Pete Hegseth: A Man Of Questionable Judgment

Maybe America should reconsider putting crypto bros in charge of the army.

"The Crusades were the most durable monument of human folly that has yet appeared in any age or nation.”

- David HumeA lot of noise has been made about the various things that make a frat bro cum Jesus freak like Pete Hegseth unqualified to be placed in charge of the largest, most expensive, and most complicated military force in the history of the world. Joyless scolds among us often land on potential shortcomings like:

Alcoholism (a lot of alcoholism)

Adultery (a lot of adultery)

Alleged sexual assault (followed by large cash payments to the alleger)

Apocalyptic cult membership (Third Temple)

Inexperience (never ran any organization larger than a dozen or so people)

Managerial failure (the organizations he did run he more or less drove into the ground - but hey, that’s forgivable. After all they threw some rad parties!)

The details of these alleged failures were covered in a long New Yorker profile of the man so I won’t waste time with them here. Personally I endorse partying and also see no issues with giving the nuclear codes to a member of a fringe Christian cult with eschatological obsessions who seems to spend a reasonable amount of his public life yelling about killing muslims while blackout drunk.

And yet even I questioned the wisdom of appointing a man like Brother Pete Hegseth to be America’s Secretary of Defense (“SecDef”). My reasons have nothing to do with whether or not SecDef is a role that should be filled by a man who could be plausibly blackmailed by allegations of groping female employees at an event he probably can’t even remember and more to do with Brother Pete’s complete and total inability to see through one of the most relentlessly obvious (and obviously mafia connected) crypto scams1 in the history of the world.

Let’s just say that when Brother Pete managed to accidentally send top secret information about an upcoming military strike (liberally interspersed with 👊🇺🇸🔥 emojis) directly to an opposition journalist yesterday I was not surprised. To describe Brother Pete’s judgment as “questionable” would be charitable. Even “nonexistent” might be kind of a stretch when attempting to describe the level of insight the man brings to bear on life’s day to day challenges. “Nonexistent” just means something like “zero” and therefore does not convey the man’s singular ability to choose the dumbest possible answer to any of life’s problems more complicated than with whom to do a keg stand or what lie his wife might believe tonight2.

Putting a man like Pete Hegseth in charge of the military is how you end up with SignalGate.

THE CELSIUS NOTWORK

Celsius Network (which from here on out will be referred to as “Celsius Notwork” or just “Celsius”, depending the level of outrage flowing through my fingers at the time of typing) was, put simply, a ponzi scheme. The legal definition of a ponzi scheme is something like “an investment fraud where returns for early investors are paid for by money coming in from new investors” - basically robbing Peter to pay Paul. This is usually accomplished by promising investors they can make more money (“better returns”) if they invest in the ponzi scheme than they could get from a more traditional investment like stocks or bonds, almost always accompanied by a promise that investing in the ponzi scheme will be “risk free”.

I usually quantify “better returns” for readers less familiar with the world of finance by offering two points of comparison:

Every financial professional currently working on Wall Street would gladly sacrifice their first born child to Satan for a risk free 8% return.

Bernie Madoff guaranteed 10% returns.

Celsius Network offered 18%3 returns4. And how did they claim to be able to pay those high returns? From Bloomberg:

“The beauty of what Celsius managed to do is that we deliver yield, we pay it to the people who would never be able to do it themselves, we take it from the rich, and we beat the index,” [Celsius CEO] Mashinsky said during one stream in December. “That’s like going to the Olympics and getting 15 medals in 15 different fields.”

So basically Celsius claimed to be Robin Hood (the mythical figure, not the confetti strewn iPhone app for gambling addicts), taking money from rich bankers and giving it to you. Who wouldn’t love that? Note that you should immediately note the parallels with the way Donald Trump claims to be taking stuff from “elites” (like money for cancer research) and giving it to you (at least if you’re already rich).

The only thing that distinguished Celsius from other ponzi schemes was not the fact that most of the “investments” on offer were marketed as “savings accounts” in a “new kind of bank” instead of “investments” - that’s a tale as old as Charles Ponzi himself. The distinguishing feature of Celsius’s approach was that these “savings accounts” were denominated in magic beans cryptocurrency.

