Are Crypto.com and Binance's European Assets Frozen In Lithuanian Banking Space-Time?

And is all that money about to be ejected from the airlock of the Starship TradFi into the frozen silence of the interplanetary void?

"In vain produced, all rays return. Evil will bless, and ice will burn." - Ralph Waldo Emerson

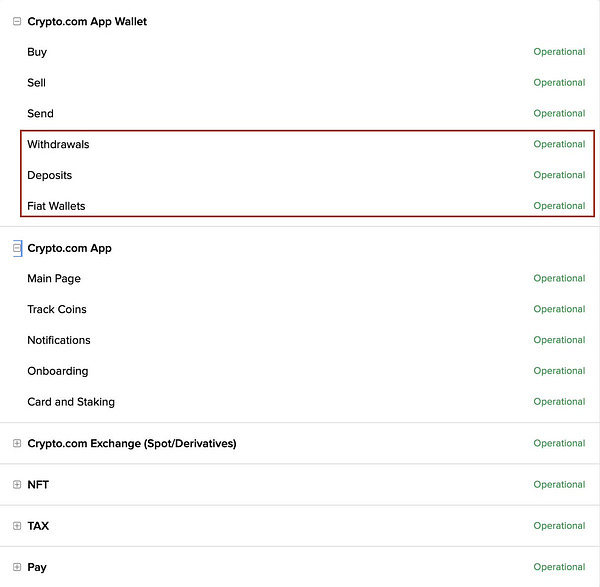

Recently users of Crypto.com were surprised to receive an email saying that SEPA (Single European Payments Area) transfers were being “migrated to a new provider” and thus Euro-denominated deposits and withdrawals were temporarily suspended. Crypto.com’s status page was also updated at some point to announce the interruption and notify customers that the team expected to restore service in 72 hours.

As someone who has been involved with the migration of a few payment systems for a few successful tech companies in my day let me just say that this could not have set off more red flags. “Red flags” is actually quite an understatement - we’re talking giant blood-red banners waving in the wind, flashing ambulance lights in every shade from palest pink to deepest crimson, shrieking air-raid sirens, several horsemen of the apocalypse appearing on the horizon, and more. Being an inquisitive sort who has by now learned from bitter experience that the art of journalism has evolved to the point where “looking into things” is considered beneath contempt (after all why look at evidence and spreadsheets when you could just call your buddy Sam Bankman-Fried and ask him for his informed opinion?) I decided to debase myself by actually figuring out might be going on.

What I found looks bad. Really, really bad. Because the available evidence clearly suggests that Euro denominated user deposits currently held at Crypto.com have been seized by the government of Lithuania as part of an anti-money laundering enforcement action, in which case any customers trying to withdraw more than a negligible amount would rapidly force Crypto.com to file for bankruptcy. It’s also clear that the executives of Crypto.com have been, shall we say, less than forthcoming with their customers about what, exactly, is going on. At least that’s the highly charitable interpretation. Because they have not given their users so much as a hint that anything bad has happened.

What I found suggests that Euro denominated user deposits currently held at Crypto.com have been seized by the government of Lithuania as part of an anti-money laundering enforcement action.

It gets worse though. In the course of untangling Crypto.com’s impending collapse I also uncovered a large body of evidence suggesting that both Crypto.com and Binance are slowly1 having their access to the international banking system - the one that works in so-called “fiat” - turned off. Both companies appear to be scrambling to find new bank accounts and payment processors only to quickly find those doors have also slammed shut. Or put another way:

“Winter is coming.”

DEPOSITA IN MEDIA RES

Usually when a company of any reasonable size run by people of any reasonable level of competence performs some unexpected action that is highly disruptive to its customers ability to use its services said customers are given plenty of notice. This expectation goes up 100x if the services in question involve those customers’ money. For instance in this case, where European customers lost their ability to deposit their money to or withdraw their money from Crypto.com’s bank accounts for something like 100 hours, I would have expected Crypto.com to notify its users at least several months in advance. I would also have expected Crypto.com to have then sent out repeated reminders of increasing frequency and urgency as the date of the disruption approached.

But that’s not how it went. Not only did Crypto.com seemingly not send any kind of prior notice to their customers - you know, the people who are supposed to trust the company with their financial futures - it is clear from the posts of many redditors that the problems began at least 24 hours before they sent out the first (and only) email about the disruption.

Also some people never got an email at all.

Also Crypto.com did not mark any of their services as less than fully operational on their status page.

Also there was no in-app notification. This is particularly baffling because these days most well run tech companies contract with vendors that integrate emails, in-app notifications, and text messages into one platform. Not being able to send critical notices out across all available channels suggests that the technologists behind this operation are perhaps not the finest minds money can buy. Either that or Crypto.com was very intentionally trying to tell as few of its users as it could get away with. After all not every user is making a deposit or withdrawal every day or even most days.

Also the Crypto.com mobile app was apparently still showing some users the old deposit instructions well after the email had gone out on January 22nd advising them of the impending “migration”.

Given that some users never got an email, some were still being told by Crypto.com’s app to send money to the old bank account, and some measurable percentage of customers can always be counted on to not notice their own children setting the family dog on fire let alone an email alert from a mid-size cryptocurrency exchange it was not at all surprising that a bunch of Crypto.com’s customers ended up wiring money to the old bank account. Which begs the question: “Where is that money now?”

Well.

