How Everyone Is Getting The Story Of Silicon Valley Bank and Signature Bank Completely Wrong

And other incomprehensible things, like Coinbase's banking partner.

"Beware the ides of March." - William ShakespeareI usually don’t write a new post so soon after the last post but it seemed kind of necessary given the implosion of Silicon Valley and Signature Banks and the potential collapse of capitalism itself. I have watched with increasing alarm as seemingly every reporter on the planet gets the story completely and totally wrong about what happened, why it happened, and why it will have dramatic and far reaching ramifications in areas far beyond finance. And if you are wondering why you should listen to me instead of the prestigious “journalists” at publications like the New York Times and Wall St. Journal, allow me to gloat for a moment and point out that I was the first person to publish an article publicly predicting the collapse of Signature Bank back in December when the stock cost $140, the company was worth almost $10 billion, and every single professional “analyst” and “journalist” in the world thought it was a great business that was bound for dizzying heights.

I will allow the full substack unfurl so that you might admire it in all its glory:

One may wonder how your humble narrator came to make such a spot on prediction. All I can say is that it’s really not that hard. You google stuff, read some SEC filings1, do some basic addition and subtraction and voila: you see that a bank like Signature is a straight up criminal enterprise. At that point it’s easy. You publish on your substack, send a few tweets, maybe make a few phone calls, and (mostly) wait around until BOOM! down goes the 3rd largest bank failure in American history.

Of course I missed the incoming collapse of Silicon Valley Bank. Forgive me but one can only detect a few enormous financial frauds at a time2 and it’s more fun to find the one where the Trump family banks. But once SVB fell down I started to look around and was… alarmed at what I was seeing. Even more alarming was the fact that apparently no one in the world is able to see what is right in front of their face.

1)WHAT

Everyone seems to be talking about Silicon Valley Bank’s “duration mismatch”. It’s a nice story: SVB executives foolishly sought to juice profits (and thus their bonuses) by making bad investments, Jerome Powell released Fed: Operation Break Shit on entitled fuckheads who took too much risk, those fuckheads tried to shore up the losses with a sale of stock, there was a run on the bank, and then BOOM. No more bank for entitled fuckheads. The saga continued when over the following weekend some of the richest and most entitled of the fuckheads took to Twitter in an attempt to whip up a national panic about bank failures big enough to force the government to bail them out - and it worked.

Now that’s not wrong, per se. Silicon Valley Bank did completely blow it on so-called “duration mismatch” and yes, they did lose a bunch of money because of Fed: Operation Break Shit. Maybe even enough money to make them insolvent. But I look at SVB’s SEC filings. I look at the news. I look back at the filings, then back at the news. And I must confess: I don’t get it. The information is right out in front of everyone. It’s on file with the SEC and at this point also widely published. And yet all anyone is out here talking about is “duration mismatch” on some treasuries.

Look carefully:

Yes, it is indeed true that SVB’s executives completely fucking blew it by holding $120 billion (26 brand new Nimitz class nuclear powered aircraft carriers, the combined economic output of two extremely wealthy suburban counties for a year) in long dated treasuries in a rising interest rate environment3. But look at SVB’s assets in the tweet above. Look at the red rectangle and tell me what do you see? Another $60 billion in “other loan assets”, right? That’s a lot of loan assets. Like really a lot. What, pray tell, are these “other loan assets” that comprise almost a third of SVB’s loan book? And maybe more importantly why is no one talking about them? They’re not mortgages ($2.6 billion). They’re not commercial loans ($11 billion). But they are the real reason no other bank was willing to buy SVB over the weekend and save the government the embarrassment of bailing out a bunch of the worst and richest entitled shitheads on the planet.

It’s called “fund banking”.

RIGHTS AND RESPONSIBILITIES

Why it has fallen to me instead of literally any “reputable” publication on the planet to point out what “other loan assets” are is beyond me, but here you go: they’re bad loans. Loans to VC funds, founders of useless internet companies, maybe some Chinese tech investors, probably some crypto bros, etc. They are probably collateralized by things like stock options4, wine collections, fine art, and (of course) cryptocurrency. Sometimes they are called “fund banking” loans (cue spooky music). And they are not going to get paid back.

