“I did not die, and yet I lost life’s breath.” ― Dante Alighieri, The Divine Comedy

Two weeks ago I wrote a piece called The More Than Seven Seals Of The Apocalypse.

Since then not much has changed. None of the portents has fully resolved. One of them might have1 slightly abated (the Crypto.com withdrawal tsunami2). Most of the other portents are out here portending more ominously by the day. For instance while Genesis Trading has not actually declared bankruptcy yet we can be far more sure now than we were then that the company is completely bankrupt and will not be rescued based on the increasingly unhinged recapitalization proposals3 being leaked to Twitter.

Read the fine print and you’ll see that the profitability of this “recapitalization” relies on the assumption that Bitcoin will double in price in the next three years. Maybe this would have convinced investors in the pre-FTXplosion era but at the moment there seem to be no takers. Almost makes you wonder why literally everyone who has the $1.2 billion (24,000 brand new BMWs or 120 $10 million mansions worth) on hand is choosing to pass up this golden opportunity to triple their money.

Yet despite the lack of resolution of many of those ominous portents of doom things are still not the same as they were in the good old days of [checks watch] two weeks ago. And it’s not because things are looking up. Quite the contrary - things are looking worse. Much, much worse. The Oracle Of Tulips has once again instructed me to transcribe the signs so that the lay reader might see their true nature. Read on for enlightenment.

1/Ω. Cryptocurrency has crossed Rubicon of “Scam” on the map of American psychogeography.

Before the FTXplosion most people heard “crypto” and thought “I don’t get it4”. Now most people hear “crypto” and think “scam”. This is not a reversible transformation. Cryptocurrency is nothing more or less than the first truly global economic mania. Economic manias, being of a piece with many other Extraordinary Popular Delusions and the Madness of Crowds, live or die based on rumour and superstition. Take the superstition away and the mania will usually eventually die in a firestorm of panic selling.

Most crypto bros are in denial about how severe the damage the FTXplosion has done been. They don’t see that even without all the other Very Bad Things going on in cryptocurrency this small shift in mass psychology alone could choke their dream of a cryptographically lubricated monetary system to death with its bare hands. But some, like the bros who host the popular crypto bro podcast Bankless, can see the damage for what it is. Thankfully they are strong, brave men capable of holding in their tears.

At least for 20-30 minutes of this episode, their first post-FTXplosion appearance.

There’s nothing quite like watching the death of a dream in real time.

2/Ω. Crypto bros keep dying in mysterious circumstances.

How mysterious? This was the final tweet of Nikolai Mushegian, a young man who had written some of the code that drives a thing called MakerDAO5.

Without getting too far into the weeds it’s worth noting that code this young man wrote now stands as the gatekeeper to almost $7 billion worth of cryptocurrency.

Mushegian “drowned while swimming in the ocean.”

Now I mean it was indeed a dangerous beach. And it’s possible he had a panic attack or a manic episode that led him to attempt to flee the scene by swimming out from shore6. It’s also possible he was driven insane by hackers, resulting in a similar fate. And of course there are… other explanations. But either way you have to admit that those are some very memorable last tweeted words. And of course he was just the first bro to fall. In the 3 weeks since there have been three more dead crypto bro billionaires and/or scammers who were definitely not old enough to die of natural causes.

Tiantian Kullander “died in his sleep” at the age of 30:

Vyacheslav Taran “died in a helicopter accident” at the age of 53:

Javier Biosca was more of a scammer than a billionaire. He “jumped from a 5th floor balcony”:

While crypto bros have died (or at least pretended to die) in all kinds of mysterious circumstances in the past the rapid pace of these deaths combined with the ultra high net worth of those who died is… unusual. Also noteworthy is that this reaping of the bros came at the same time every crypto whale worth his or her lambo is scrambling to extract fiat from the system before it all goes down in flames.

But hey, maybe it’s just a coincidence. Or two - sorry, I mean three… wait no I mean four coincidences.

3/Ω. OKX, a crypto currency exchange with a mostly Chinese language user base, seems to be using the exact same information warfare tactics on Twitter that the Chinese government used to interfere with the recent protests on other social media sites.

This one actually creeps me out. A lot. I’m not totally sure OKX is actually having issues but it’s quite clear the communications muddying tactics are the same.

Details in this Twitter thread:

4/Ω. The CEO of Prime Trust, another so-called “fiat gateway” wherein magic internet beans could be turned back into actual money, was just summarily fired.