FUNDS ARE SAFU SAFEGUARDED

A little digging revealed that prior to the sudden total failure of all funds sent via SEPA2 transfers to reach their Crypto.com "fiat wallets"3 customers had been sending their deposits to a bank called Transactive Systems UAB based in Lithuania. Lithuania is, of course, where all legitimate companies go to find high quality providers of banking services so this was not in and of itself alarming. But I was surprised to find that when I went to Transactive Systems UAB's website I encountered this rather dramatic popup:

Note the language, complete with grammatical errors which would be more forgivable were not more or less everyone in Lithuania fluent in English4. That wording - in particular the use of “safeguarded” - sounded to me like the kind of language a bank might use if, say, the government had come in and seized a bunch of that bank’s assets because of criminal activity. But hey, I’m not an expert. So I poked around a bit more and lo and behold, what did I find on The Bank Of Lithuania’s official website?

If you read that text as having many references to money laundering and terrorist financing on a massive scale and specifically involving the bank accounts of cryptocurrency trading platforms, congratulations: that’s exactly what it says.

Which begs the question: what happened to all of Crypto.com’s Euro denominated money? Because it sure sounds like it was seized by the government of Lithuania and is no longer available to be withdrawn. And all those users who sent their Euros to Transactive Systems UAB account - what happened to their funds?

Let’s just say it’s not going well.

Thankfully Crypto.com’s customer support is being responsive and keeping its customers informed and up to the minute5, right?

Oh.

UPDATE January 30th 4PM: Since this was published Crypto.com’s users who recently sent funds to the bank account at Transactive Systems UAB have received their money back; the wire transfers bounced back due to the account having been seized. This is great news for those users who sent Euros to Crypto.com after January 21st (because they got their money back) but possibly very bad news for everyone who sent Euros to Crypto.com before January 21st 2023 (because it confirms the bank account has been seized, which is what this entire piece is about).

NOVA NUMMULARIORUM

Fortunately (at least for those customers who didn’t send money to the now seized bank accounts at Transactive Systems UAB) Crypto.com quickly found some kind of new banking partner and/or payment processor and was able to get SEPA Euro-denominated deposits and withdrawals back online. Users who had previously been instructed to send their deposits to a company called “Foris DAX Asia” were now instructed to send them to bank accounts owned by a company named “Foris DAX MT Limited” located in Malta instead of Lithuania.

One might think that Crypto.com, in attempting to find a financial centre its customers could be confident in, would choose only a location with the most reliable regulators and an incorruptible government. A country whose banks’ names do not appear on tens of thousands of pages worth of documents in the infamous Panama and Paradise papers. A country with strong disclosure requirements for companies that give investors peace of mind about how their capital is being deployed. A country whose banks the financial systems of places like the United States, Japan, and Europe would be happy to do business with. And definitely not a country where journalists and anti-corruption crusaders are routinely assassinated by the mafiosi they are trying to expose.

Oh.

As it happens when European users were told to send money to accounts in the name of this new company “Foris Dax MT Limited” in a Maltese bank it actually worked… at least for those Crypto.com customers who use banks that are willing to process wire transfers to Maltese institutions where many of the important positions are quite literally held by the mafia. Somewhat surprisingly this didn’t turn out to be all banks. Some poor6 souls who tried to tithe a percentage of their pay cheque to the porcelain cryptocurrency gods were met with immediately cancelled transactions. But even if all banks had turned out to be willing to send money to Maltese financial institutions run by murderers there would still be The Very Uncomfortable Question:

Will customers who hold what they thought were Euros on Crypto.com’s platform ever be able to withdraw those Euros?

Because if Crypto.com’s Euros were seized before they could be transmitted to the new Maltese banks that would imply that Crypto.com is in effect starting over from scratch. The new Maltese bank account could have had as little as €0 in it as recently as 7 days ago. And that, in turn, would mean that even a small modicum of withdrawal pressure would force Crypto.com to halt withdrawals… and it is not for me to tell you what happens then.

TETHERED VS. ANCHORED

Who was this new payment processor that would accept Crypto.com deposits? Turns out it was a company called OpenPayd. Guess who else likes OpenPayd? Turns out OpenPayd is a favorite payment processor/bank/whatever7 of the cryptocurrency exchange Bitfinex. And what other company do the owners of Bitfinex run?

Tether.

The saga of Tether is too complicated to explain here but suffice it to say that Tether is a $65 billion cryptocurrency company Bloomberg once described as “practically quilted out of red flags”. It has been involved with financial institutions run by and for drug cartels, the Chinese mafia, Vladimir Putin, arms dealers, human traffickers, and more. Truly who you want to see on the client list of any financial services provider. Especially a financial services provider whose website gets a whole 650 page views a month.

But at least Crypto.com Euro-denominated deposits and withdrawals payments are working now, right? Right?

Uh oh.

ENDLESS NAMELESS

Unfortunately this saga doesn’t end there. Just a few hours ago at around 7:07 PM UTC on January 28th, 2023 someone posted this to reddit.

Other people were posting stuff like this about trying to send British pounds to Crypto.com’s deposit addresses via the UK’s Faster Payments network:

Tough nuts for European crypto investors, I guess, because we’re apparently back in “maintenance mode”.

CRYPTO PAST IS CRYPTO PROLOGUE

Let me preface this section with some extensive CNBC reporting about Crypto.com Kris Marszalek’s extensive history of connections to accounting frauds and money laundering operations.