I mean sure, some of them will get paid back. But let me predict right now that many tens of billions of dollars of them will not. By the time all is said and done it might well be that the vast majority of this $60 billion is just… gone. Why? Because these loans were designed to be paid back when the tech bro or broette in question was given an even bigger pile of money by VCs than the last pile they were given. That means if there are no more big piles of money being given to dumpster fire companies like WeWork and FTX the loans cannot not be repaid. Silicon Valley Bank (or what’s left of it) will have to seize the company’s assets and auction them off. But newsflash: tech startups don’t really have “assets”. They have employees, maybe a lease, and a few computers. If SVB gets lucky the company will have some intellectual property that’s worth something, but trust me when I saw that the DoorDash IP is not going to fetch the big bucks.

Surprised? Well then let me really blow your mind by pointing out that Silicon Valley Bank’s “fund banking” business - one third of the whole bank - was a Ponzi scheme.

They really did this 👆. Many founders who took money from rich VCs like the bloodless husk formerly known as Peter Thiel and Jason “ALL CAPS BANK RUN INCITER” Calacanis signed terms that required them to use Silicon Valley Bank exclusively, which in turn meant SVB could lever up its deposits to the max, which in turn meant SVB could make an absurd amount of “fund banking” loans, which created more deposits… you get the idea. Remember anon, the “fund banking” loans were designed to be paid back when the venture capitalist class invested an even bigger pile of money in ShitCo X than it had invested last time. And where do the VCs get those piles of money? They borrow it from Silicon Valley Bank. Charles Ponzi would have been proud.

Most of the time people naturally spread out their loans and deposits and so on among various banks. You might have a car loan from one financial institution, be given a pay cheque from an account at your boss’s favorite vampiric corporate banking enterprise, take out a mortgage from a local credit union, and keep the vast majority of your net worth in a collection of off shore banks in small island countries like Seychelles and the Cayman Islands (at least if you’re a reputable person5) . Not so with Silicon Valley Bank. Not only did VC funds keep their cash there, the companies they invested in kept their cash there… and so did the founders of the companies they funded, who got special “white glove” treatment on their home loans, their car loans, and their tax avoidance loans.

UPDATE 2023-03-21: Since I published this I had a minute to go through Silicon Valley Bank’s helpful “What is venture debt?” FAQ. And let me just tell you: it’s mind melting.

Keep that in mind as you watch Jason “ALL CAPS BANK RUN INCITER” Calacanis wax poetic about the 50 year under market mortgage Silicon Valley Bank gave him because “they understand what founders are going through”.

UNINTENSIONS

You may want to watch the above video of Janet Yellen A.K.A. "The Secretary of the Treasury" patiently explaining on the floor of the United States Congress that yes, the government did just reach into Americans' pockets6 to bail out a bunch of Silicon Valley billionaires and also some crypto bros who happen to be citizens of China but no, the governmnet will absolutely not bail out farmers in Oklahoma or anyone who is not already a billionaire or a member of the Trump family. Though to be honest if you are American you can probably save some time and just not watch it because you’re going to see it a whole bunch of times in the coming years anyways. This is going to be the issue in American politics for years. If you’re unsure how that will work then here, I’ll save you some time and explain the coming 2024 election for you:

Democrats: “YOU DEREGULATED THE BANKS YOU VILE TOADS!”

Republicans: “YOU BAILED OUT A BUNCH OF RICH WOKE COMMIE CHINAMEN YOU TRAITOR!”7

Back and forth over and over ad infinitum. And unfortunately they both kind of have a point.