CEOs are only extremely rarely summarily fired so it’s reasonable to wonder what exactly the ginger bro seen in the photo above could have ever done to deserve such a fate?

Oh.

At this point there really aren’t all that many so-called fiat gateways left in the American market. Silvergate is still in trouble as was detailed in the original More Than Seven Seals Of The Cryptocalypse. Signature bank might be holding Tether’s cash which if true would leave them extremely vulnerable to sudden death-by-regulator.

Here’s a fun story: back in June when the Oracle Of Tulips had only recently called me into service and I had no idea who or what any of these myriad crypto scam companies was I ended up getting a DM from some low follower count alt account. I can no longer locate the conversation but it basically amounted to

Them: “Beware Prime Trust… the most evil company of them all…”

Me: “Why?”

Them: “Double, double, toil and trouble!”

Me: “What?!?”

Them: [deletes account]

It has haunted me to this day.

5/Ω. A bunch of big companies (Microsoft, IBM, etc.) admitted that they had never actually found a business use for blockchain and intended to stop trying.

Microsoft Azure, IBM, Sydney Stock Exchange, the Australian Securities Exchange, and Maersk were the flagship big proofs of concept of "enterprise blockchain". They are all now kaput.

The chairman of the Australian Securities Exchange even publicly apologized to the people, kangaroos, and enormous poisonous spiders of Australia for being dumb enough to ever think blockchain was useful. Global shipping giant Maersk threw their entire blockchain project in a dumpster. And the engineers who created Amazon Web Services A.K.A “AWS” A.K.A “the infrastructure on which ~40% of the internet runs7”, published a piece explaining why AWS never made a blockchain play. It’s a fun read if you’re technically inclined and probably even if you aren’t but if you just want the summary: the smartest and most experienced engineers of distributed systems in the world thought blockchain was kinda stupid from the moment they laid eyes on it.

Being incredibly smart and capable engineers with a proven track record of success meant that they could smell bullshit 10 miles away. They thus wisely steered Amazon away from wasting any money pretending that the emperor’s magic beans were made of something other than male cow excrement.

6/Ω. At the current price of Bitcoin the American, European, and Australian mining companies will all go bankrupt. Russia may eventually take over the mining of cryptocurrencies.

The largest mining operation in the world, Cora Scientific, is already bankrupt though it has not formally filed yet. Most miners carry extremely heavy debt loads and use mining computers AKA “rigs” or (in Bitcoin’s case) “ASICs” for collateral. Those rigs are now worth less then half of what the miners paid for them. Liquidation of bankrupt miners will drive those prices even lower, maybe even all the way into the ground.

But hey at least Vladimir Putin has seen the light blockchain LEDs. Now that Russia and its banks have been cut off from the traditional banking system Putin is finally in favor of using cryptocurrencies as an international payment system to rival the dominant SWIFT based system.

7/Ω. Digital Currency Group owes Genesis Trading $1.7 billion (or 170 ten million dollar mansions). Genesis Trading owes users of Gemini Earn interest bearing accounts $900 million (or 90 ten million mansions). That means Digital Currency Group owes retail users of Gemini Earn $900 million.

Why did Digital Currency Group borrow all that money from retail? Barry Silbert, the Emperor Palpatine-esque CEO of the dark DCG empire, explained last week that they borrowed the money to do stock buybacks. Put another way they borrowed half a billion dollars from mum and pop cryptocurrency “investors” and put it straight into their own pockets and the pockets of their friends. Ryan Selkis is one such person (though it is unclear whether he was bought out by this loan or some other earlier transaction).

8/Ω. One of the largest pools of investor owned Bitcoin in the world, the Grayscale Bitcoin Trust, is refusing to tell anyone where all the Bitcoins are.

I have written about the history of Grayscale and GBTC before in a piece called “3AC and BlockFi Made The Same Dumb Trade And Seem Headed For The Same Dumb Place (That Place Is Hell) so I’ll spare you the history lesson. These days it feels like the only thing with any value under DCG’s enormous (and enormously dark) penumbra is Grayscale Bitcoin Trust (GBTC) which contains billions of dollars worth of Bitcoins that no one has ever seen.

I can see a couple of possible explanations for why Grayscale won’t show us the coins:

[best explanation] Everything is as it should be they are just shy.

[reasonable if problematic explanation] The bitcoins in the trust can be traced to crimes like Silk Road or the child pornography trade and Grayscale would prefer not to reveal that yet (remember they bought a lot of these coins in the ultra Wild West times of 2015-2016).