As I was digging into Crypto.com’s shell companies, dodgy financial services providers, and criminal enterprises of days past I stumbled across a few things. For instance, the fact that North American users had as of October 2021 been sending their deposits to neither Foris DAX Asia nor Foris DAX MT Limited but to a company called “Cro St Julians”.

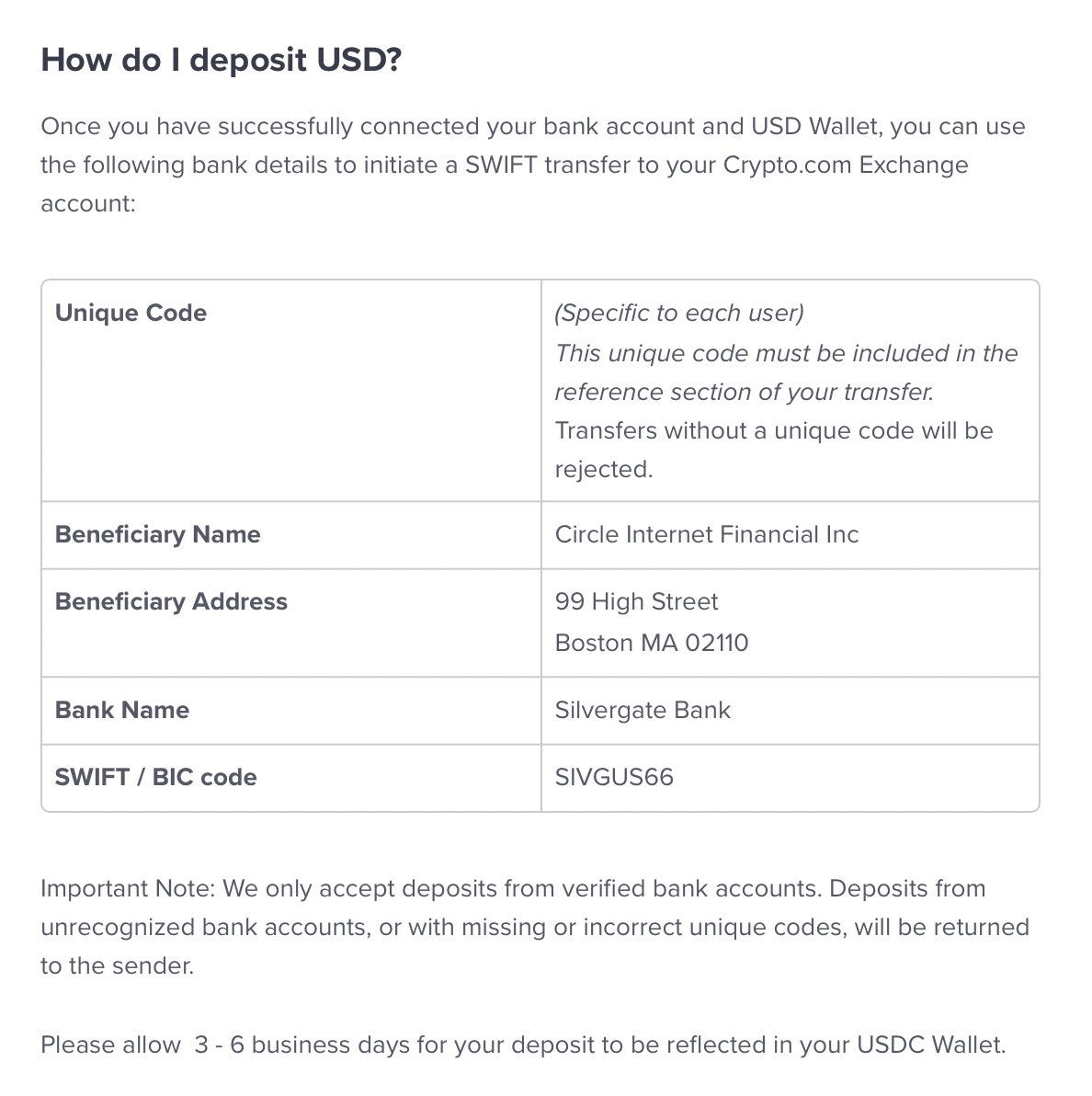

Everyone knows legitimate companies also need to use an endless treadmill of shell companies based in the Seychelles, the Cayman Islands, or Bermuda just to stay afloat. That’s just how tax laws work these days. But what was surprising was that apparently for quite a long time the deposit instructions on the Crypto.com website told users to send money to an entirely different massive player in the cryptocurrency space. A Coinbase-backed company called Circle Internet Financial that held some of its accounts at the recently incredibly troubled “crypto-friendly” bank Silvergate (stock ticker: SI) and much of the rest at the probably-soon-to-be-incredibly-troubled “crypto-friendly” bank Signature (stock ticker: SBNY).

If you’re new here the short version is that Circle is Tether’s primary competitor. They offer a very similar product - a so-called “stablecoin” called USDC. One USDC is supposed to be worth $1, always and evermore. Now unlike Tether there’s at least a few good reasons to suspect that Circle isn’t just making shit up out of whole cloth and printing fake stablecoins out of thin air whenever they feel like it. However this still raises a whole bunch of exciting questions.