THAT OTHER BANK

Of course Silicon Valley Bank wasn’t even the only bank that collapsed over the course of last weekend. There was a whole other bank, the one I predicted would fall over back in December. Allow me to gloat again:

If you want to understand the chain of events in the citizen journalists’ take down of the 3rd largest bank to fail in American history click here; I wrote a timeline along with links to all four critical publications8 a month or two ago. But back to the point: Signature Bank imploded. So what happened? Was it the same as Silicon Valley Bank?

The short answer is “not really”. There’s a few hints as to what might be different about it. For instance the fact that the Federal Reserve’s announcement was all about Silicon Valley Bank and then they kinda just threw in an offhand comment about “oh yeah there was this other bank too nbd almost forgot” in the middle there.

Seems like a curiously casual way to announce that the preferred bank for the Trump and Kushner families just completely blew up. Ivanka even sat on the board of directors for a few years (they were obviously very concerned about corporate governance). Say what you will about the Trumps but you would think the New York Times would be all over that shit. But it wasn’t. The first headlines out of the mainstream media amounted to “HOLY FUCK The Rich Tech Dude Bank Blew Up And We’re All Gonna Die!!!! (and some other bank or something)”. And that was it9.

Nevermind that Signature was the third largest bank failure in American history after heavyweight champion Washington Mutual in 2008 and runner-up Silicon Valley Bank a few days ago. Ignore the fact that one of the board members of Signature was Barney Frank A.K.A “literally the guy the famous Dodd-Frank Wall Street Reform and Consumer Protection Act is named after.” And definitely forget about the fact that it was far and away the largest “crypto-friendly” bank in the galaxy (and the Trump family bank!). Best to kind of just sweep the news under the hue and cry of the explosion of ignorance that constituted the media’s coverage of Silicon Valley Bank.

So you ask yourself: why is the coverage like this? Why did the Federal Reserve’s press release totally bury the lede? Why did The New Yorker embarrass itself (again) and completely miss the story right in front of its face by asking Barney Frank about banking regulations instead of the fact that he sat on the board of a payment network that moved a trillion dollars a year - roughly 4% of the entire economic output of the United States of America, the world’s largest economy - for drug cartels, terrorists, and the Russian mafia?

I’ll tell you why: because a lot of people who run drug cartels live in far away places where they might be forgiven for not noticing the fact that more than one bank had failed given all the hullaballoo about the bank for rich dipshits in the Bay Area. Maybe they wouldn’t notice that the bank they use to pay their suppliers had suffered an… intervention.

Because Signature Bank wasn’t totally shut down. In fact Signature Bank’s SigNET system - the one the criminals all use to make all those dollar payments - was kept running well after the take down. Hell it might still be running right now, offering a warmly tacky landing page to anyone who chooses to login to their account and do stuff like check their balances or pay for that shipping container full of fentanyl they just got a reminder about.

One more thing before we go. Remember how in the first part I mentioned that Silicon Valley Bank had this enormous (and enormously mysterious) “fund banking” business that amounted to an incredible amount of loans going out the window to rich people who would then make deposits in the same bank? And that the government was going to guarantee the deposits didn’t disappear even if the people with the loans did? Well you’ll be excited to know that Signature Bank also had a preposterously large “fund banking” business for rich fuckheads that also made absolutely no sense. In fact it made even less sense than Silicon Valley Bank’s “fund banking” business, which is impressive.

We cannot explain to you exactly what Signature’s ~$40 billion “fund banking” loans even are despite months of digging through filings and trying to figure it out. They are far more mysterious than Silicon Valley Bank’s already-pretty-mysterious “fund banking” loans. But what we can tell you is the fact that these loans appear to defy all of the fundamental laws of lending at the same time10 was the top signal that told us the Bank was headed for collapse.

By the way where do you think Signature Bank found such a talented “fund banking” team? They found them the easy way. They hired the “fund banking” team that used to work at Silicon Valley Bank.

It’s all a little X-Files, isn’t it. Oh and by the way the international fugitive Justin Sun appears to have managed to wire out at least a billion dollars from Signature Bank on the final Friday, which would make it easily the biggest bank heist in history. No one is talking about this yet except Patrick Tan at Chain Argos.