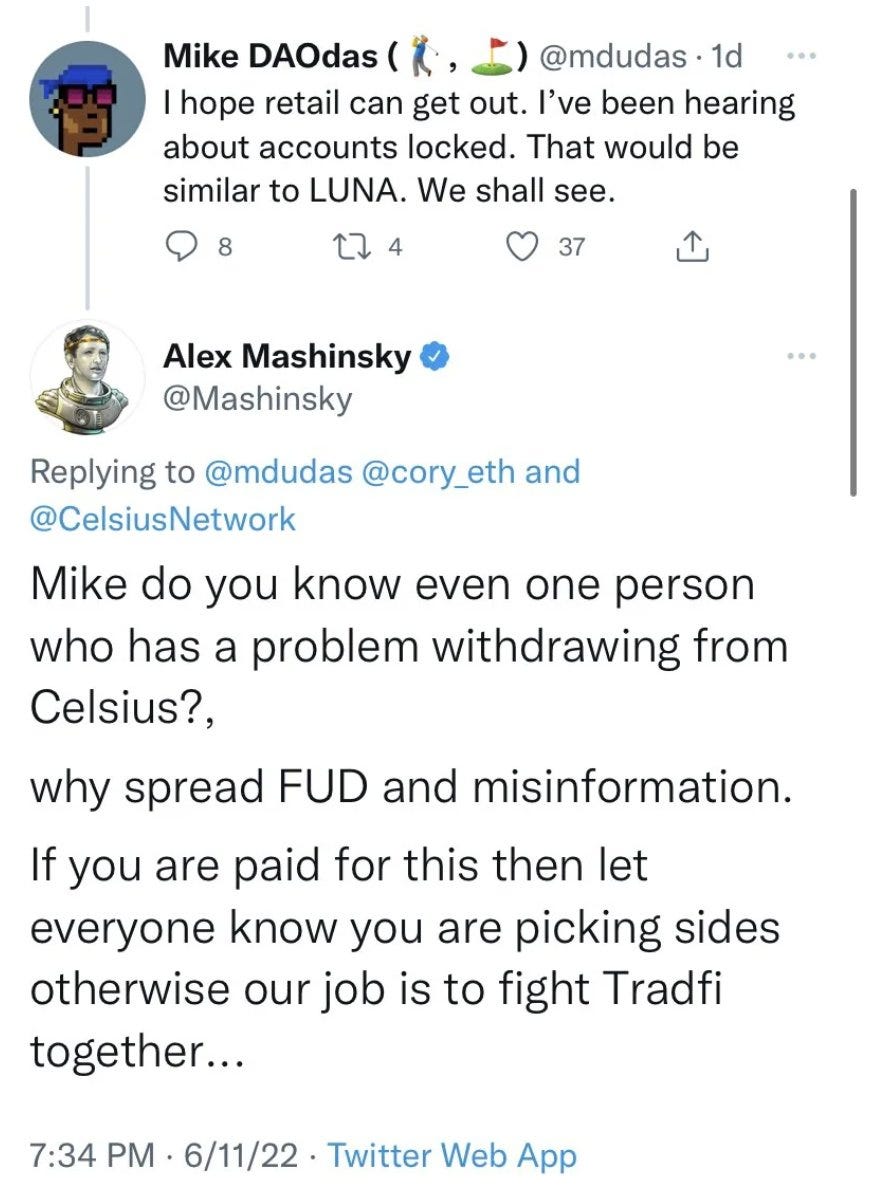

Like all ponzi schemes before it Celsius imploded when new customers stopped providing fresh money it could steal and use to pay out those absurd 18% returns to people who had invested earlier5 and Celsius ran out of money. While the details of the collapse are absolutely incredible they are also, sadly, beyond the scope of this article. Just to give you a little color, here’s Celsius CEO Alex Mashinsky’s final tweet 48 hours before Celsius officially started refusing to allow “investors” to withdraw their money from the platform:

There’s a lot of amazing aspects to this story that I’m not going to get into here but I will also mention that Mashinsky pleaded guilty to running a massive financial fraud just a few weeks ago. Prior to November 2024 I would have said he will probably spend the rest of his life in federal prison but now I will instead suggest that you set a pardon countdown timer because wealthy Russian/Israeli financial fraudsters are Trump’s second favorite class of people to pardon.