First of all how did Circle and Silvergate justify to the banking regulators the fact that they would be receiving funds customers thought they were sending to a Bermuda Cayman Islands El Salvador Seychelles Malta-based financial services company?8 Accepting money for one company in the name of another is literally what they teach at Pyongyang University in the world renowned International Money Laundering 101 course. Which is, of course, why it is usually strictly verboten. Maybe Crypto.com and Circle had a special arrangement wherein Crypto.com was granted the exclusive right to turn customer cash sent to Circle directly into USDC sent to China? Surely no other member of the cryptocurrency exchanges most closely associated with the Tether cartel would be given such a privilege? Especially those exchanges more obviously tied to criminal elements in China and Korea?

Oh9.

I’M AFRAID OF AMERICANS

Just because most of the excitement described here has involved Crypto.com’s European banking partners doesn’t mean that Brussels gets to have all the fun. Because just as the Transactive Systems UAB asset seizure was interrupting Crypto.com’s EUR and GBP operations it seems that Crypto.com also made changes to their American banking relationships.

The Crypto.com site no longer directs its customers to make deposits through Circle’s Silvergate bank account. Instead it appears that Crypto.com has pulled yet another shell company out of its bag of offshore tricks and now that Caymans Island based company, “CRO Dax Limited”, has a Silvergate bank account to call its very own.

HARK, BINANCIANS!

I’m running out of time and patience here so we’ll have to keep the Binance section of this issue of The Cryptocalypse Chronicles kind of brief and/or limited to a series of embedded links to The Privatized Public Square AKA “Twitter”. Hopefully now that you have been exposed to the recent saga of Crypto.com’s attempts to re-bank itself it should take a bit less fine grained detail to give you a sufficiently focused picture. Which is good, because the picture is much, much worse.

The story starts with four pivotal publications by an intrepid group of citizen journalists of which I am proud to be a member. The first of them was a piece published by DataFinnovation using simple numerical analysis to suggest very convincingly that Signature Bank (stock ticker: SBNY), the biggest “crypto-friendly” lending institution on the planet, was probably holding Tether’s cash in some incredibly large uninsured accounts. You can read the important details of DataFinnovation’s analysis here but if you just want the money shot here is a graph that compares the number of Tether’s USDT “stablecoin” in circulation to the uninsured, non-interest bearing deposits at Signature Bank.

Having read DataFinnovation’s work and found it compelling, I worked with Crypto1nfern0 to build out a timeline of the shifting relationships between Binance, FTX, and Signature Bank which I published in early December.

This in turn prompted the Twitter sleuth Deltec’ed10 to unearth some actual receipts proving that Signature Bank was providing bank accounts to Binance through a shell company so scammy it had been struck from the corporate register of the goddamned Seychelles11. Which is both impressive (on Binance’s part) and incredibly illegal (on Signature Bank’s part).

Finally Dirty Bubble Media, destroyer of Bankmans and devastator of Frieds, unearthed the full list of Signature Bank’s clients from back in “the day” when people still thought cryptocurrency was cool instead of an enterprise completely overrun with Russian and Chinese money launderers, murderers, people with whatever personality disorder Sam Bankman-Fried's blog most suggests he suffers from on any given day, and the financially illiterate zealots known to some as HODLers12.

To the surprise of exactly no one who was paying any attention13 Binance was on the official Signature Bank client list despite being barred from offering its services to customers in the United States and also being currently under investigation by the federal governments of many developed countries for laundering money for drug dealers, arms dealers, ransomware developers, Iranians, North Koreans, and (probably) Russians.