FRAUD TIMES AT COINBASE HIGH

You might find yourself wondering something like “Wait a minute, weren’t Silvergate and Signature the crypto banks in America? Where are all these big crypto companies like Coinbase that trade for billions on the stock market doing all their banking if those banks are gone?”

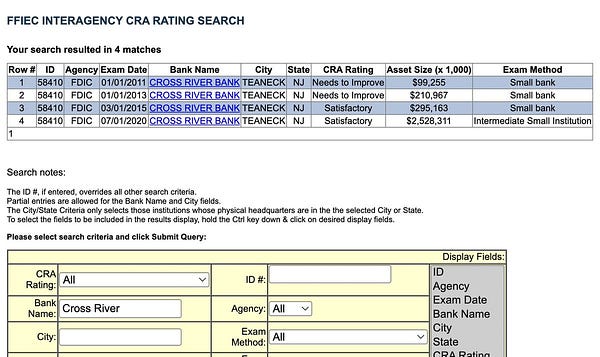

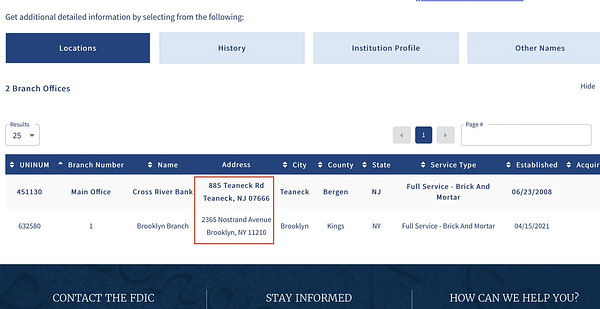

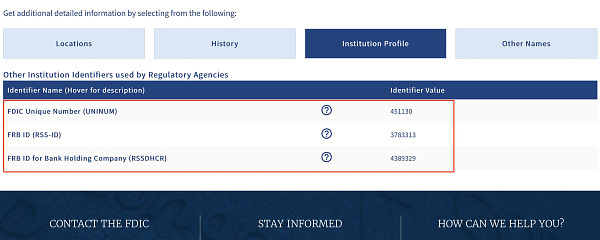

Well that’s a whole fun story on its own but sadly it’s one that’s too long to write up here. But I did make a very long thread on Twitter explaining some of what goes on at Cross River Bank of New Jersey.

The short version is that the last remaining crypto-friendly bank of systemic importance is a tiny outfit called Cross River Bank. A tiny, poorly run bank that somehow managed to issue more PPP covid relief loans than any other bank besides JP Morgan, A.K.A “the biggest bank in the world.” And right now Cross River has a, shall we say, “interesting” situation going on with those loans. There’s a congressional investigation and everything.

Let’s just say the whole situation doesn’t bode well for the continued existence of crypto in America. Especially when you really start digging into Cross River’s balance sheet and other government filings, which I did in yet another very long thread on The Privatized Public Square.

When crypto bros tell you about “Operation Choke Point 2.0” they’re not wrong. But the part they fail to tell you is that the bros keep placing bazookas in the government’s hands and then daring the FBI to pull the trigger. There’s a saying about this I think, some kind of cliche or something… Oh, now I remember.

“Fuck around and find out.”

UPDATE 2023-03-24: Shortly after I went over Cross River Bank’s financials I stumbled on the most eyebrow-raising fact of all about their history: they took a $100 million funding round led by a retired Malaysian Inspector General of the Police. The same government official who “investigated” the theft of billions of dollars of government money in Malaysia’s 1MDB scandal 1MDB, if you haven’t heard of it, is currently in the running for the greatest financial fraud of all time.

Though unlike most scams at least the public got something for their money. The guy who stole the billions used at least a small percentage of it to fund a pretty sweet movie called The Wolf Of Wall Street11. It worked out well for me too. My tweet about this connection earned me a retweet from from Jim Chanos, the most famous short seller walking the earth. Put another way: everybody won.