THE HEGSETH OF IT ALL

There’s two main reasons people fall for a ponzi scheme like Celsius:

Financial illiteracy

Stupidity

Pete Hegseth has degrees from Princeton and Harvard Universities. At the time he graduated from Princeton something like 30% or more of the undergraduate class went into finance6 so I think we can conclusively rule out explanation #1.

So then how come his name appears in the Celsius bankruptcy documents as someone who lost money in this fiasco?

Hegseth’s statements on Fox News on the subject make it sound like he might have lost kind of a lot of money to the Celsius Notwork. Note that Brother Pete did not lose money in FTX, which was a much less obvious scam than Celsius Network.

While bankruptcy filings obfuscate small creditors’ balances, some people have access to the transaction histories for some Celsius customer accounts in the last few months of the company’s life. I am one of those people.

I believe (but am not sure) that the PETE HEGSETH interest payment in the above data represents a single month’s interest payments, which would mean Hegseth was receiving about 0.25 bitcoins per year in interest. If that’s correct it would mean that Hegseth lost around 1.4 bitcoins currently valued at around $130,000 in Celsius Network.

That’s just for this one kind of account - he may well have had other Celsius accounts not in this data set, which was accidentally leaked by Celsius’s crack team of “big law” attorneys.

THE BROTHER DOTH PROTEST SO MUCH

But, you might protest, how could one have known Celsius was a scam? Well other than the fact that the CEO Alex Mashinksy was a charlatan who (falsely) claimed to be the inventor of a major internet technology called VoIP7 there’s the fact that Mashinsky received an absolutely glowing profile from Forbes magazine8. Profiles in Forbes are, of course, one of the leading indicators of every type of financial fraud, from Enron to Theranos and beyond.

But there’s also the fact that Celsius Notwork’s Chief Financial Officer (CFO)9 had previously been employed by Moshe Hogeg, one of Israel’s more infamous organized crime figures and child abusers of recent vintage, before being arrested in Israel for money laundering… while he was the CFO of Celsius.

The fact that none of this information seemed to set off any red flags for Brother Pete makes one wonder, what, exactly, might constitute a red flag in his world other than the letters “DEI”. I may be old fashioned but it seems to me that being able to accurately assess risks like, oh, I dunno, the risk of investing a bunch of money in an obvious ponzi scheme run by a bunch of Russian/Ukrainian/Israeli organized crime figures who tell incredibly obvious lies as often as they breathe is the kind of character trait a republic might desire in the person making life or death military decisions. Pete Hegseth, it seems to me, is not only unfit to lead the United States military, he’s not fit to manage a special needs preschool north of the Arctic Circle.

Likes, restacks, and all other kinds of shares are always appreciated here at The Cryptocalypse Chronicles.

I realize “crypto scam” is redundant here but I included both words for clarity.

The fact that correctly picking who to choose as one’s college keg stand partner is a life skill more heavily rewarded than pretty much any other decision one will make in life is beyond the scope of this post, but it seems like at least some kind of indictment of the American system.

The Celsius Notwork website is still up.

More, even, if you were willing to accept your “returns” in the form of Celsius’s fake money cryptocurrency, the CEL token but the fact that Celsius Network invented its own form of fake money on top of running a ponzi scheme is outside the scope of this article.

Exponential growth is a motherfucker.

Probably more like 80% of the humanities majors on sports teams that would bro down with someone like Pete Hegseth.

"Voice over IP”, basically the way you talk to people through an app like Skype or iMessage.

This profile was written by a crypto VC investor masquerading as a journalist.

The guy who handles the money at a company.

I bow to your mastery of the headline: "Pete Hegseth: A Man Of Questionable Judgment"

No notes, 13 out of 10.

How TF did PH get admitted to Princeton & Harvard?