SO IT BEGINS

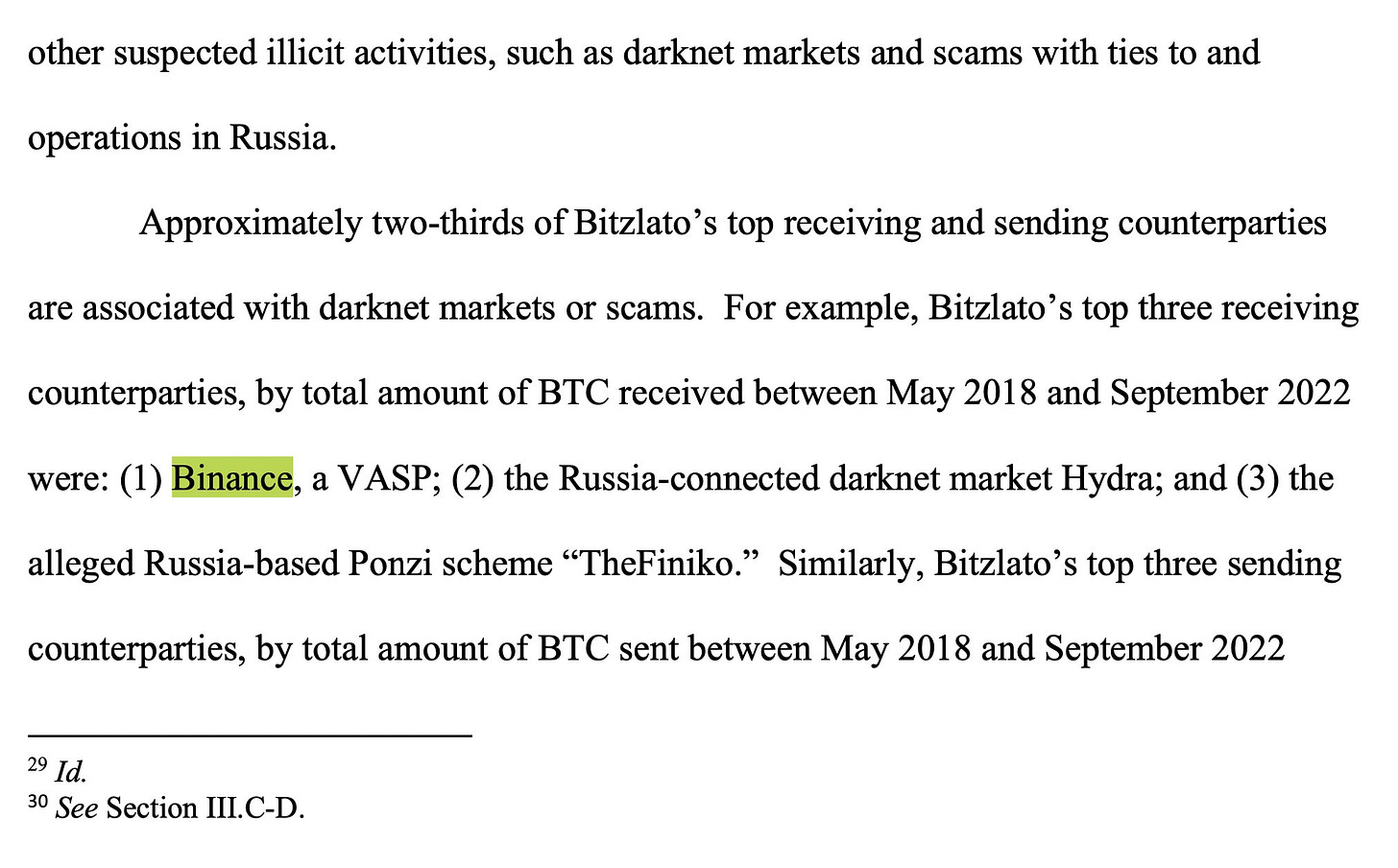

These discoveries about Binance’s shady and illegal ties to the American banking system seem to have played a role in a series of recent events that starts with the Department of Justice of the United States of America teasing a press release about an internationally coordinated bust of a criminal enterprise that was truly massive in scope. “Who could it be?” we wondered. “Is it (finally) Tether? Binance? Circle? Coinbase?” Thus it was perhaps somewhat disappointing when the DOJ came out and said they had shut down… Bitzlato, a cryptocurrency exchange literally no one on either side of The Coinerian Jihad had ever heard of. Memes abounded attesting to the uselessness of American law enforcement.

The memes were funny for a minute. Most people assumed the DOJ had its head completely up its own ass and moved on convinced that the criminals were going to win (and easily). More astute observers, however, quickly picked up on the fact that in the criminal complaint against Bitzlato the name of exactly one other cryptocurrency exchange showed up front and centre.

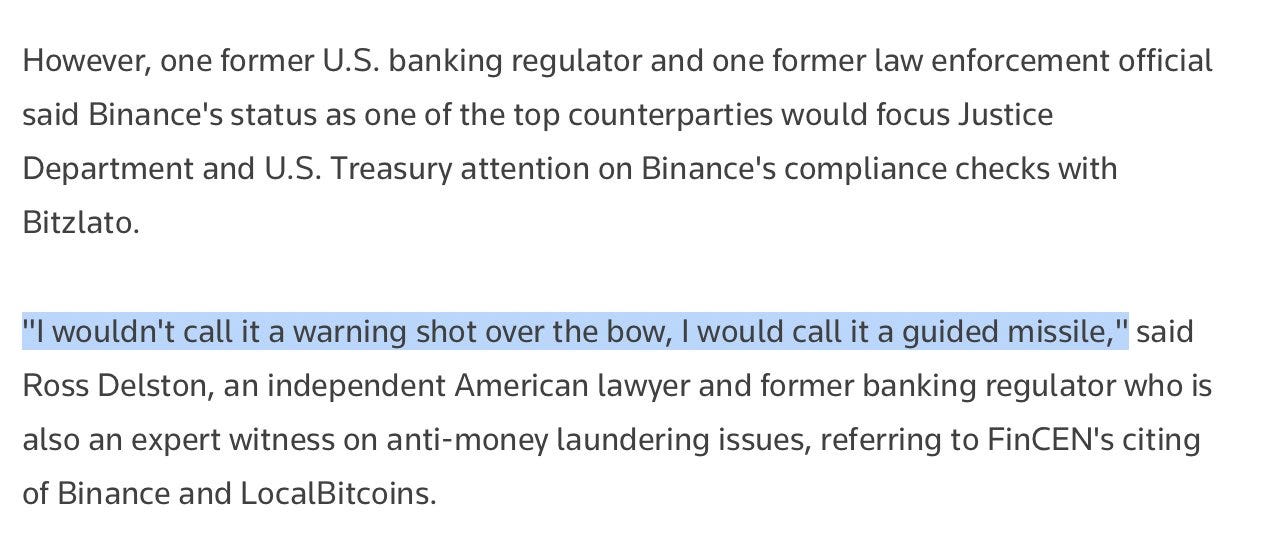

Reuters reported an interesting comment by former banking regulators. Something about guided missiles, somewhere in the vicinity of a vast money laundering enterprise called “Binance”.

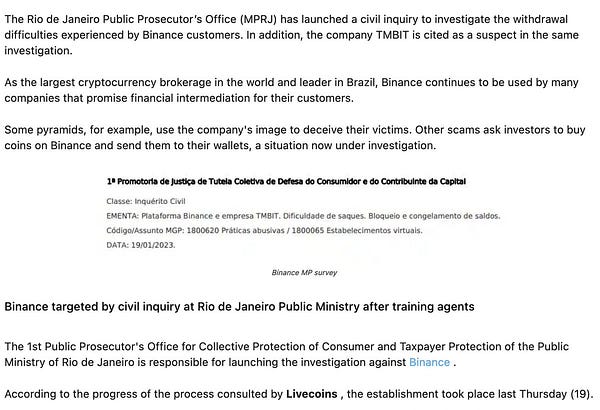

Then the Brazilian government announced an investigation into Binance for financial fraud.