[bad explanation] There are no coins.

9/Ω. Binance announced a bailout fund for companies crippled by the FTX fallout. They got 150 applications on the first day.

No comment.

![150 companies seek Binance's bailout for organizations "facing significant, short term, financial difficulties" On November 14, CZ of Binance announced an "industry recovery fund", which he said would devote money to "further cascading negative effects of FTX [and] help projects who are otherwise strong, but in a liquidity crisis". In a blog post outlining the $1 billion initiative, Binance also divulged that "we have already received around 150 applications from companies seeking support under the [Industry Recovery Initiative]"—only a week and a half after it was announced.](https://substackcdn.com/image/fetch/$s_!pDmA!,w_600,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fpbs.substack.com%2Fmedia%2FFicH_x4XkAEUuzj.jpg)

10/Ω. The CEO of another large cryptocurrency exchange manipulative and amoral casino named AAX that seems to have mostly served the Chinese language and African markets has run away with all the money. Violent mobs of customers are laying siege to AAX’s offices.

The customers are furiously posting the personal details of executives and employees of AAX all over social media.

There are even reports that mobs of customers are laying siege to AAX’s Nigeria office and physically attacking the employees.

Not directly related but victims of Hoo Exchange, a cryptocurrency marketplace whose leaders ran off with all the money in surprisingly similar circumstances, can now be found on Twitter organizing search parties to hunt down the ex-CEO Rexi Wang and/or any of his family members.

Dark.

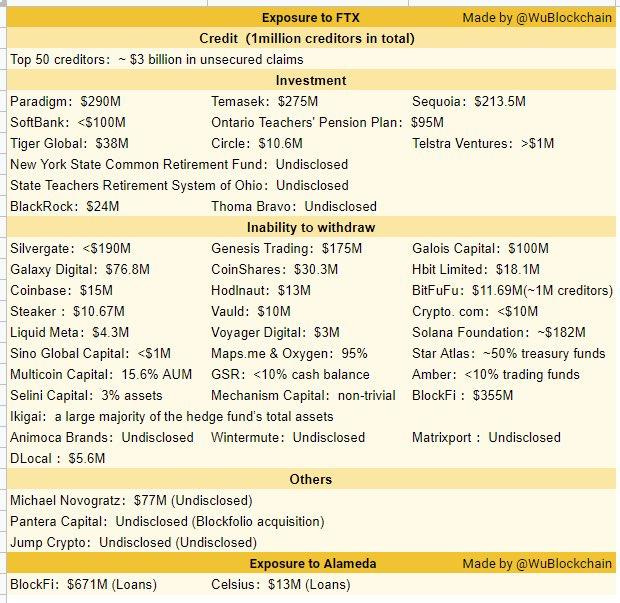

11/Ω. American pension plans are starting to admit they too lost a bunch of money on the FTX scam.

Wu Blockchain reported that FTX owes money to all these parties, the New York State Common Retirement Fund and the State Teachers Retirement System of Ohio among them:

At least so far. There will be more.

The remaining entries consist of readings from The Book of the Hammer of Regulation. The book was thought lost for many years but recently it turned out that it had just been temporarily lost in a dark wood.

12/Δ. The Book of the Hammer of Regulation, Chapter 1: The politicians are becoming enraged about the large quantity of SBF shaped egg dripping from their faces.

Α α, Β β, Γ γ, Δ δ, Ε ε, Ζ ζ, Η η, Θ θ, Ι ι, Κ κ, Λ λ, Μ μ, Ν ν, Ξ ξ, Ο ο, Π π, Ρ ρ, Σ σ/ς, Τ τ, Υ υ, Φ φ, Χ χ, Ψ ψ, Ω ω.

By failing to continue to hide his fraud from the public Sam Bankman-Fried (“SBF” in crypto vernacular) has committed the unpardonable sin of damaging the egos of powerful politicians. SBF and Ryan Salame gave so much money to so many politicians in such a bipartisan manner that they managed to be photographed with a very large number of members of the Congress of the United States of America. Those photographs will be used as ammunition against those Congressmembers foolish enough to allow themselves to be bought by the hideous monstrosity made out of computers and greed that is the cryptocurrency industry for the rest of their lives. Sure, a photo of yourself with SBF isn’t quite a photo of yourself with Jeffrey Epstein. But it’s on the spectrum. Here he is with Rep. Maxine Waters (D - California):

And here is Rep. Tom Emmer literally licking SBF’s anus clean with his tongue (and then thanking him for the privilege):

Many people were shocked that SBF was on the verge of basically buying his way into a state of total regulatory capture. He was choosing his own regulators and writing laws that would allow him to more effectively cheat his customers. “Look at the math!” these sceptics tried in vain to tell their politicians for years and years. “SBF is a total scammer!” But of course politicians don’t speak math and never do things because of a sober, mathematically accurate understanding of the costs and consequences. Quite the contrary: it’s all vibes all the time over there. And now the vibes are bad. Very bad. So bad we’re starting to see the conversation in Washington finally shifting in the right direction.