CLOWNS

In closing I would like to point out that Silicon Valley Bank was a $15 billion company right up until the moment it went to a big fat zero in less than 48 hours. This despite the fact that many months ago SVB had put the fact that it was about to lose $16 billion12 in its SEC filings. Short sellers (and even one Wall Street Journal journalist - it was that easy to see!) had been pointing this out for months but the market didn’t choose to believe it.

When SVB collapsed the most famous of those short sellers, Jim Chanos (A.K.A “The Wisest Man In The Galaxy”), made a scathing comment about those who actually believe markets are an efficient means of discovering the dollar value of anything.

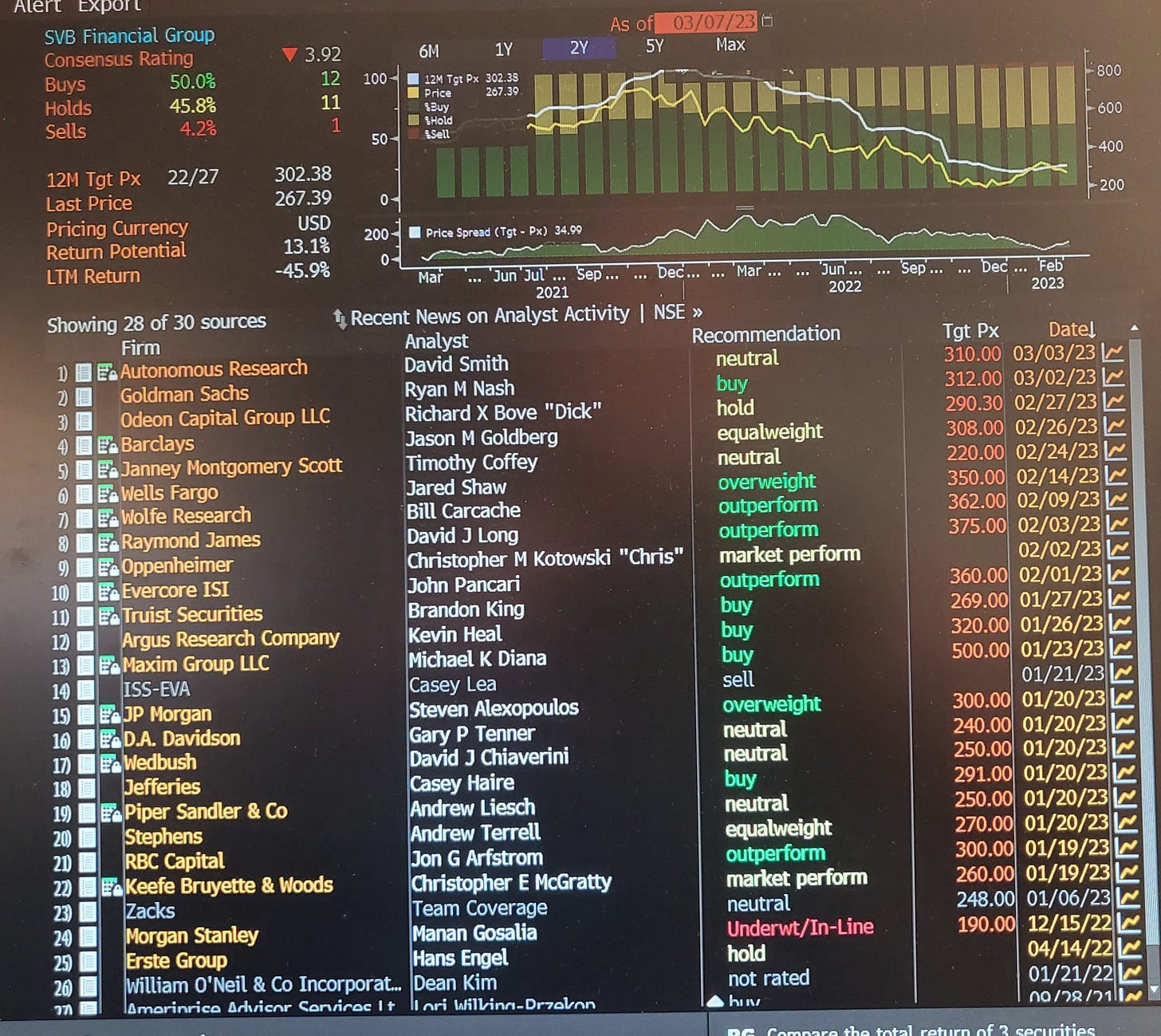

As a short seller Chanos understands the irrationality of markets far better than most - including (or especially) the irrationality of those who are supposed to be the most rational, the so-called “professional analysts”. Theoretically they just apply cold hard facts-don’t-care-about-your-feelings style Logic to reality and tell the world whether a company is gonna make you rich or not… and they are incredibly highly compensated for their efforts. So let’s take a look at the ratings on Silicon Valley Bank’s stock by these so-called “professional analysts” as of March 7th, 2023, three days before total collapse:

Why it’s almost as if these people have no fucking idea what they’re talking about! (Except, of course, for some hero named Casey Lea, who it is prophesied will some day return from the realm beyond the veil to save capitalism from The Fire.)

Then there’s this professional clown:

And finally let’s not forget the Federal Reserve’s economists. The ones whose job it is to notice stuff like this before it happens so that it can be prevented from happening.

Anonymous Twitter macroeconomist Concodanomics explained everything that was about to happen with a mega thread way back in January. The Fed? Not so much.

Turns out “Beware the Ides of March” has always been good advice.

If you like reading this consider spreading the revelations of The Oracle Of Tulips by posting it on some other social media site like Twitter, Reddit, Facebook, Instagram, TikTok (you may have to get creative), Youtube, etc. or sharing it with a friend.

Enlightenment is cheap these days; don’t be afraid to spread it.