Subsequently it was noticed by some European Binancians that the “withdraw” button had been removed from the Binance app for both of the major European currencies (Euros and British Pounds), albeit in different combinations depending on the location of the end user.

And of course back in October some reporters at Reuters named Angus Berwick and Tom Wilson14 had unearthed the long-lost secrets of a dark art known as “journalism” and published this:

And this:

And this:

Tom Wilson was even kind enough to make a Twitter thread explaining Binance’s compliance strategy. It primarily consisted of writing lies down on pieces of paper, signing them, and then handing them to governmental agencies tasked with regulating the financial markets.

There’s also a tweet about Binance’s relationship with Boris Johnson’s brother. No biggie.

🚨 RED ALERT 🚨

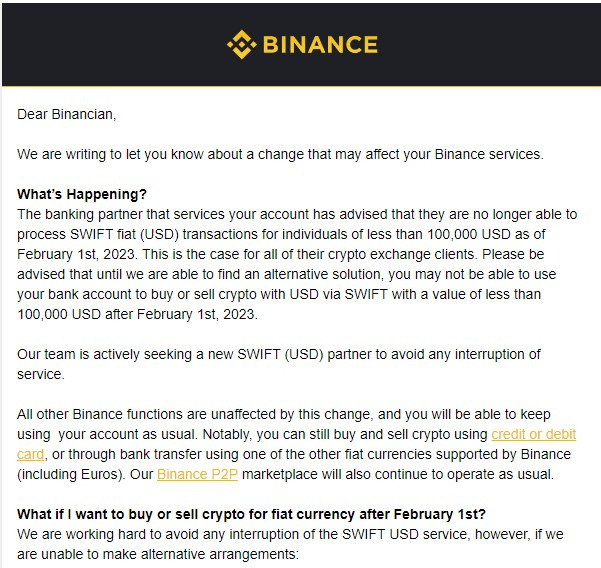

Several days later Binance sent a most unexpected email notification out to all its customers saying that after February 1st the company would no longer be able to transmit money via SWIFT (AKA “international bank transfer”) in amounts less than $100,00. Sounds bad, right? But this being crypto, it’s always worse.

The information war began when Binance planted a bullshit story in a fake media outlet called Asia Markets with some “reporting” claiming that all cryptocurrency exchanges (meaning not just Binance) were being de-SWIFTed.

Oddly however none of the crypto exchanges contacted on Twitter was willing to go on the record as having lost or not lost their SWIFT access other than Kraken who claimed to be still among the SWIFTed. By the time Bloomberg reported on this same story story the headline had evolved slightly:

POP QUIZ!

Read the news clipping below and then answer the three yes or no questions that follow.

Did Signature Bank set a transaction limit on Binance?

Will Binance be able to send a $50,000 wire transfer before Feb. 1st?

Will Binance be able to send a $1,000,000 wire transfer after Feb. 1st?

Answers: 15

If you answered “yes” to #1 you may want to brush up on your reading comprehension skills because that definitely is not what happened. Perhaps you made the common mistake of thinking that Binance is a cryptocurrency company. This is incorrect. The actual area in which Binance operates is mass psychology. Every piece of information you encounter about Binance should be assumed to be a psyop until proven otherwise.

With that in mind it’s easy to see that what the headline actually says is:

Binance planted a news story in a fake outlet somewhere in ‘Asia’ saying that Signature Bank had imposed transaction limits on their account.

The source of the information is not the bank. It’s Binance. Which means there’s no reason to believe any of it. In fact you should actively assume it’s all a lie. All we actually know about this situation is that:

“Responsible” exchanges like Kraken and Coinbase aren’t reporting issues.

SWIFT is not even the kind of entity that can “turn bank accounts off”.

Binance wants us to be prepared for a time when it no longer has SWIFT access.

Signature Bank hasn’t said a goddamn word.

If you don’t know what SWIFT is consider that cutting Vladimir Putin off from SWIFT was considered the armageddon level tactic. Past recipients of the honour of having their SWIFT access unceremoniously disconnected include fan favorites like North Korea, Iran, and Osama Bin laden. El Chapo didn’t quite make it onto the short and august list of the SWIFT-less16. But CZ? CZ seems to have a pretty good shot.

The information war over WTF was going on with Binance and something crypto Twitter had never heard of called “SWIFT” was still raging across the Social Media Wastes when there were suddenly official reports stating that a number of banks both large and small and based in a variety of countries were announcing that they would no longer process payments to certain cryptocurrency exchanges.

Visa cards in particular were being denied when customers tried to deposit funds to Binance. Not all Visa cards stopped working but more than enough to make Binance’s more intellectually curious customers Concerned. Unofficial reports followed about at least two large banks in each of Scotland, Pakistan, Australia, and “the European Union” suddenly halting all money transfers to and from Binance.

Also on January 26th the FBI announced the conclusion of a long running infiltration into and destruction of a Russia-linked ransomware enterprise called Hive. Obviously the ransomwarers17 of Hive, much like the drug dealers of Bitzlato, made heavy use of any and all money laundering services available to them. Thus it's probably not a coincidence that the DOJ's earlier statements and court filings in the Bitzlato affair made reference to ransomware.