4/Ω. The Book of the Hammer of Regulation, Chapter 2: The federal judiciary has (finally) handed down an official opinion on whether or not cryptocurrencies are securities and thus subject to an incredible array of regulations.

SEC vs. LBRY has been a closely watched case in the industry because the judge’s ruling in this matter would be the first official precedent on the subject of “are these magic internet money beans securities (like stocks) or commodities (like corn)?” Selling corn is pretty easy. Selling stocks, on the other hand, is a huge pain of the ass and involves an absolutely incredible amount of paperwork, fingerprinting, legal fees, and accounting results. All for a very good reason: this dense web of regulatory oversight makes scams less likely to make it onto the stock exchange and makes it easier to stop them in the cases where they do.

Here is the text of the ruling. Here is a summary by a pro-crypto publication. I mentioned the LBRY result at slightly more length in an earlier post about the fall of GodEmperorSBF to Lord CZ but somehow forgot to include it the original More Than Seven Seals of the Cryptocalyse despite the fact that is a veritable death sentence for the Ethereum market. So many cryptocalyptic omens, so little time.

Obviously the creators of the LBRY token didn’t like this ruling. We have enlisted the learned scholar David Gerard to translate their complaint from the original bizarre creole of English, gibberish, and avarice that cryptocurrency creators speak and into English.

5/Ω. The Book of the Hammer of Regulation, Chapter 3: The Department of Justice has some questions.

Questions for, you know, everyone who ever sent money to, received money from, traded on, or farted in the general direction of SBF’s cryptocurrency empire.

6/Ω. Caroline Ellison, the CEO of FTX’s inappropriately close sister operation Alameda, was spotted in Manhattan.

Now I don’t like to judge a book too much by its cover but Caroline Ellison’s media appearances have no exactly t left me with the impression that she is a hardened international criminal ready to have plastic surgery and disappear into a non-extradition country like Uzbekistan. She strikes more as the kind of person who would immediately come to the authorities with information in the hopes that doing so would lead to lender treatment from the authorities. Be your own judge just in case I’m racist against white nerds or something:

IIRC Caroline Ellison’s parents work at MIT. MIT is in Boston, not New York City. Maybe I’m wrong and her family is in New York and they just commute to Boston8. She could also be visiting her favorite uncle or something. There’s no way to know for sure. But it's kind of... interesting, at least, that this is how far the coffee shop she was seen in is from the offices of the prosecutors of the Southern District of New York (SDNY) A.K.A the hardest financial regulators in the world.

There’s rumours she even has a lawyer already. Turning yourself in, offering to turn state’s evidence, and hiring a high powered East Coast law firm is pretty much exactly what any white collar criminal with a lick of sense does in this predicament. Which is why this was not at all surprising news.

I’ll leave you with this final video wherein one smarter than average crypto bro accurately explains to the world what Alameda and FTX were really all about.

Seriously I wouldn’t count on it.

Some people call what happened to FTX, Hoo Exchange, AAX, and so many exchanges “bank runs” but crypto exchanges are not banks and therefore cannot experience “bank runs”. A “bank run” is when a bank’s customers want to take money out but that money is tied up in loans to homeowners or whatever. When a bank’s customers want to take money out but that money has been stolen the technical term is instead “theft.”

AKA “fix” for those less familiar with financial vernacular

Many of them had a followup thought about that stoner they knew in high school with the lava lamp obsession who somehow now drives a Lamborghini and owns two yachts.

MakerDAO is the biggest, most important thing in the world of “decentralized finance” A.K.A “DeFi”.

This sort of death-by-psychotic break most famously happened to Elisa Lam who most probably jumped into a water tank to escape phantom pursuers that existed only in her mind

A lot more than 40% if you’re in the USA.

Believe it or not people actually do this. I even know one of them.