Which I had never done until a few months ago.

I have some other strong candidates.

The financial mechanics of how duration mismatch is the ultimate widowmaker are a lot simpler than most people who watch The Cartoon Network¹ would like you to believe but I’m not going to go into them here; if you want a refresher you can read an unexpectedly popular thread on The Privatized Public Square I wrote about a different bank called Silvergate that did in fact blow up on “duration mismatch” well before the future moment it will be announced that Silvergate² was running a trillion dollar a year payment network for drug cartels and terrorists of all races. (That part of the story hasn’t happened yet so we’ll leave that for another time.)

¹ Some call it “CNBC”.

² And Signature.

Warrants, technically, but let’s keep it easy.

The banks also really enjoy the sunny weather.

Some people, most especially Joe Biden’s team, would like you to believe that taxpayers won’t foot the bill. They need you to believe this because taxpayers bailing out silicon valley’s billionaire class is Just Not Good Politics. But it’s horseshit. SVB and Signature Bank’s depositors will be bailed out by everyone who has a bank account, because the insurance costs the banks will be charged will be passed on to every American with a bank account.

At least in between all the “HUNTER BIDEN HUNTERBIDEN H-UN-TER BEE EYE DEE EE EN” war cries.

Note that 100% of the important facts were published here on substack or over on its demented cousin Medium. You should probably just go ahead and cancel your New York Times subscription because it’s not giving you any information.

I don’t have a screenshot but I’m like 90% sure the sub-headline was literally “Other New York Lender Is Also Closed”.

a) Signature’s loan portfolio doubled in size in 2 years, b) the loans were paying very high interest, and c) Signature regarded this truly massive amount of loans - roughly 50% of their entire business - as close to “risk free”.

You can’t make this shit up.

For the journalists and others with intellectual handicaps out there in the audience I will draw the connection that $16 billion is one more billion than $15 billion.

Fantastic read as always

Gee, all the credit rating guys all saying everything is just hunky-dory. I’ve never ever ever heard that before…

Or have I? I don’t know.