And of course this all came on top of the announcement that executives at the last remaining "crypto bank", a firm called Nexo whose Bulgarian headquarters were recently the subject of a massive police raid and accusations of organized crime connections, were now officially wanted men.

And as if all that wasn’t ominous enough, this happened.

A READING FROM THE BOOK OF FRAUDITS

Maybe now is a good time to mention that Crypto.com is currently touting the fact that it is fully audited all over its website. A post to that effect is currently stickied to the top of the Crypto.com subreddit. As it so happens these claims are made of a substance commonly known as “absolute horseshit” because unlike actual audits these “audits” have a few interesting properties.

They were not audits. The auditor did not call them audits. They were at best "attestations", which just means that for the 60 seconds the auditing firm looked in Crypto.com’s blockchain wallets there were some tokens there. It does not say anything at all about the several months after or the many years preceding the moment of attestation. The tokens could have been borrowed, or teleported, or [insert past tense verb] moments before or after the “audit” process was complete18.

They contained no proof of anything. In fact they had every single number in them redacted for "confidentiality reasons". Literally there was not a single visible BTC, USD, or ETH amount in the 3 nearly blank pages.

They were immediately retracted by the firm who issued them. In fact were retracted so violently that the firm dissolved that entire wing of their practice and deleted that section from their website.

And Binance? What about their audits, surely they had at least one or two numbers on them? Well, yes, they did. In fact Binance’s “audit” had three entire numbers! But let’s just say the situation was not much better. In fact it was, if anything, much worse.

Binance’s “audit” was, of course, also immediately violently retracted.

REVENGE OF THE CHAIN

This also happened:

CRYPTOWNERSHIP

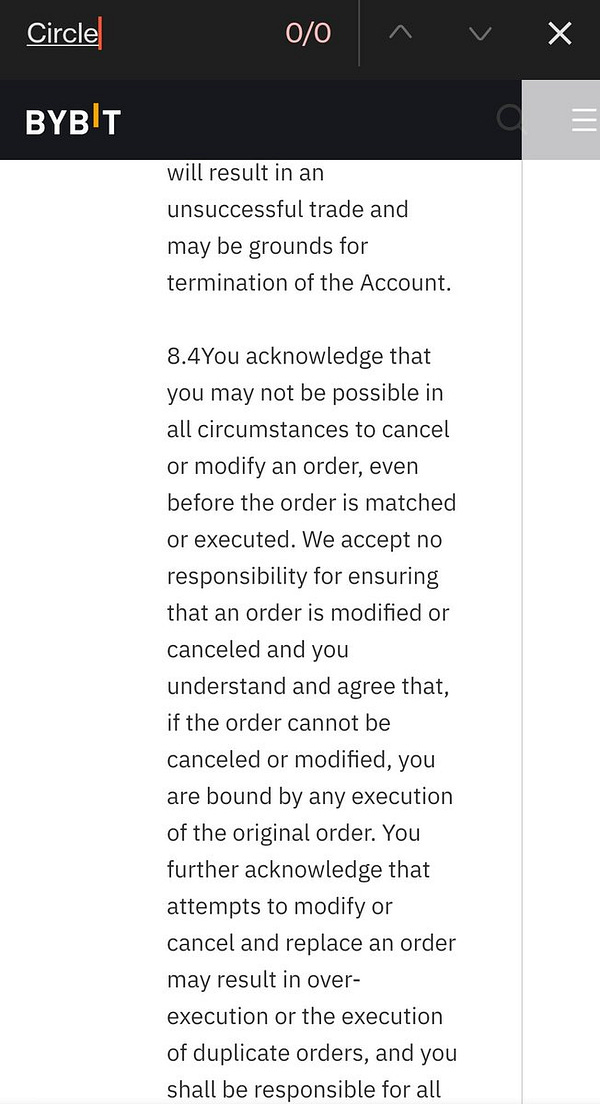

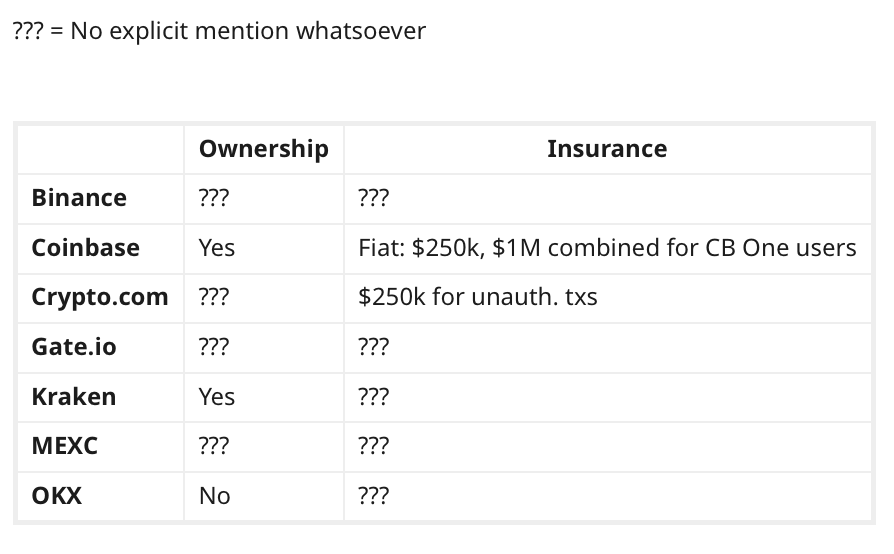

As a cherry on top some helpful human being on Reddit recently went through many of the largest cryptocurrency exchanges’ Terms of Service to figure out what they say about ownership, insurance, and other things that no one pays attention to until the moment withdrawals are halted and/or a filing is made in bankruptcy court.

