans will be launched into the stratosphere.

What kind of payment? Cash.

When? Now.

What about people who owe you a lot of money? Cash. Yesterday, if possible. If not the interest rate is gonna go up.

But that’s not fair, last week I was only paying 3% on that loan! The interest rate on that loan is now 50%. Per day, not per year. We accept cash. Now.

Why? Because if you enter into a trade or loan and the other party to the trade goes bankrupt your assets - and potentially your business - won’t fall into bankruptcy with them.

And for those who don’t know, this is what happened in 2008 - overnight rate actually hit 40% per day on some margin loans .

9/Ω. Ontario Teacher’s Pension Fund (OTPP) was reported to have lost $95 million (950 houses) of retirees’ money in the FTX debacle

It’s not even the first major Canadian pension fund to do so. We found out that one enormous Canadian pension fund, Caisse de Dépôt et Placement du Québec (CDPQ), which at $400 billion (400,000 houses) is one of the most awe inspiringly enormous pools of capital in the known universe, had already lost $150 million (1,500 houses) of retirees’ money in the Celsius debacle back in midsummer. Now we also know that Ontario Teacher’s Pension Fund, a much more sophisticated fund run by “smart” fund managers, has lost $95 million (950 houses) in the FTX “situation”.

I use the euphemism “situation” only because we haven’t yet settled on a word nuanced enough to describe just how horrific the situation with FTX is. No one is even sure if such a word exists given that FTX sailed past the former holder of the “Most Spectacular Financial Scandal In American History” heavyweight belt (Enron) without even breaking a sweat when the same guy who was brought in to deal with untangling the Enron fraud had this to say:

"Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented." (John Jay Ray on SBF/FTX)

”Oops” was the expression of the day from OTPP’s management. “We apologise but just so you know that’s not even a fat stack.”

And yes, it is true that for funds of that size these are small losses. Less than a fraction of 1%. That doesn’t change the fact that society would surely have got a far better return on its investment had that money been given to retired teachers instead of set on fire given to a psychopathic grifter (SBF). It also totally ignores an incredibly important side effect of giving money to psychopathic grifters at the same time as you are lauded as some of the smartest investors in the world: morons in charge of smaller pools of money will copy your homework. Put another way:

If OTPP put pension money into crypto you can be damn sure a bunch of American retirees’ money is also currently being burned into ash inside the crypto casinos.

As you contemplate that horror show consider this: OTPP is run by Canadians. Not exactly the most reckless bunch. American pension plans, on the other hand, are run by…

Americans.

God help us all.

10/Ω. Even Blackstone, one of the most successful / “smartest” private equity firms in the entire world, fell for this FTX bullshit

Series C round was $400 million (4,000 houses). While we’re not sure how much of this came from Blackstone, it was definitely tens of millions (thousands of houses).

This is actually the least depressing item on this list because at least you can get some schadenfreude thinking about how the CEO of Blackstone, a billionaire who without even suffering a major dissociative episode went on TV and publicly compared Barack Obama’s attempt to eliminate the capital gains tax loophole for multi-millionaires to Hitler invading Czechoslavakia and kicking off the worst catastrophe in human history (no seriously, he really did that) lost an amount of his net worth that for most Americans would be the equivalent of around $10.

I mean, I know it’s not much. But at least it’s a negative number.

11/Ω. SBF was the second biggest Democratic donor in the country. Mitch McConnell accepted $2.5 million (25 houses) in campaign contributions from FTX’s Ryan Salame.

That’s “second” as in “number two”. As in, only one person in the entire world stuffed more cash into American politicians’ pockets than this guy. Ryan Salame was not far behind but on the other side of the aisle. While I know our politicians are bought and sold by monied interests like chattel at an auction block the nakedness of this attempt to literally take over the government of the United States by a psychopath who named his company Alameda Research only because he was skeptical that banks would open accounts for a company called “Shitcoin Daytraders” just by… buying it… is breathtaking.

Consider that Charlie Munger, the 97 year old partner of Warren Buffet and one of the most successful investors to ever walk the earth, described trading cryptocurrencies as “trading in freshly harvested baby brains.” Then consider that it’s a very good metaphor. Salame ultimately dispersed around $25 million (250 houses) to Republican lawmakers while SBF gave something like $43 million (430 houses).

It should not surprise you that passing laws to let psychopaths like SBF steal even more money from retirees was a totally bipartisan effort. New York’s Senator Gillibrand reaching across the aisle with Wyoming’s Senator Lummis to sponsor legislation they had put together with the help of a guy who was at the time in the very profitable business of stealing every dollar that ever passed in the vicinity of his computer. At last count he had completely incinerated as much as $36 billion (360,000 houses) belonging to retirees and poor children in 3rd world countries11.

You may be wondering what exactly the bill did. Unfortunately no one is really sure because a piece of proposed legislation wrought from pure evil is not safe to read top to bottom lest the reader be driven into the tentacled arms of Cthulhu. But we can tell you at least one thing it definitely did: weaponize the American government against SBF’s archrival in the unregulated scam trade, Changpeng Zhao (CZ), a man who (so far) seems to only have committed financial sins on the order of laundering $8 billion (80,000 houses) of Iranian money.

Compared to SBF he now looks like the good guy.

12/Ω. El Salvador is headed towards a default on its sovereign debt in January 2023.

El Salvador, for those who missed it, is the only country to adopt Bitcoin as its national currency. They also have the world’s coolest dictator as their leader.

Let’s just say it’s not going so well.

13/Ω. A message for those who say “Nobody Could Have Known!” when asked why they sold their souls to psychopaths at a discount rate

May screenshots of your delusional rantings and pro-crypto tweets haunt you the rest of your natural life.

Lots of us knew. It wasn’t even hard to know.

There may be more than seven, just warning you. Especially by the time I publish this.

1 house = $100,000, for the purpose of this analysis. It’s a small house, like in suburban Saskatoon, not a luxurious flat in Vancouver.

Celsius, BlockFi, Three Arrows Capital (3AC), Babel Finance, Voyager Digital, Vauld, and Genesis Trading went down one after another, ruining millions of lives as they took people’s life’s savings with them. It was like, really Dramatic.

As well as other, less sympathetic people, but I shall not name them here.

We were surprised by these events given that the Genesis character had died in the first season along with BlockFi. Not sure why the writers decided to bring those characters back.

Hundreds of millions.

Billions.

Though you won’t have to look very hard to find someone who will tell you the death of Genesis is good for Bitcoin, I can assure you that those people are either incorrect or smoking some powerful shit.

Don’t worry - it’s not a real accountant.

Just think “earn interest” if you don’t know what this word means in cryptoland.

As well as other, less sympathetic people, but I shall not name them here.

"Have you ever seen two self satisfied dipshits exude more douchebaggery than the Winklevoss twins achieve just by breathing in and out?"

Yes, and they go by the names Don Jr and Eric...

"machine known “the" -> AS the

"New York’s Southern Distinct" -> DistRIct

"is one of things" -> THE or THOSE things

"because at you can get" -> at LEAST you

"Czechoslavia" -> CzechoslOVaKia

"stealing ever dollar" -> everY