This is what they found:

Yes, you read that right. Both Binance and Crypto.com’s Terms of Service do not even use the word “ownership”. Many Crypto.com customers like to tout the fact that they are trading on an “insured” exchange. Which is, in a way, true. But users are only insured against unauthorized transactions sent on their behalf. They are not in any way insured against the failure of Crypto.com itself. And Binance?

Binance’s insurance policy is basically “YOLO”.

So then what in tarnation is actually going on with this bizarre “no SWIFT transfers under $100,000” policy that Binance claims to be introducing? I can offer only reasonable guesses along with a note that some other intelligent people who know far more about the world of banking than I do have the same guesses.

POSTUM SCRIPTUM

Needless to say all of the above paints an increasingly dark picture of the financial futures of both Binance and Crypto.com. If you have any money on either of these exchanges I would encourage you to consider moving your assets to either self custody, a more reputable fully audited exchange like Kraken or Coinbase, or a "fiat wallet” A.K.A. “a bank account.” And if any of your loved ones have money with these august institutions I encourage you to warn them. Given that a lot of people who enjoy cryptocurrency investing like to “do their own research” it may be easier to just show them this document and let them decide on their own than to actually convince them, so here is a share button for you to admire and perhaps click on.

One of the reporters at The Financial Times who broke the Wirecard fraud said that they knew they were really onto something when the Wirecard executives would always double down on their obviously nonsensical explanations every time they were given a chance to come clean with the public, pay a fine, and move on. Why? Because the Wirecard team literally didn’t know how to come clean. They were criminals running a criminal organization. And sure, Crypto.com’s behavior has not been quite as underhanded as Wirecard’s was… but every minute that passes without a satisfactory explanation about where exactly Crypto.com’s Euro and GBP reserves are is a minute that they are trending in that direction.

By the way if you’re wondering what happens when you put inconvenient facts like these on The Privatized Public Square (A.K.A. “Twitter”), you can expect to have an army of crypto bros, money launderer sock puppets, and assorted financial criminals mass report you for posting abusive content until your threads disappear from everyone’s timelines and are not findable in the search results. Which is, of course, exactly what Wirecard did.

Such is life in the days of The Coinerian Jihad.

This story was continued in another post:

Crypto.com or Crypto Dot Con?

Before we get into the weeds on Crypto.com here’s an unexpectedly popular thread I ended up writing on The Privatized Public Square about something a little more temporally relevant: the apparent implosion of Silvergate Bank.

Or maybe not so slowly.

“Single European Payment Area”. Basically just a way to send cash between bank accounts within the EU.

Normies call these “bank accounts”.

At least, the Lithuanian part of the population. I’ll just mention in passing that a sizeable percentage of Lithuania’s population is not Lithuanian and is in stead descended from an ancient tribe called The Rus.

At least in some other space-time dimension. Probably.

Pronounced “lucky”.

Seriously there are way too many bullshit ways to pretend to be a financial institution in 2023. Payment processors, virtual bank account providers, the ubiquitous and yet completely undefined term “fintech”, the even more nebulous BaaS companies (“Banking as a service”, whatever the fuck that means)…

Answer: they didn’t.

The joke is that ByBit also gets to use Circle’s Silvergate account for wire transfers. And I would wager there are many other cryptocurrency exchanges who also have at some point been sending their users’ deposits to Circle Internet Financials bank accounts.

Deltec is Tether’s banking partner. Or at least the one they talk about publicly. Getting “Deltec’ed” is thus not to be understood as pleasant experience.

It’s really, really hard to be too sketchy for Seychelles. Remember we are talking here about a tiny island in the middle of the Indian Ocean whose entire economy is built on enabling money laundering.

But known to me as “financial suicide bombers” for their monomaniacal focus on destroying both their own financial future as well as that of everyone around them.

Roughly 20 people.

Shout out to Angus and Tom, who are as far as I know the only mainstream journalists on the entire planet who have ever published information they obtained by querying the public databases crypto bros call “blockchains” rather than information they got by calling their buddy Sam Bankman-Fried or Cameron Winklevoss.

No, Yes, Yes,

This is probably untrue - El Chapo himself was almost certainly made SWIFT-less. But the banks who dealt with him were allowed to survive after paying a fine. At least I think they were. Being that El Chapo’s banking habits are only really useful in this essay as a dramatic flourish I didn’t spend the time verifying all the details in the way I did all the other things in this essay.

I just made that word up.

If that sounds far-fetched consider that this is exactly what Tether was busted for the one and only time they actually got indicted. At leas the only time… so far.

Thanks from a crypto ignorant. Enjoyed it despite the fact that I kept remembering that some innocent folks got their hard earned money caught in true fictional abyss

Lots of information here, thanks for bringing all of this in this one article. I would point however that SWIFT did NOT ban crypto withdrawal under 100,000$. It's SBNY who said starting Feb 1st they would stop processing this kind of transaction, thus affecting all its partners including Binance.

https://finance.yahoo.com/news/signature-bank-halts-swift-transactions-110924206.html